JetBlue Airlines 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

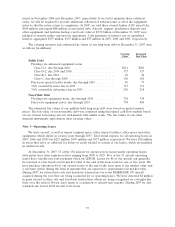

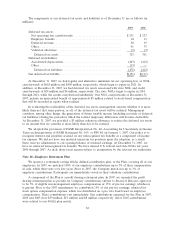

to disclose the fair value of their financial instruments according to a fair value hierarchy, as defined,

and may require them to provide additional disclosures based on that hierarchy. SFAS 157 is effective

for financial statements issued for fiscal years beginning after November 15, 2007 and interim periods

within those fiscal years. On November 15, 2007, the FASB partially deferred the effective date of

FAS 157 to fiscal years (and interim periods within those fiscal years) beginning after

November 15, 2008 for certain non financial assets and non financial liabilities. We have considered

the impact of our adoption of SFAS 157 and the related partial deferral and we do not believe it will

result in a material cumulative effect adjustment on our consolidated financial statements when

adopted on January 1, 2008. However, we believe it will likely be required to provide additional

disclosures as part of future financial statements beginning with the first quarter 2008.

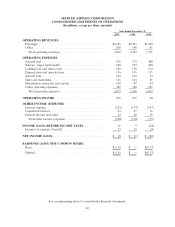

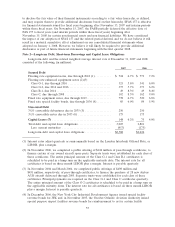

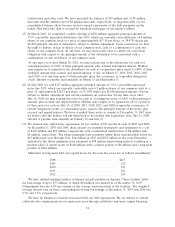

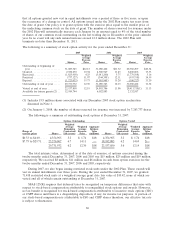

Note 2—Long-term Debt, Short-term Borrowings and Capital Lease Obligations

Long-term debt and the related weighted average interest rate at December 31, 2007 and 2006

consisted of the following (in millions):

2007 2006

Secured Debt

Floating rate equipment notes, due through 2018 (1) ........... $ 724 6.7%$ 772 7.2%

Floating rate enhanced equipment notes (2)(3)

Class G-1, due through 2016 .............................. 321 5.6%341 6.0%

Class G-2, due 2014 and 2016 ............................. 373 5.7%373 6.2%

Class B-1, due 2014 ...................................... 49 8.3%49 8.4%

Class C, due through 2008 ................................ 102 8.5%162 9.0%

Fixed rate equipment notes, due through 2019................. 778 6.7%520 6.6%

Fixed rate special facility bonds, due through 2036 (4) .......... 85 6.0%84 5.9%

Unsecured Debt

3

3

⁄

4

%convertible debentures due in 2035 (5) .................. 250 250

3

1

⁄

2

%convertible notes due in 2033 (6) ....................... 175 175

Capital Leases (7) ......................................... 148 6.2%75 6.0%

Total debt and capital lease obligations ....................... 3,005 2,801

Less: current maturities .................................. (417) (175)

Long-term debt and capital lease obligations .................. $2,588 $2,626

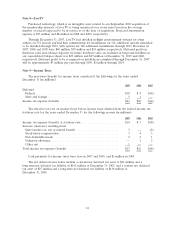

(1) Interest rates adjust quarterly or semi-annually based on the London Interbank Offered Rate, or

LIBOR, plus a margin.

(2) In November 2006, we completed a public offering of $124 million of pass-through certificates, to

finance certain of our owned aircraft spare parts. Separate trusts were established for each class of

these certificates. The entire principal amount of the Class G-1 and Class B-1 certificates is

scheduled to be paid in a lump sum on the applicable maturity date. The interest rate for all

certificates is based on three month LIBOR plus a margin. Interest is payable quarterly.

(3) In November 2004 and March 2004, we completed public offerings of $498 million and

$431 million, respectively, of pass-through certificates, to finance the purchase of 28 new Airbus

A320 aircraft delivered through 2005. Separate trusts were established for each class of these

certificates. Principal payments are required on the Class G-1 and Class C certificates quarterly.

The entire principal amount of the Class G-2 certificates is scheduled to be paid in a lump sum on

the applicable maturity dates. The interest rate for all certificates is based on three month LIBOR

plus a margin. Interest is payable quarterly.

(4) In December 2006, the New York City Industrial Development Agency issued special facility

revenue bonds for JFK and, in November 2005, the Greater Orlando Aviation Authority issued

special purpose airport facilities revenue bonds for reimbursement to us for certain facility

53