JetBlue Airlines 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

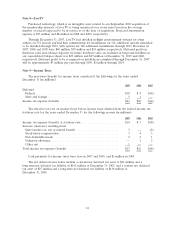

Note 8—LiveTV

Purchased technology, which is an intangible asset related to our September 2002 acquisition of

the membership interests of LiveTV, is being amortized over seven years based on the average

number of aircraft expected to be in service as of the date of acquisition. Projected amortization

expense is $13 million and $8 million in 2008 and 2009, respectively.

Through December 31, 2007, LiveTV had installed in-flight entertainment systems for other

airlines on 372 aircraft and had firm commitments for installations on 314 additional aircraft scheduled

to be installed through 2012, with options for 182 additional installations through 2017. Revenues in

2007, 2006 and 2005 were $40 million, $29 million and $19 million, respectively. Deferred profit on

hardware sales and advance deposits for future hardware sales are included in long term liabilities in

our consolidated balance sheets was $29 million and $27 million at December 31, 2007 and 2006,

respectively. Deferred profit to be recognized on installations completed through December 31, 2007

will be approximately $7 million per year through 2009, $2 million through 2014.

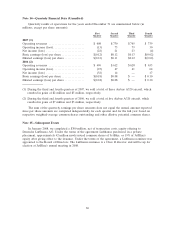

Note 9—Income Taxes

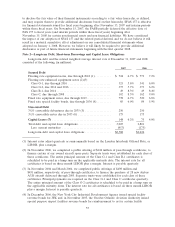

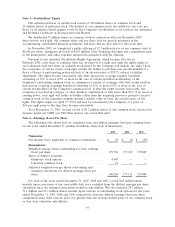

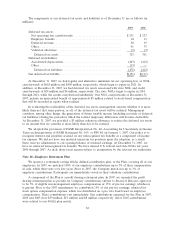

The provision (benefit) for income taxes consisted of the following for the years ended

December 31 (in millions):

2007 2006 2005

Deferred:

Federal........................................................... $18 $ 9 $(4)

State and foreign .................................................. 5 1 —

Income tax expense (benefit) ......................................... $23 $10 $(4)

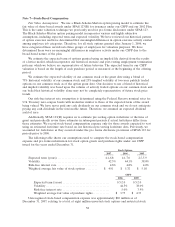

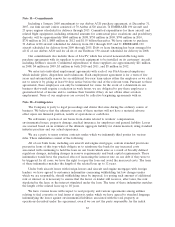

The effective tax rate on income (loss) before income taxes differed from the federal income tax

statutory rate for the years ended December 31 for the following reasons (in millions):

2007 2006 2005

Income tax expense (benefit) at statutory rate........................... $14 $ 3 $(8)

Increase (decrease) resulting from:

State income tax, net of federal benefit............................... 3 — (2)

Stock-based compensation .......................................... 3 4 3

Non-deductible meals .............................................. 2 2 1

Valuation allowance ............................................... — 1 2

Other, net ........................................................ 1 — —

Total income tax expense (benefit) .................................... $23 $10 $(4)

Cash payments for income taxes were zero in 2007 and 2006, and $1 million in 2005.

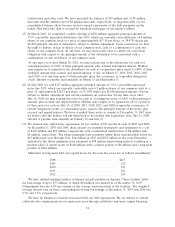

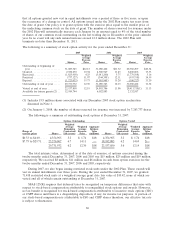

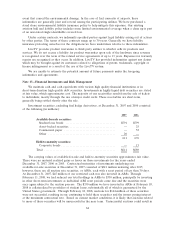

The net deferred taxes below include a current net deferred tax asset of $41 million and a

long-term net deferred tax liability of $192 million at December 31, 2007, and a current net deferred

tax asset of $25 million and a long-term net deferred tax liability of $136 million at

December 31, 2006.

61