JetBlue Airlines 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note 11—Commitments

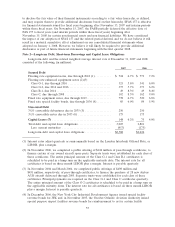

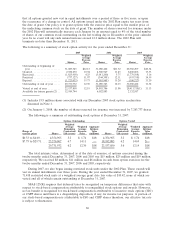

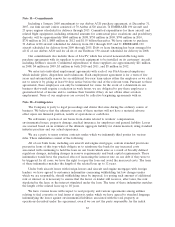

Including a January 2008 amendment to our Airbus A320 purchase agreement, at December 31,

2007, our firm aircraft orders consisted of 70 Airbus A320 aircraft, 74 EMBRAER 190 aircraft and

23 spare engines scheduled for delivery through 2015. Committed expenditures for these aircraft and

related flight equipment, including estimated amounts for contractual price escalations and predelivery

deposits, will be approximately $660 million in 2008, $750 million in 2009, $700 million in 2010,

$730 million in 2011, $885 million in 2012 and $1.55 billion thereafter. We have options to purchase

32 Airbus A320 aircraft scheduled for delivery from 2011 through 2015 and 91 EMBRAER 190

aircraft scheduled for delivery from 2009 through 2015. Debt or lease financing has been arranged for

all 12 of our Airbus A320 and for all six of our Embraer 190 aircraft scheduled for delivery in 2008.

Our commitments also include those of LiveTV, which has several noncancelable long-term

purchase agreements with its suppliers to provide equipment to be installed on its customers’ aircraft,

including JetBlue’s aircraft. Committed expenditures to these suppliers are approximately $21 million

in 2008, $4 million in 2009, $3 million in both 2010 and 2011, and $5 million in 2012.

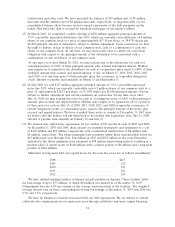

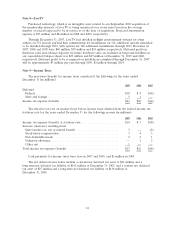

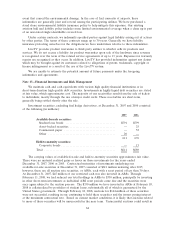

We enter into individual employment agreements with each of our FAA-licensed employees,

which include pilots, dispatchers and technicians. Each employment agreement is for a term of five

years and automatically renews for an additional five-year term unless either the employee or we elect

not to renew it by giving at least 90 days notice before the end of the relevant term. Pursuant to these

agreements, these employees can only be terminated for cause. In the event of a downturn in our

business that would require a reduction in work hours, we are obligated to pay these employees a

guaranteed level of income and to continue their benefits if they do not obtain other aviation

employment. None of our employees are covered by collective bargaining agreements with us.

Note 12—Contingencies

The Company is party to legal proceedings and claims that arise during the ordinary course of

business. We believe that the ultimate outcome of these matters will not have a material adverse

effect upon our financial position, results of operations or cash flows.

We self-insure a portion of our losses from claims related to workers’ compensation,

environmental issues, property damage, medical insurance for employees and general liability. Losses

are accrued based on an estimate of the ultimate aggregate liability for claims incurred, using standard

industry practices and our actual experience.

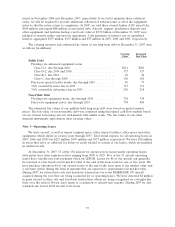

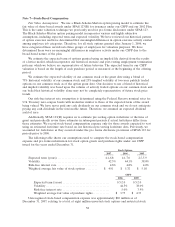

We are a party to many routine contracts under which we indemnify third parties for various

risks. These indemnities consist of the following:

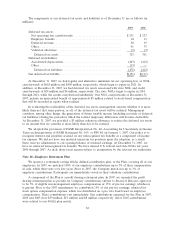

All of our bank loans, including our aircraft and engine mortgages, contain standard provisions

present in loans of this type which obligate us to reimburse the bank for any increased costs

associated with continuing to hold the loan on our books which arise as a result of broadly defined

regulatory changes, including changes in reserve requirements and bank capital requirements. These

indemnities would have the practical effect of increasing the interest rate on our debt if they were to

be triggered. In all cases, we have the right to repay the loan and avoid the increased costs. The term

of these indemnities matches the length of the related loan up to 12 years.

Under both aircraft leases with foreign lessors and aircraft and engine mortgages with foreign

lenders, we have agreed to customary indemnities concerning withholding tax law changes under

which we are responsible, should withholding taxes be imposed, for paying such amount of additional

rent or interest as is necessary to ensure that the lessor or lender still receives, after taxes, the rent

stipulated in the lease or the interest stipulated under the loan. The term of these indemnities matches

the length of the related lease up to 18 years.

We have various leases with respect to real property, and various agreements among airlines

relating to fuel consortia or fuel farms at airports, under which we have agreed to standard language

indemnifying the lessor against environmental liabilities associated with the real property or

operations described under the agreement, even if we are not the party responsible for the initial

63