JetBlue Airlines 2007 Annual Report Download - page 47

Download and view the complete annual report

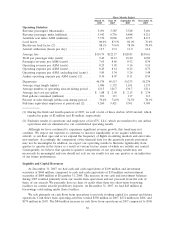

Please find page 47 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.was primarily as a result of the growth of our business. Cash flows from operations in 2006 compared

to 2005 also increased due to the growth of our business, offset in part by the increase in fuel prices.

Net cash used in investing and financing activities was $178 million in 2007, $270 million in 2006, and

$183 million in 2005.

Investing Activities. During 2007, capital expenditures related to our purchase of flight

equipment included expenditures of $531 million for 17 aircraft and four spare engines, $128 million

for flight equipment deposits and $12 million for spare part purchases. Capital expenditures for other

property and equipment, including ground equipment purchases and facilities improvements, were

$74 million. Expenditures related to the construction of our new terminal at JFK totaled $242 million.

Net cash provided by the sale of investment securities was $78 million. Other investing activities

included the receipt of $100 million in proceeds from the sale of three Airbus A320 aircraft, the

release of $72 million related to restricted cash that collateralized a letter of credit we had posted in

connection with our new terminal lease at JFK and the refund of $12 million in flight equipment

deposits related to aircraft delivery deferrals.

During 2006, capital expenditures related to our purchase of flight equipment included

expenditures of $874 million for 30 aircraft and five spare engines, $106 million for flight equipment

deposits and $33 million for spare part purchases. Capital expenditures for other property and

equipment, including ground equipment purchases and facilities improvements, were $89 million. Net

cash used for the purchase of investment securities was $213 million. Other investing activities

included the receipt of $154 million in proceeds from the sale of five Airbus A320 aircraft and the

refund of $19 million in flight equipment deposits related to aircraft delivery deferrals.

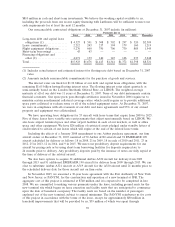

Financing Activities. Financing activities during 2007 consisted primarily of (1) the sale and

leaseback over 18 years of seven EMBRAER 190 aircraft for $183 million by a U.S. leasing

institution, (2) our issuance of $278 million in fixed rate equipment notes to various European

financial institutions secured by eight Airbus A320 aircraft, (3) our issuance of $69 million in floating

rate equipment notes to various European financial institutions secured by two Airbus A320 aircraft,

(4) reimbursement of construction costs incurred for our new terminal at JFK of $242 million, (5) the

financing of four spare engine purchases of $29 million, (6) scheduled maturities of $197 million of

debt and (7) the repayment of $68 million of debt in connection with the sale of three Airbus A320

aircraft.

Financing activities during 2006 consisted primarily of (1) the sale and leaseback over 18 years of

16 EMBRAER 190 aircraft for $406 million by a U.S. leasing institution, (2) our issuance of

$329 million in fixed rate equipment notes to various European financial institutions secured by nine

Airbus A320 aircraft and one EMBRAER 190 aircraft, 3)our issuance of $69 million in floating rate

equipment notes to various European financial institutions secured by two Airbus A320 aircraft,

4) our issuance of $223 million in fixed and floating rate debt to various U.S. and European financial

institutions secured by eight Airbus A320 aircraft, five of which were refinanced, (5) reimbursement of

construction costs incurred for our new terminal at JFK of $179 million, (6) the financing of previously

unsecured owned assets for $234 million, (7) scheduled maturities of $162 million of debt and (8) the

repayment of $105 million of debt in connection with the sale of five Airbus A320 aircraft.

In June 2006, we filed an automatic shelf registration statement with the SEC relating to our sale,

from time to time, in one or more public offerings of debt securities, pass-through certificates,

common stock, preferred stock and/or other securities. The net proceeds of any securities we sell

under this registration statement may be used to fund working capital and capital expenditures,

including the purchase of aircraft and construction of facilities on or near airports. Through

December 31, 2007, we had issued a total of $124 million of pass-through certificates under this

registration statement to finance certain previously purchased aircraft spare parts.

In January 2008, we completed the issuance and sale of approximately 42 million shares of our

common stock, representing approximately 19%of our total outstanding shares of common stock, to

Deutsche Lufthansa AG for approximately $300 million, net of transaction costs. At the closing of the

stock sale, we and Deutsche Lufthansa AG entered into a Registration Rights Agreement covering

the shares pursuant to which we are required, within 90 days after the closing date, to file with the

37