JetBlue Airlines 2007 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are beyond our control, including natural disasters, computer viruses or telecommunications failures.

Substantial or sustained system failures could impact customer service and result in our customers

purchasing tickets from other airlines. We have implemented security measures and change control

procedures and have disaster recovery plans; however, we cannot assure you that these measures are

adequate to prevent disruptions, which, if they were to occur, could result in the loss of important

data, increase our expenses, decrease our revenues and generally harm our business.

Our maintenance costs will increase as our fleet ages.

Because the average age of our aircraft is 3.1 years, our aircraft require less maintenance now

than they will in the future. We have incurred lower maintenance expenses because most of the parts

on our aircraft are under multi-year warranties. Our maintenance costs will increase significantly, both

on an absolute basis and as a percentage of our operating expenses, as our fleet ages and these

warranties expire.

If we are unable to operate the new EMBRAER 190 aircraft reliably, our business could be harmed.

We were the first airline to take delivery of the new EMBRAER 190 aircraft in late 2005.

Acquisition of a new type of aircraft, such as the EMBRAER 190, involves a variety of risks relating

to its operational reliability, including the ability of the aircraft and all of its components to comply

with agreed upon specifications and performance standards. If we are unable to operate the new

EMBRAER 190 aircraft reliably, our business could be harmed.

If we are unable to attract and retain qualified personnel or fail to maintain our company culture,

our business could be harmed.

We compete against the other major U.S. airlines for pilots, mechanics and other skilled labor

and some of them offer wage and benefit packages that exceed ours. We may be required to increase

wages and/or benefits in order to attract and retain qualified personnel or risk considerable employee

turnover. If we are unable to hire, train and retain qualified employees, our business could be harmed

and we may be unable to complete our growth plans.

In addition, as we hire more people and grow, we believe it may be increasingly challenging to

continue to hire people who will maintain our company culture. One of our competitive strengths is

our service-oriented company culture that emphasizes friendly, helpful, team-oriented and

customer-focused employees. Our company culture is important to providing high quality customer

service and having a productive workforce that helps keep our costs low. As we grow, we may be

unable to identify, hire or retain enough people who meet the above criteria, including those in

management or other key positions. Our company culture could otherwise be adversely affected by

our growing operations and geographic diversity. If we fail to maintain the strength of our company

culture, our competitive ability and our business may be harmed.

Our results of operations will fluctuate.

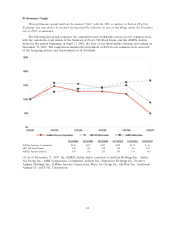

We expect our quarterly operating results to fluctuate due to price changes in aircraft fuel as well

as the timing and amount of maintenance and advertising expenditures. Seasonality also impacts our

operations, with high vacation and leisure demand occurring on the Florida routes between October

and April and on our western routes during the summer. Actions of our competitors may also

contribute to fluctuations in our results. We are more susceptible to adverse weather conditions,

including snow storms and hurricanes, as a result of our operations being concentrated on the East

Coast, than are some of our competitors. As we enter new markets, we could be subject to additional

seasonal variations along with any competitive responses to our entry by other airlines. As a result of

these factors, quarter-to-quarter comparisons of our operating results may not be a good indicator of

our future performance. In addition, it is possible that in any future period our operating results could

be below the expectations of investors and any published reports or analyses regarding JetBlue. In

that event, the price of our common stock could decline, perhaps substantially.

We are subject to the risks of having a limited number of suppliers for our aircraft, engines and a key

component of our in-flight entertainment system.

Our current dependence on two types of aircraft and engines for all of our flights makes us

vulnerable to any problems associated with the Airbus A320 aircraft or the IAE International Aero

17