JetBlue Airlines 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

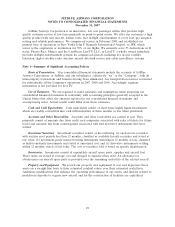

issued in November 2006 and December 2007, respectively. If we fail to maintain these collateral

ratios, we will be required to provide additional collateral or redeem some or all of the equipment

notes so that the ratios return to compliance. In 2007, we sold three owned Airbus A320 aircraft for

$100 million and repaid $68 million in associated debt. Aircraft, engines, predelivery deposits and

other equipment and facilities having a net book value of $3.52 billion at December 31, 2007 were

pledged as security under various loan agreements. Cash payments of interest, net of capitalized

interest, aggregated $175 million, $133 million and $79 million in 2007, 2006 and 2005, respectively.

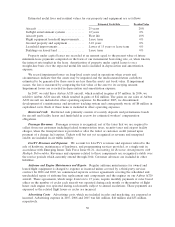

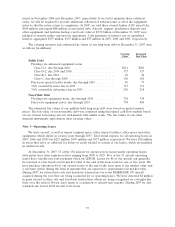

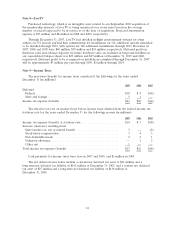

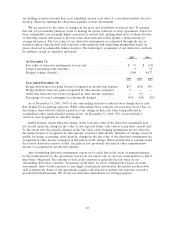

The carrying amounts and estimated fair values of our long-term debt at December 31, 2007 were

as follows (in millions):

Carrying

Value

Estimated

Fair Value

Public Debt

Floating rate enhanced equipment notes

Class G-1, due through 2016 ............................... $321 $281

Class G-2, due 2014 and 2016 .............................. 373 327

Class B-1, due 2014....................................... 49 46

Class C, due through 2008................................. 102 102

Fixed rate special facility bonds, due through 2019 ............. 85 77

3½%convertible notes due in 2033 ........................... 175 171

3¾%convertible debentures due in 2035 ...................... 250 214

Non-Public Debt

Floating rate equipment notes, due through 2018............... 724 724

Fixed rate equipment notes, due through 2019 ................. 778 800

The estimated fair values of our publicly held long-term debt were based on quoted market

prices. The fair value of our non-public debt was estimated using discounted cash flow analysis based

on our current borrowing rates for instruments with similar terms. The fair values of our other

financial instruments approximate their carrying values.

Note 3—Operating Leases

We lease aircraft, as well as airport terminal space, other airport facilities, office space and other

equipment, which expire in various years through 2035. Total rental expense for all operating leases in

2007, 2006 and 2005 was $225 million, $190 million and $137 million, respectively. We have $26 million

in assets that serve as collateral for letters of credit related to certain of our leases, which are included

in restricted cash.

At December 31, 2007, 53 of the 134 aircraft we operated were leased under operating leases,

with initial lease term expiration dates ranging from 2009 to 2025. Five of the 53 aircraft operating

leases have variable-rate rent payments based on LIBOR. Leases for 46 of our aircraft can generally

be renewed at rates based on fair market value at the end of the lease term for one or two years. We

have purchase options in 44 of our aircraft leases at the end of the lease term at fair market value and

a one-time option during the term at amounts that are expected to approximate fair market value.

During 2007, we entered into sale and leaseback transactions for seven EMBRAER 190 aircraft

acquired during the year that are being accounted for as operating leases. We have deferred $4 million

in gains related to these sale and leaseback transactions, which are being recognized on a straight-line

basis over the related 18-year lease terms as a reduction to aircraft rent expense. During 2007 we also

returned one leased A320 aircraft to its lessor.

55