Honda 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

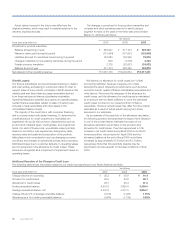

The provision for credit losses increased by ¥4.9 billion, or

11%, refl ecting the continued deterioration of the U.S.

economy which has negatively affected certain customers’

ability to meet their contractual obligations despite the effect of

exchange rate changes. Net charge-offs increased by ¥4.5

billion, or 11%. The ending allowance balance increased by

¥3.0 billion, or 11%, refl ecting the higher estimate of losses

incurred despite the effect of exchange rate changes.

Losses due to customer defaults on operating leases are not

recognized in the provision for credit losses. These losses are

recognized as a component of impairment losses on operating

leases. Impairment losses recognized totaled ¥8.7 billion and

¥5.8 billion for fi scal years 2009 and 2008, respectively. Higher

losses are due to the increasing volume of leases that are

accounted for as operating leases.

(Losses on Lease Residual Values)

End-customers of leased vehicles typically have an option to

buy the leased vehicle for the contractual residual value of the

vehicle or to return the vehicle to our fi nance subsidiaries

through the dealer at the end of the lease term. Likewise,

dealers have the option to buy the vehicle returned by the

customer or to return the vehicle to our fi nance subsidiaries.

The likelihood that the leased vehicle will be purchased varies

depending on the difference between the actual market value

of the vehicle at the end of the lease term and the contractual

value determined at the inception of the lease. Our fi nance

subsidiaries in North America have historically accounted for all

leases as direct fi nancing leases. However, starting in the year

ended March 31, 2007, some of the leases which do not

qualify for direct fi nancing leases accounting treatment are

accounted for as operating leases.

We initially determine the contract residual values by using

our estimate of future used vehicle values, taking into

consideration data obtained from third parties. We are exposed

to risk of loss on the disposition of returned lease vehicles

when the proceeds from the sale of the vehicles are less than

the contractual residual values at the end of the lease term. We

periodically review the estimate of residual values. Downward

adjustments are made for declines in estimated residual values

that are deemed to be other-than-temporary. For direct

fi nancing leases, our fi nance subsidiaries in North America

purchase insurance to cover a portion of the estimated residual

value. The adjustments on the uninsured portion of the

vehicle’s residual value are recognized as a loss in the period in

which the estimate changed. For vehicle leases accounted for

as operating leases, the adjustments to estimated residual

values result in changes to the remaining depreciation expense

to be recognized prospectively on a straight-line basis over the

remaining term of the lease.

The primary components in estimating losses on lease

residual values are the expected frequency of returns, or the

percentage of leased vehicles we expect to be returned by

customers at the end of the lease term, and the expected loss

severity, or the expected difference between the residual value

and the amount we receive through sales of returned vehicles

plus proceeds from insurance, if any. We estimate losses on

lease residual values by evaluating several different factors,

including trends in historical and projected used vehicle values

and general economic measures.

We also periodically test our operating leases for impairment

under Statement of Financial Accounting Standards (SFAS) No.

144, “Accounting for the Impairment or Disposal of Long-Lived

Assets”.

Recoverability of operating leases to be held is measured by

a comparison of the carrying amount of operating leases to

future net cash fl ows (undiscounted and without interest

charges) expected to be generated by the operating leases. If

such operating leases are considered to be impaired, the

impairment to be recognized is measured by the amount by

which the carrying amount of the operating leases exceeds the

estimated fair value of the operating leases.

We believe that our estimated losses on lease residual values

is a “critical accounting estimate” because it is highly

susceptible to market volatility and requires us to make

assumptions about future economic trends and lease residual

values, which are inherently uncertain. We believe that the

assumptions used are appropriate. However actual losses

incurred may differ from original estimates.

If future auction values for all Honda and Acura vehicles in

our North American direct fi nancing lease portfolio as of March

31, 2009, were to decrease by approximately ¥10,000 per unit

from our present estimates, holding all other assumption

constant, the total impact would be an increase in losses on

lease residual values by approximately ¥0.6 billion. Similarly, if

future return rates for our existing portfolio of all Honda and

Acura vehicles were to increase by one percentage point from

our present estimates, the total impact would be an increase in

losses on lease residual values by approximately ¥0.1 billion.

With the same prerequisites shown above, the impacts to the

operating lease portfolio would be approximately ¥2.5 billion

and ¥0.6 billion, which would be recognized over the remaining

lease terms. Note that this sensitivity analysis may be

asymmetric, and are specifi c to the base conditions in fi scal

2009. Also, declines in auction values are likely to have a

negative effect on return rates which could affect the

sensitivities.

(Fiscal Year 2009 Compared with Fiscal Year 2008)

Despite a declining portfolio of direct fi nancing leases and the

effect of exchange rate changes, losses on lease residual

values increased by ¥11.1 billion or 94% as a result of the

declines in used vehicle prices. Despite the effect of exchange

rate changes, incremental depreciation increased by ¥11.6

billion or 545% due to the increase in operating lease assets

and declines in estimated residual values.

Impairment losses of ¥9.7 billion were recognized in

accordance with Statement of Financial Accounting Standards

(SFAS) No. 144, “Accounting for the Impairment or Disposal of

Long-Lived Assets” during the year.

Annual Report 2009 59