Honda 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Operating and Financial Review

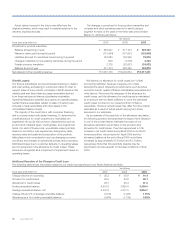

Net Sales and Other Operating Revenue

Honda’s consolidated net sales and other operating revenues

(hereafter, “net sales”) for the fi scal year ended March 31,

2009, decreased ¥1,991.5 billion, or 16.6%, to ¥10,011.2

billion from the fi scal year ended March 31, 2008, primarily due

to foreign currency translation effects and decreased net sales

in the automobile business. Honda estimates that by applying

Japanese yen exchange rates of the previous fi scal year to the

current fi scal year, net sales for the year would have decreased

by approximately ¥795.8 billion, or 6.6%, compared to the

decrease as reported of ¥1,991.5 billion, which includes

negative foreign currency translation effects.

Net sales in Japan decreased ¥139.2 billion, or 8.8%, to

¥1,446.5 billion from the previous fi scal year and overseas net

sales decreased ¥1,852.3 billion, or 17.8%, to ¥8,564.7 billion

from the previous fi scal year.

Operating Income

Operating income decreased ¥763.4 billion, or 80.1%, to

¥189.6 billion from the previous fi scal year. Excluding negative

foreign currency effects of ¥269.5 billion, caused by the

appreciation of the Japanese yen, Honda estimates operating

income decreased ¥493.8 billion, or 51.8%.

Factors contributing to the decrease of ¥493.8 billion in

operating income excluding negative foreign currency effects

can be summarized as follows (i) changes in net sales and the

model mix, (ii) cost reductions and the effect of raw material

cost fl uctuations, (iii) changes in selling, general and

administrative (SG&A) expenses and (iv) R&D expenses. Details

regarding these factors are as follows.

Changes in net sales and the model mix had a negative

impact of ¥247.7 billion, due mainly to a decrease in income

attributable to the decreased net sales and changes in the

model mix caused by shift of customers’ demands towards

more fuel effi cient (compact) models in automobile business,

which was offset by price increases and reduced sales

incentives in automobile business in North America.

Cost reductions and the effect of raw material fl uctuations

had a negative impact of ¥182.5 billion, due mainly to

increased raw materials costs, such as steel and precious

grade metals, and an increase in fi xed costs per unit as a result

of reduced production, which was offset by continuing cost

reductions.

Selling, general and administrative expenses had a negative

impact of ¥88.3 billion due mainly to expenses related to

withdrawal from some racing activities and cancellations of

development new models and an increase in provisions for

credit losses and losses on lease residual values in the fi nancial

services business in North America, which was offset by a

decrease in costs for product warranties.

R&D expenses also had a positive impact of ¥24.7 billion,

due mainly to reduction of R&D expenses, which was offset by

increased R&D expenses related to safety and environmental

technologies and enhancement of the attractiveness of the

products.

With respect to the discussion above of the changes in

operating income, management identifi ed the factors set forth

below and used what it believes to be a reasonable method to

analyze the respective changes in such factors. Each of these

factors is explained below. Management analyzed changes in

these factors at the levels of the Company and its material

consolidated subsidiaries.

(1) “Foreign currency effects” consist of “translation

adjustments”, which come from the translation of the

currency of foreign subsidiaries’ fi nancial statements into

Japanese yen, and “foreign currency adjustments”, which

result from foreign-currency-denominated sales. With

respect to “foreign currency adjustments”, management

analyzed foreign currency adjustments primarily related to

the following currencies: U.S. dollar, Canadian dollar, Euro,

British pound, Brazilian real and Japanese yen, at the level

of the Company and its material consolidated subsidiaries.

(2) With respect to “cost reduction and effects of raw material

cost fl uctuations”, management analyzed cost reduction

and effects of raw material cost fl uctuations at the levels of

the Company and its material foreign manufacturing

subsidiaries in North America, Europe and other regions.

(3) With respect to “changes in net sales and the model mix”,

management analyzed changes in sales volume and the mix

of product models sold in major markets which resulted in

increases/decreases in profi t, as well as certain other

reasons for increases/decreases in net sales and cost of

sales.

(4) With respect to “selling, general and administrative

expenses”, management analyzed reasons for increases/

decreases in selling, general and administrative expenses

from the previous fi scal year excluding currency translation

effects.

Income before Income Taxes, Minority Interest and

Equity in Income of Affi liates

Income before income taxes, minority interest and equity in

income of affi liates decreased ¥734.1 billion, or 81.9%, to

¥161.7 billion. Main factors of this decrease, except factors

relating to operating income, are as follows;

Unrealized gains and losses related to derivative instruments,

such as interest rate swaps of fi nance subsidiaries, had a

positive impact of ¥85.7 billion. On the other hand, realized

0

2,000

4,000

6,000

8,000

10,000

12,000

0908070605

Net Sales and Other Operating

Revenue

Years ended March 31

Yen (billions)

Annual Report 2009

50