Honda 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

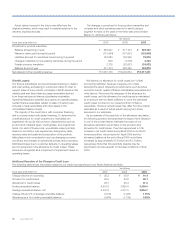

Power Product and Other Businesses

Honda’s unit sales of power products totaled 5,187 thousand

units, decreased by 14.4% from the previous fi scal year. Unit

sales in Japan totaled 516 thousand units, decreased by 6.2%.

Overseas unit sales totaled 4,671 thousand units, decreased

by 15.2%, due mainly to decreased unit sales in North America

and Europe. Revenue from external customers decreased

¥78.1 billion, or 18.5%, to ¥343.0 billion from the previous

fi scal year, due mainly to the decreased unit sales and negative

foreign currency translation effects. Honda estimates that by

applying Japanese yen exchange rates of the previous fi scal

year to the current fi scal year, net sales for the year would have

decreased by approximately ¥49.0 billion, or 11.7%, compared

to the decrease as reported of ¥78.1 billion, which includes

negative foreign currency translation effects.

Operating loss was ¥15.4 billion, a decrease of ¥37.8 billion

of operating income from the previous fi scal year, due mainly to

a decrease in income attributable to the decreased net sales

and increase in R&D expenses in other businesses, which was

offset by decreased SG&A expenses.

Financial Services Business

To support the sale of its products, Honda provides retail

lending and leasing to customers and wholesale fi nancing to

dealers through our fi nance subsidiaries in Japan, the United

States, Canada, the United Kingdom, Germany, Brazil, Thailand

and other countries.

In North America, the fi nancial crisis had a severe impact on

the economy, the deterioration in employment conditions,

deterioration in consumer sentiment and other factors. As a

result, the environment for fi nancial services business remained

under pressure.

Total amount of fi nance subsidiaries-receivables and property

on operating leases of fi nance subsidiaries decreased by 2.2%,

to ¥4,860.1 billion from the previous fi scal year, due mainly to

the currency translation effects.

Revenue from external customers in a fi nancial services

business increased ¥48.7 billion, or 9.1%, to ¥582.2 billion

from the previous fi scal year, due mainly to an increase in

operating lease revenue, which was offset by negative foreign

currency translation effects. Honda estimates that by applying

Japanese yen exchange rates of the previous fi scal year to the

current fi scal year, revenue for the year would have increased

by approximately ¥124.7 billion, or 23.4%, compared to the

increase as reported of ¥48.7 billion, which includes negative

foreign currency translation effects.

Operating income decreased ¥37.1 billion, or 31.5%, to

¥80.6 billion from the previous fi scal year, due mainly to an

increase in provisions for credit losses and losses on lease

residual values in North America and negative foreign currency

translation effects, which was offset by an increase in income

attributable to higher revenue. In North America, prices of SUVs

and minivans in the used car market dropped during the fi scal

fi rst half, and losses on lease residual values of these models

increased. In addition, from September onward, losses on

lease residual values of compact and mid-sized sedans and

other passenger vehicles also increased. In addition, provisions

for credit losses also increased as the ability of certain

customers to pay their debts declined.

Our fi nance subsidiaries in North America have historically

accounted for all leases as direct fi nancing leases. However,

starting in the fi scal year ended March 31, 2007, some of the

leases which do not qualify for direct fi nancing leases

accounting treatment are accounted for as operating leases.

Generally, direct fi nancing lease revenues and interest income

consist of the recognition of fi nance lease revenue at inception

of the lease arrangement and subsequent recognition of the

interest income component of total lease payments using the

effective interest method. In comparison, operating lease

revenues include the recognition of the gross lease payment

amounts on a straight line basis over the term of the lease

arrangement, and operating lease vehicles are depreciated to

their estimated residual value on a straight line basis over the

term of the lease. It is not anticipated that the differences in

accounting for operating leases and direct fi nancing leases will

have a material net impact on Honda’s results of operations

overall, however, operating lease revenues and associated

depreciation of leased assets do result in differing presentation

and timing compared to those of direct fi nancing leases.

Geographical Information

Japan

In Japan, revenue from domestic and export sales decreased

¥726.4 billion, or 14.9%, to ¥4,162.5 billion from the previous

fi scal year, due mainly to a decrease in revenue in automobile

business. Operating loss was ¥161.6 billion, a decrease of

¥354.1 billion of operating income from the previous fi scal year,

due mainly to negative foreign currency effects, a decrease in

income attributable to the decreased revenue, increased raw

material costs, an increase in fi xed costs per unit as a result of

reduced production and expenses related to withdrawal from

some racing activities and cancellations of development of new

models, which was offset by continuing cost reductions,

decreased SG&A and R&D expenses.

North America

In North America, which mainly consists of the United States,

revenue decreased ¥1,486.1 billion, or 23.7%, to ¥4,779.1

billion from the previous fi scal year, due mainly to negative

foreign currency translation effects and a decrease in revenue

in automobile business. Operating income decreased ¥352.9

billion, or 81.6%, to ¥79.7 billion from the previous fi scal year,

due mainly to a decrease in income attributable to the

decreased revenue, an increase in fi xed costs per unit as a

result of reduced production, negative foreign currency effects,

and increased raw material costs, which was offset by

continuing cost reductions and decreased SG&A expenses.

Europe

In Europe, revenue decreased ¥315.3 billion, or 19.8% to

¥1,278.9 billion from the previous fi scal year, due mainly to

negative foreign currency translation effects and a decrease in

revenue in the motorcycle business and automobile business.

Operating income decreased ¥41.3 billion, or 80.2%, to ¥10.2

billion from the previous fi scal year, due mainly to a decrease in

income attributable to the decreased revenue, increased SG&A

expenses, an increase in fi xed costs per unit as a result of

reduced production and increased raw material costs, which

was offset by continuing cost reductions.

Annual Report 2009

52