JetBlue Airlines 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

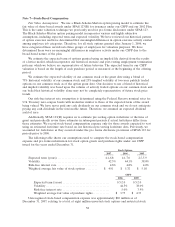

that all options granted now vest in equal installments over a period of three or five years, or upon

the occurrence of a change in control. All options issued under the 2002 Plan expire ten years from

the date of grant. Our policy is to grant options with the exercise price equal to the market price of

the underlying common stock on the date of grant. The number of shares reserved for issuance under

the 2002 Plan will automatically increase each January by an amount equal to 4%of the total number

of shares of our common stock outstanding on the last trading day in December of the prior calendar

year. In no event will any such annual increase exceed 12.2 million shares. The 2002 Plan will

terminate no later than December 31, 2011.

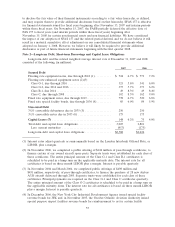

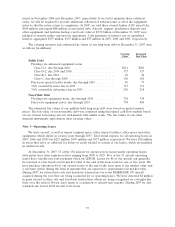

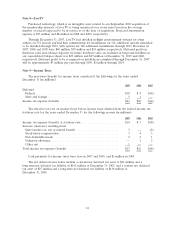

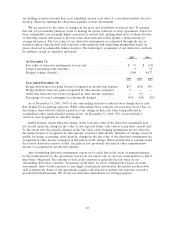

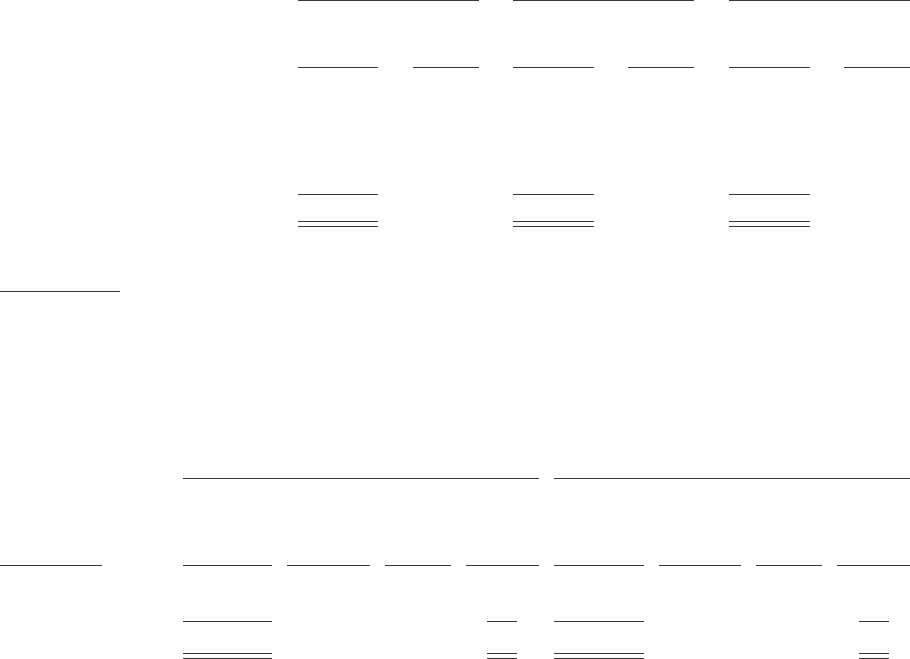

The following is a summary of stock option activity for the years ended December 31:

2007 2006 2005

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding at beginning of

year ..................... 31,089,745 $12.13 31,086,422 $11.52 26,966,499 $10.54

Granted .................... 2,926,250 10.94 4,360,949 11.43 6,600,006 13.53

Exercised ................... (1,823,903) 4.25 (3,011,260) 3.75 (1,779,598) 3.16

Forfeited ................... (737,127) 11.87 (344,398) 12.11 (593,758) 14.59

Expired .................... (1,723,033) 15.73 (1,001,968) 15.20 (106,727) 11.20

Outstanding at end of year ..... 29,731,932 12.30 31,089,745 12.13 31,086,422 11.52

Vested at end of year ......... 22,537,850 12.19 24,881,786 11.86 28,411,718(1) 11.13

Available for future grants (2) . . 12,589,744 6,022,883 2,132,587

(1) Includes 19.9 million shares associated with our December 2005 stock option acceleration

discussed in Note 1.

(2) On January 1, 2008, the number of shares reserved for issuance was increased by 7,263,737 shares.

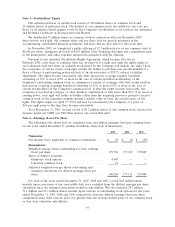

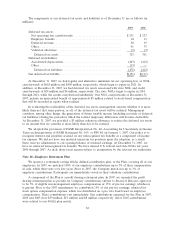

The following is a summary of outstanding stock options at December 31, 2007:

Options Outstanding Options Vested

Range of

exercise prices Shares

Weighted

Average

Remaining

Contractual

Life (years)

Weighted

Average

Exercise

Price

Aggregate

Intrinsic

Value

(millions) Shares

Weighted

Average

Remaining

Contractual

Life (years)

Weighted

Average

Exercise

Price

Aggregate

Intrinsic

Value

(millions)

$0.33 to $4.00..... 4,354,965 3.2 $ 1.74 $18 4,354,965 3.2 $ 1.74 $18

$7.79 to $29.71.... 25,376,967 6.7 14.11 — 18,182,885 6.2 14.69 $—

29,731,932 6.2 12.30 $18 22,537,850 5.6 12.19 $18

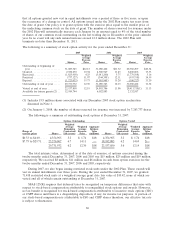

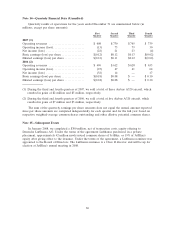

The total intrinsic value, determined as of the date of exercise, of options exercised during the

twelve months ended December 31, 2007, 2006 and 2005 was $15 million, $25 million and $19 million,

respectively. We received $8 million, $11 million and $6 million in cash from option exercises for the

twelve months ended December 31, 2007, 2006 and 2005, respectively.

During 2007, we also began issuing restricted stock units under the 2002 Plan. These awards will

vest in annual installments over three years. During the year ended December 31, 2007, we granted

71,418 restricted stock units at a weighted average grant date fair value of $10.42, none of which are

vested and all of which remain outstanding at December 31, 2007.

SFAS 123(R) requires that deferred taxes be recognized on temporary differences that arise with

respect to stock-based compensation attributable to nonqualified stock options and awards. However,

no tax benefit is recognized for stock-based compensation attributable to incentive stock options (ISO)

or CSPP shares until there is a disqualifying disposition, if any, for income tax purposes. A portion of

our stock-based compensation is attributable to ISO and CSPP shares therefore, our effective tax rate

is subject to fluctuation.

60