Honda 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(Income Taxes)

Honda adopted the provision of FASB Interpretation No. 48

“Accounting for Uncertainty in Income Taxes” (FIN No. 48) on

April 1, 2007. Honda is subject to income tax examinations in

many tax jurisdictions because Honda conducts its operations

in various regions of the world. We recognize the tax benefi t

from an uncertain tax position based on the technical merits of

the position when the position is more likely than not to be

sustained upon examination. Benefi ts from tax positions that

meet the more likely than not recognition threshold are

measured at the largest amount of benefi t that is greater than

50% likelihood of being realized upon ultimate resolution. We

performed a comprehensive review of any uncertain tax

positions in accordance with FIN No. 48.

We believe our accounting for tax uncertainties is a “critical

accounting estimate” because it requires us to evaluate and

assess the probability of the outcome that could be realized

upon ultimate resolution. Our estimates may change in the

future due to new developments.

We believe that our estimates and assumptions of

unrecognized tax benefi ts are reasonable, however, if our

estimates of unrecognized tax benefi ts and potential tax

benefi ts are not representative of actual outcomes, our

consolidated fi nancial statements could be materially affected

in the period of settlement or when the statutes of limitations

expire, as we treat these events as discrete items in the period

of resolution.

(Pension and Other Postretirement Benefi ts)

We have various pension plans covering substantially all of our

employees in Japan and certain employees in foreign countries.

Benefi t obligations and pension costs are based on

assumptions of many factors, including the discount rate, the

rate of salary increase and the expected long-term rate of

return on plan assets. The discount rate is determined mainly

based on the rates of high quality corporate bonds or

governmental bonds currently available and expected to be

available during the period to maturity of the defi ned benefi t

pension plans. The salary increase assumptions refl ect our

actual experience as well as near-term outlook. Honda

determines the expected long-term rate of return based on the

investment policies. Honda considers the eligible investment

assets under investment policies, historical experience,

expected long-term rate of return under the investing

environment, and the long-term target allocations of the various

asset categories. Our assumed discount rate and rate of salary

increase as of March 31, 2009 were 2.0% and 2.3%,

respectively, and our assumed expected longterm rate of return

for the year ended March 31, 2009 was 4.0% for Japanese

plans. Our assumed discount rate and rate of salary increase

as of March 31, 2009 were 6.9-8.0% and 1.5-6.4%,

respectively, and our assumed expected long-term rate of

return for fi scal 2009 was 6.5-8.0% for foreign plans.

We believe that the accounting estimates related to our

pension plans is “critical accounting estimate” because

changes in these estimates can materially affect our fi nancial

condition and results of operations.

Actual results may differ from our assumptions, and the

difference is accumulated and amortized over future periods.

Therefore, the difference generally will be refl ected as our

recognized expenses and recorded obligations in future

periods. We believe that the assumptions currently used are

appropriate, however, differences in actual expenses or

changes in assumptions could affect our pension costs and

obligations, including our cash requirements to fund such

obligations.

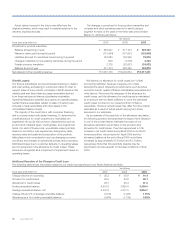

The following table shows the effect of a 0.5% change in the

assumed discount rate and the expected long-term rate of

return on our funded status, equity, and pension expense.

Japanese Plans Yen (billions)

Assumptions Percentage point change (%) Funded status Equity Pension expense

Discount rate +0.5/–0.5 –87.0/+88.6 +40.9/–46.8 –4.5/+5.5

Expected long-term rate of return +0.5/–0.5 — — –3.8/+3.8

Foreign Plans Yen (billions)

Assumptions Percentage point change (%) Funded status Equity Pension expense

Discount rate +0.5/–0.5 –14.0/+16.9 +18.7/–20.9 –3.7/+4.2

Expected long-term rate of return +0.5/–0.5 — — –2.1/+2.1

*1 Note that this sensitivity analysis may be asymmetric, and are specifi c to the base conditions at March 31, 2009.

*2 Funded status for fi scal 2009 is affected by March 31, 2009 assumptions.

Pension expense for fi scal 2009 is affected by March 31, 2009 assumptions.

Annual Report 2009

60