JetBlue Airlines 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Overview

We are an innovative, low cost passenger airline that provides award-winning customer service

primarily on point-to-point routes. We offer our customers a high quality product, including generous

legroom, free in-flight entertainment, pre-assigned seating, unlimited snacks and reliable performance.

We currently serve 53 destinations in 21 states, Puerto Rico, Mexico and the Caribbean and operate

over 550 flights a day with a fleet of 104 Airbus A320 aircraft and 30 EMBRAER 190 aircraft.

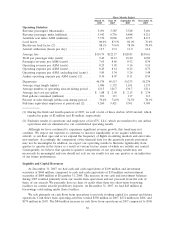

In 2007, we reported net income of $18 million and an operating margin of 6.0%, compared to a

net loss of $1 million and an operating margin of 5.4%in 2006. We achieved these results despite

operational challenges in the first quarter and record high fuel prices, through revenue optimization,

continued cost discipline and strategically managing our growth.

In the first quarter of 2007, we were negatively impacted by an ice storm which hit the New York

metropolitan area and resulted in our cancelling approximately 1,200 flights over a six day

period. Following our recovery from the storm, we appointed Russell Chew as our Chief Operating

Officer who led our successful implementation of a multi-phased strategy to improve our overall

operating reliability, better handle of irregular operations (which includes preemptive cancellations for

severe weather), and improve customer communications. We further demonstrated our

industry-leading commitment to our customers with the introduction of the JetBlue Airways Customer

Bill of Rights which provides for compensation to our customers who are inconvenienced by service

disruptions within our control. We believe that we have emerged from 2007 a better airline through

these strategic changes, which also have contributed to our improved operating results.

The summer of 2007 was one of the worst for flight delays in the New York metropolitan area,

principally as a result of airlines’ over-scheduling the capacity of the New York metropolitan airports

during certain hours of the day. In response to these chronic delays, the DOT announced that

beginning in 2008, it would limit the number of flights in and out of JFK. We believe that, along with

other initiatives the FAA and DOT are undertaking to enhance capacity, these restrictions will help

alleviate congestion in the nation’s largest travel market and thereby enable us to operate more

reliably, reduce costs and improve the customer experience.

In 2007, we continued our focus on a more disciplined growth strategy, beginning with managing

the growth, size and age of our fleet. In March 2007, we amended our Airbus A320 purchase

agreement, deferring four aircraft deliveries from 2009 to 2012. In 2008, we further amended this

purchase agreement, deferring delivery of 16 aircraft, which had been scheduled for delivery in 2010

and 2011, to 2012 and 2013. During 2007, we sold three of our older Airbus A320 aircraft and

returned another to its lessor. Removing older aircraft from our fleet allows us to keep the average

age of our fleet down and improves our efficiency, which results in a better experience for our

customers as well as reduces maintenance costs. We plan further sales and lease terminations of older

aircraft in 2008, including commitments to sell six A320 aircraft in 2008. In 2007, we also amended our

purchase agreement with Embraer by slowing delivery of 16 firm aircraft orders. Our original

purchase agreement called for delivery of an average of 18 EMBRAER 190 aircraft per year.

Following the 2007 amendments, we slowed the pace of firm aircraft deliveries to an average of 10 per

year. However, because we have 91 EMBRAER 190 purchase options remaining, we retained the

flexibility to increase deliveries if demand warrants. In December 2007, we exercised purchase options

for three EMBRAER 190 aircraft to be delivered in 2009 (which purchase options would have

otherwise expired).

Our growth in 2007 was achieved largely through expanding our existing route network by adding

frequencies and new routes between existing destinations. We added only five new destinations in

2007, compared to the 16 that were added in 2006. In late 2007, we made the decision to close our

stations in Nashville, TN and Columbus, OH, which allowed us to redeploy aircraft to more profitable

routes. In 2008, we plan to continue to focus on adding service between existing destinations and

rational growth in the number of new destinations, including the January 2008 additions of Puerto

Plata in the Dominican Republic and St. Maarten in the Netherlands Antilles.

28