JetBlue Airlines 2007 Annual Report Download - page 51

Download and view the complete annual report

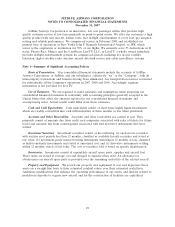

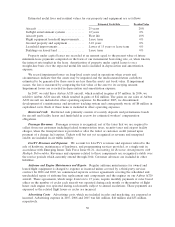

Please find page 51 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.thorough process to review the application of our accounting policies and to evaluate the

appropriateness of the estimates that are required to prepare our financials statements. We believe

that our estimates and judgments are reasonable; however, actual results and the timing of recognition

of such amounts could differ from those estimates. In addition, estimates routinely require adjustment

based on changing circumstances and the receipt of new or better information.

Critical accounting policies and estimates are defined as those that are reflective of significant

judgments and uncertainties, and potentially result in materially different results under different

assumptions and conditions. The policies and estimates discussed below have been reviewed with our

independent registered public accounting firm and with the Audit Committee of our Board of

Directors. For a discussion of these and other accounting policies, see Note 1 to our consolidated

financial statements.

Passenger revenue. Passenger ticket sales are initially deferred in Air traffic liability. The Air

traffic liability also includes customer credits issued and unused tickets whose travel date has passed.

Credit for unused tickets and customer credits can each be applied towards another ticket within

12 months of the original scheduled service or 12 months from the issuance of the customer credit.

Revenue is recognized when transportation is provided or when a ticket or customer credit expires.

We also defer in the Air traffic liability, an estimate for customer credits issued in conjunction with the

JetBlue Airways Customer Bill of Rights that are expected to be ultimately redeemed. These

estimates are based on historical experience and are periodically evaluated, and adjusted if necessary,

based on actual credit usage.

Accounting for long-lived assets. In accounting for long-lived assets, we make estimates about

the expected useful lives, projected residual values and the potential for impairment. In estimating

useful lives and residual values of our aircraft, we have relied upon actual industry experience with

the same or similar aircraft types and our anticipated utilization of the aircraft. Changing market

prices of new and used aircraft, government regulations and changes in our maintenance program or

operations could result in changes to these estimates. The amortization of our purchased technology,

which resulted from our acquisition of LiveTV in 2002, is based on the average number of aircraft in

service and expected to be in service as of the date of their acquisition. This method results in an

increasing annual expense through 2009 when the last of these aircraft are expected to be placed into

service and is adjusted to reflect changes in our contractual delivery schedule.

Our long-lived assets are evaluated for impairment at least annually or when events and

circumstances indicate that the assets may be impaired. Indicators include operating or cash flow

losses, significant decreases in market value or changes in technology. As our assets are all relatively

new and we continue to have positive cash flow, we have not identified any significant impairments

related to our long-lived assets at this time.

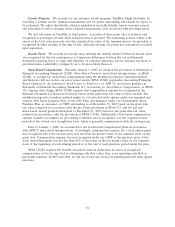

Stock-based compensation. The adoption of SFAS 123(R) in 2006 required the recording of

stock-based compensation expense for issuances under our stock purchase plan and stock option plan

over their requisite service period using a fair value approach similar to the pro forma disclosure

requirements of Statement of Financial Accounting Standards No. 123, Accounting for Stock-Based

Compensation, or SFAS 123. We use a Black-Scholes-Merton option pricing model to estimate the fair

value of share-based awards under SFAS 123(R), which is the same valuation technique we previously

used for pro forma disclosures under SFAS 123. The Black-Scholes-Merton option pricing model

incorporates various and highly subjective assumptions. We estimate the expected term of options

granted using an implied life derived from the results of a lattice model, which incorporates our

historical exercise and post-vesting cancellation patterns, which we believe are representative of future

behavior. The expected term for our employee stock purchase plan valuation is based on the length of

each purchase period as measured at the beginning of the offering period. We estimate the expected

volatility of our common stock at the grant date using a blend of 75%historical volatility of our

common stock and 25%implied volatility of two-year publicly traded options on our common stock as

of the option grant date. Our decision to use a blend of historical and implied volatility was based

upon the volume of actively traded options on our common stock and our belief that historical

volatility alone may not be completely representative of future stock price trends. Regardless of the

41