JetBlue Airlines 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SEC a post-effective amendment or supplement to our automatic shelf registration statement filed on

June 30, 2006 to allow Deutsche Lufthansa AG to resell the shares. Subject to blackout periods that

do not exceed 90 trading days in any 365-day period, we are obligated to keep such shelf registration

statement continuously effective under the Securities Act of 1933 until the earlier of (1) the date as of

which all of the shares have been sold and (2) the date as of which all of the shares may be sold

without registration pursuant to Rule 144 under the Securities Act of 1933.

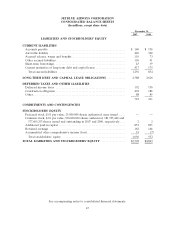

None of our lenders or lessors are affiliated with us. Our short-term borrowings consist of two

floating rate facilities, each with a group of commercial banks to finance aircraft predelivery deposits.

Capital Resources. We have been able to generate sufficient funds from operations to meet our

working capital requirements. We do not currently have any lines of credit, other than our short-term

aircraft predelivery deposit facilities, and virtually all of our property and equipment is encumbered.

We typically finance our aircraft through either secured debt or lease financing. At December 31,

2007, we operated a fleet of 134 aircraft, of which 53 were financed under operating leases, four were

financed under capital leases and the remaining 77 were financed by secured debt. Financing in the

form of secured debt or leases has been arranged for all 12 of our Airbus A320 aircraft and for all six

of our EMBRAER 190 aircraft scheduled for delivery in 2008. Although we believe that debt and/or

lease financing should be available for our remaining aircraft deliveries, we cannot assure you that we

will be able to secure financing on terms attractive to us, if at all. While these financings may or may

not result in an increase in liabilities on our balance sheet, our fixed costs will increase significantly

regardless of the financing method ultimately chosen. To the extent we cannot secure financing, we

may be required to modify our aircraft acquisition plans or incur higher than anticipated financing

costs.

Working Capital. We had a working capital deficit of $140 million at December 31, 2007, which

is customary for airlines since air traffic liability is classified as a current liability, compared to working

capital of $73 million at December 31, 2006. Included in our working capital deficit is $175 million of

indebtedness related to our 3

1

⁄

2

%convertible notes due 2033, which is now classified as a current

liability because we expect holders of these notes to exercise their option to have us repurchase them

on their first purchase date of July 15, 2008. We expect to meet our obligations as they become due

through available cash, investment securities and internally generated funds, supplemented as

necessary by debt and/or equity financings and proceeds from aircraft sale and leaseback transactions.

We also plan to sell six additional Airbus A320 aircraft in 2008 and may further reduce our

obligations through additional aircraft sales and/or return of leased aircraft. We expect to generate

positive working capital through our operations. However, we cannot predict what the effect on our

business might be from the extremely competitive environment we are operating in or from events

that are beyond our control, such as continued unprecedented high fuel prices, the impact of airline

bankruptcies or consolidations, U.S. military actions or acts of terrorism.

As of December 31, 2007, $611 million of our short-term investments were invested in auction

rate securities, or ARSs. We also had $45 million of restricted cash invested in ARSs. Through

February 11, 2008, we had reduced our total investments in ARSs to $330 million, principally by

investing in other short-term investments as individual ARS reset periods came due and the securities

were once again subject to the auction process. The $330 million we have invested in ARSs at

February 18, 2008 is collateralized by portfolios of student loans, substantially all of which is

guaranteed by the United States government. Through February 18, 2008, auctions for $144 million of

these securities were not successful, resulting in our continuing to hold these securities and the issuers

paying interest at the maximum contractual rate. Based on current market conditions, it is likely that

auctions related to more these securities will be unsuccessful in the near term. Unsuccessful auctions

will result in our holding securities beyond their next scheduled auction reset dates and limiting the

short-term liquidity of these investments. While these failures in the auction process have affected our

ability to access these funds in the near term, we do not believe that the underlying securities or

collateral have been affected. We believe that the higher reset rates on failed auctions provide

sufficient incentive for the security issuers to address this lack of liquidity. If the credit rating of the

security issuers deteriorates, we may be required to adjust the carrying value of these investments

through an impairment charge. Excluding ARSs, at February 18, 2008, we had approximately

38