JetBlue Airlines 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

efforts to create a growth plan that is sustainable, we may modify our rate of growth over the next

few years through a combination of additional aircraft sales, returns, assignments and/or delivery

deferrals. Assuming fuel prices of $2.55 per gallon, net of effective hedges, our cost per available seat

mile for 2008 is expected to increase by 10%to 12%over 2007. Our operating margin is expected to

be between 6%and 8%and our pre-tax margin is expected to be between 1%and 3%for the full year.

Results of Operations

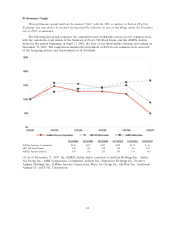

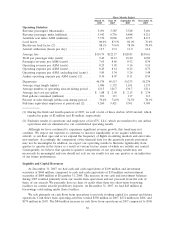

The U.S. domestic airline environment continues to be extremely challenging primarily due to

high aircraft fuel prices and vigorous price competition. However, due to the optimization of our own

fare mix, average fares for the year increased 3%over 2006 to $123.23, while load factor declined

0.9 points to 80.7%from the full year 2006.

Our on-time performance, defined by the DOT as arrivals within 14 minutes of schedule, was

70.2%in 2007 compared to 72.9%in 2006. Our on-time performance was affected by our commitment

to operate our scheduled flights whenever possible, along with operating at three of the most

congested and delay-prone airports in the U.S., as reflected by our 98.0%and 99.6%completion

factors in 2007 and 2006, respectively.

Year 2007 Compared to Year 2006

We reported net income of $18 million in 2007 compared to a net loss of $1 million in 2006. In

2007, we had operating income of $169 million, an increase of $42 million over 2006, and our

operating margin was 6.0%, up 0.6 points from 2006. Diluted earnings per share was $0.10 for 2007

and $0.00 for 2006.

Operating Revenues. Operating revenues increased 20%, or $479 million, primarily due to an

increase in passenger revenues. The $413 million increase in passenger revenues was attributable to a

7.4%increase in yield due to higher average fare offset by a slightly lower load factor. Passenger

revenues were also higher due to a 24%increase in departures.

Other revenue increased 47%, or $66 million, primarily due to higher change fees and excess

baggage fees of $28 million resulting from more passengers and higher rates. Other revenue also

increased due to higher LiveTV third-party revenues of $12 million, rental income of $8 million, mail

revenues of $3 million and the marketing component of TrueBlue point sales of $3 million.

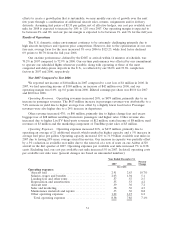

Operating Expenses. Operating expenses increased 20%, or $437 million, primarily due to

operating an average of 21 additional aircraft, which resulted in higher capacity, and a 5%increase in

average fuel price per gallon. Operating capacity increased 12%to 31.9 billion available seat miles in

2007 due to having 20%more average aircraft in-service. Our increase in capacity was partially offset

bya3%reduction in available seat miles due to the removal of a row of seats on our Airbus A320

aircraft in the first quarter of 2007. Operating expenses per available seat mile increased 7%to 8.38

cents. Excluding fuel, our cost per available seat mile increased 5%in 2007. In detail, operating costs

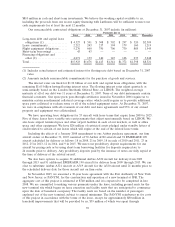

per available seat mile were (percent changes are based on unrounded numbers):

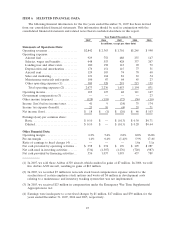

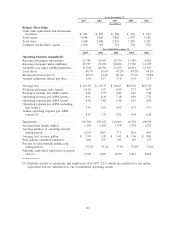

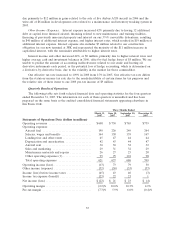

Year Ended December 31,

2007 2006

Percent

Change

(in cents)

Operating expenses:

Aircraft fuel ........................................ 2.91 2.63 10.7%

Salaries, wages and benefits ........................... 2.03 1.94 5.1

Landing fees and other rents .......................... .57 .55 2.5

Depreciation and amortization ........................ .55 .53 4.2

Aircraft rent ........................................ .39 .36 7.2

Sales and marketing ................................. .38 .36 4.3

Maintenance materials and repairs ..................... .33 .30 8.8

Other operating expenses ............................ 1.22 1.15 6.2

Total operating expenses ........................... 8.38 7.82 7.1%

31