Honda 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

rates in estimating expected cash fl ows from the trust or bank

conduit, which affect the recoverability of our retained interests

in the sold fi nance receivables. We periodically evaluate these

assumptions and adjust them, if appropriate, to refl ect the

performance of the fi nance receivables.

Guarantee

At March 31, 2009, we guaranteed ¥33.6 billion of employee

bank loans for their housing costs. If an employee defaults on

his/her loan payments, we are required to perform under the

guarantee. The undiscounted maximum amount of our

obligation to make future payments in the event of defaults is

¥33.6 billion. As of March 31, 2009, no amount was accrued

for any estimated losses under the obligations, as it was

probable that the employees would be able to make all

scheduled payments.

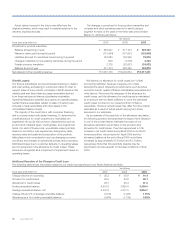

Tabular Disclosure of Contractual Obligations

The following table shows our contractual obligations at March 31, 2009:

Yen (millions)

Payments due by period

At March 31, 2009 Total Less than 1 year 1-3 years 3-5 years After 5 years

Long-term debt ¥2,910,160 ¥ 977,523 ¥1,037,624 ¥798,944 ¥ 96,069

Operating leases 128,673 26,776 34,700 19,142 48,055

Purchase commitments*1144,874 144,874 — — —

Interest payments*2326,718 159,012 120,991 44,140 2,575

Contributions to defi ned benefi t pension plans*382,795 82,795 — — —

Total ¥3,593,220 ¥1,390,980 ¥1,193,315 ¥862,226 ¥146,699

*1 Honda had commitments for purchases of property, plant and equipment at March 31, 2009.

*2 To estimate the schedule of interest payments, the company utilized the balances and average interest rates of borrowings and debts and derivative instruments as of March 31,

2009.

*3 Since contributions beyond the next fi scal year are not currently determinable, contributions to defi ned benefi t pension plans refl ect only contributions expected for the next fi scal

year.

If our estimates of unrecognized tax benefi ts and potential tax

benefi ts are not representative of actual outcomes, our

consolidated fi nancial statements could be materially affected

in the period of settlement or when the statutes of limitations

expire, as we treat these events as discrete items in the period

of resolution. Since it is diffi cult to estimate actual payment in

the future related to our uncertain tax positions, unrecognized

tax benefi t totaled ¥125,771 million is not represented in the

table above.

At March 31, 2009, we had no material capital lease

obligations or long-term liabilities refl ected on our balance

sheet under U.S. GAAP other than those set forth in the table

above.

Application of Critical Accounting Policies

Critical accounting policies are those which require us to apply

the most diffi cult, subjective or complex judgments, often

requiring us to make estimates about the effect of matters that

are inherently uncertain and which may change in subsequent

periods, or for which the use of different estimates that could

have reasonably been used in the current period would have

had a material impact on the presentation of our fi nancial

condition and results of operations. A sustained loss of

consumer confi dence which may be caused by continued

economic slowdown, recession, rising fuel prices, fi nancial

crisis or other factors have combined to increase the

uncertainty inherent in such estimates and assumptions.

The following is not intended to be a comprehensive list of all

our accounting policies.

We have identifi ed the following critical accounting policies

with respect to our fi nancial presentation.

(Product Warranty)

We warrant our products for specifi c periods of time.

Product warranties vary depending upon the nature of the

product, the geographic location of their sales and other

factors.

We recognize costs for general warranties on products we

sell and product recalls. We provide for estimated warranty

costs at the time products are sold to customers or the time

new warranty programs are initiated. Estimated warranty costs

are provided based on historical warranty claim experience with

consideration given to the expected level of future warranty

costs, including current sales trends, the expected number of

units to be affected and the estimated average repair cost per

unit for warranty claims. Our products contain certain parts

manufactured by third party suppliers. Since suppliers typically

warrant these parts, the expected receivables from warranties

of these suppliers are deducted from our estimates of accrued

warranty obligations.

We believe our accrued warranty liability is a “critical

accounting estimate” because changes in the calculation can

materially affect net income, and require us to estimate the

frequency and amounts of future claims, which are inherently

uncertain.

Our policy is to continuously monitor warranty cost accruals

to determine the adequacy of the accrual. Therefore, warranty

expense accruals are maintained at an amount we deem

adequate to cover estimated warranty expenses.

Annual Report 2009 57