Honda 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

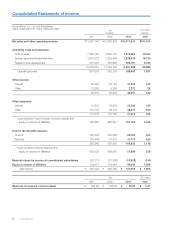

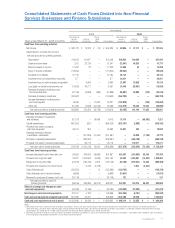

Consolidated Statements of Cash Flows

Honda Motor Co., Ltd. and Subsidiaries

Years ended March 31, 2007, 2008 and 2009 Yen

(millions)

U.S. dollars

(millions)

2007 2008 2009 2009

Cash fl ows from operating activities:

Net income

¥ 592,322 ¥ 600,039 ¥ 137,005 $ 1,395

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation excluding property on operating leases

361,747 417,393 441,868 4,498

Depreciation of property on operating leases

9,741 101,032 195,776 1,993

Deferred income taxes

(16,448) 31,341 41,773 425

Minority interest in income

20,117 27,308 13,928 141

Equity in income of affi liates

(103,417) (118,942) (99,034) (1,008)

Dividends from affi liates

54,849 67,764 65,140 663

Provision for credit and lease residual losses on fi nance subsidiaries—receivables

44,128 58,011 77,016 784

Impairment loss on investments in securities

798 577 26,001 265

Impairment loss on long-lived assets and goodwill excluding property on operating leases

——21,597 220

Impairment loss on property on operating leases

559 5,850 18,528 189

Loss (gain) on derivative instruments, net

56,836 70,251 (15,506) (158)

Decrease (increase) in assets:

Trade accounts and notes receivable

(49,529) (67,696) (30,025) (306)

Inventories

(96,839) (100,622) (262,782) (2,675)

Other current assets

(15,206) (2,609) (82,838) (843)

Other assets

(5,523) (130,666) 8,640 88

Increase (decrease) in liabilities:

Trade accounts and notes payable

38,186 32,327 (133,662) (1,361)

Accrued expenses

41,898 (24,768) (102,711) (1,046)

Income taxes payable

(37,282) 20 (12,861) (131)

Other current liabilities

1,103 2,301 10,630 108

Other liabilities

14,274 179,537 74,872 762

Other, net

(7,789) (21,530)

(9,714) (97)

Net cash provided by operating activities

904,525 1,126,918

383,641 3,906

Cash fl ows from investing activities:

Increase in investments and advances

(9,874) (6,417) (4,879) (50)

Decrease in investments and advances

3,829 1,270 1,921 20

Payments for purchases of available-for-sale securities

(141,902) (158,426) (31,936) (325)

Proceeds from sales of available-for-sale securities

172,806 179,911 26,896 274

Payments for purchases of held-to-maturity securities

(13,614) (39,482) (17,348) (177)

Proceeds from redemptions of held-to-maturity securities

41,109 32,557 32,667 333

Capital expenditures

(597,958) (668,228) (635,190) (6,466)

Proceeds from sales of property, plant and equipment

20,641 26,868 18,843 192

Acquisitions of fi nance subsidiaries—receivables

(2,857,024) (2,712,775) (2,303,930) (23,455)

Collections of fi nance subsidiaries—receivables

2,138,875 2,312,311 2,023,031 20,595

Proceeds from sales of fi nance subsidiaries—receivables

477,927 158,497 324,672 3,305

Purchases of operating lease assets

(366,795) (839,261) (668,128) (6,802)

Proceeds from sales of operating lease assets

1,276 26,776

100,017 1,018

Net cash used in investing activities

(1,130,704) (1,686,399)

(1,133,364) (11,538)

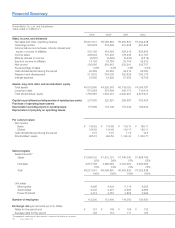

Cash fl ows from fi nancing activities:

Increase (decrease) in short-term debt, net

306,063 601,957 270,795 2,757

Proceeds from long-term debt

969,491 1,061,792 1,299,984 13,233

Repayments of long-term debt

(677,539) (782,749) (889,483) (9,055)

Cash dividends paid

(140,482) (152,590) (139,724) (1,422)

Cash dividends paid to minority interests

(7,434) (9,663) (10,841) (110)

Sales (purchases) of treasury stock, net

(26,689) (30,746)

131 1

Net cash provided by fi nancing activities

423,410 688,001

530,862 5,404

Effect of exchange rate changes on cash and cash equivalents

31,527 (23,164)

(141,672) (1,442)

Net change in cash and cash equivalents

228,758 105,356

(360,533) (3,670)

Cash and cash equivalents at beginning of year

716,788 945,546

1,050,902 10,698

Cash and cash equivalents at end of year

¥ 945,546 ¥1,050,902

¥ 690,369 $ 7,028

Annual Report 2009 69