JetBlue Airlines 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

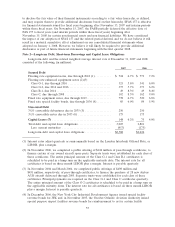

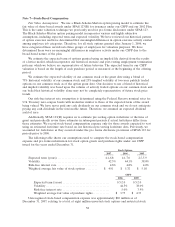

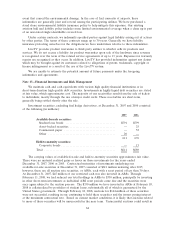

The components of our deferred tax assets and liabilities as of December 31 are as follows (in

millions):

2007 2006

Deferred tax assets:

Net operating loss carryforwards .................................. $ 231 $ 233

Employee benefits .............................................. 18 13

Deferred revenue ............................................... 38 19

Other.......................................................... 41 39

Valuation allowance ............................................. (3) (3)

Deferred tax assets ............................................ 325 301

Deferred tax liabilities:

Accelerated depreciation......................................... (463) (412)

Other.......................................................... (13) —

Deferred tax liabilities ........................................ (476) (412)

Net deferred tax liability ........................................... $(151) $(111)

At December 31, 2007, we had regular and alternative minimum tax net operating loss, or NOL,

carryforwards of $618 million and $458 million, respectively, which begin to expire in 2021. In

addition, at December 31, 2007, we had deferred tax assets associated with state NOL and credit

carryforwards of $24 million and $4 million, respectively. The state NOLs begin to expire in 2010

through 2021, while the credits carryforward indefinitely. Our NOL carryforwards at December 31,

2007, include an unrecorded benefit of approximately $9 million related to stock-based compensation

that will be recorded in equity when realized.

In evaluating the realizability of the deferred tax assets, management assesses whether it is more

likely than not that some portion, or all, of the deferred tax assets will be realized. Management

considers, among other things, the generation of future taxable income (including reversals of deferred

tax liabilities) during the periods in which the related temporary differences will become deductible.

At December 31, 2007, we provided a $3 million valuation allowance to reduce the deferred tax assets

to an amount that we consider is more likely than not to be realized.

We adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes-an Interpretation of FASB Statement No. 109, or FIN 48, on January 1, 2007. Our policy is to

recognize interest and penalties accrued on any unrecognized tax benefits as a component of income

tax expense. We did not have any material uncertain tax positions upon the adoption, as a result,

there were no adjustments to our opening balance of retained earnings. At December 31, 2007, we

have no material unrecognized tax benefits. We have unused U.S. federal and state NOLs for years

2000 through 2007. As such, these years remain subject to examination by the relevant tax authorities.

Note 10—Employee Retirement Plan

We sponsor a retirement savings 401(k) defined contribution plan, or the Plan, covering all of our

employees. In 2007, we matched 100%of our employee contributions up to 5%of their compensation

in cash, which then vests over five years. Prior to 2007, the Company match was up to 3%of

employee contributions. Participants are immediately vested in their voluntary contributions.

A component of the Plan is a profit sharing retirement plan. In 2007, we amended the profit

sharing retirement plan to provide for Company contributions, subject to Board of Director approval,

to be 5%of eligible non-management employee compensation or 15%of pre-tax earnings, whichever

is greater. Prior to the 2007 amendment, we contributed 15%of our pre-tax earnings, adjusted for

stock option compensation expense, which was distributed on a pro rata basis based on employee

compensation. These contributions vest immediately. Our contributions expensed for the Plan in 2007,

2006 and 2005 were $39 million, $13 million and $8 million, respectively. All of 2005 contributions

were related to our 401(k) plan match.

62