Honda 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Honda annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(Interest Rate Risks)

Honda is exposed to market risk for changes in interest rates

related primarily to its debt obligations and fi nance receivables.

In addition to short-term fi nancing such as commercial paper,

Honda has long-term debt with both fi xed and fl oating rates.

Our fi nance receivables are primarily fi xed rate. Interest rate

swap agreements are mainly used to manage interest rate risk

exposure and to convert fl oating rate fi nancing (normally

three-fi ve years) to fi xed rate fi nancing in order to match

fi nancing costs with income from fi nance receivables. Foreign

currency and interest rate swap agreements used among

different currencies, also serve to hedge foreign currency

exchange risk as well as interest rate risk.

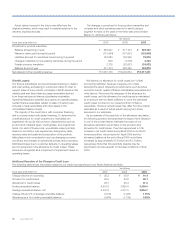

The following tables provide information about Honda’s

fi nancial instruments that were sensitive to changes in interest

rates at March 31, 2008 and 2009. For fi nance receivables and

long-term debt, these tables present principal cash fl ows, fair

value and related weighted average interest rates. For interest

rate swaps and currency and interest rate swaps, the table

presents notional amounts, fair value and weighted average

interest rates. Variable interest rates are determined using

formulas such as LIBOR+ and an index.

Quantitative and Qualitative Disclosure About Market

Risk

Honda is exposed to market risks, which are changes in foreign

currency exchanges rates, in interest rates and in prices of

marketable equity securities. Honda is a party to derivative

fi nancial instruments in the normal course of business in order

to manage risks associated with changes in foreign currency

exchange rates and in interest rates. Honda does not hold any

derivative fi nancial instruments for trading purposes.

Honda adopted Statement of Financial Accounting

Standards (SFAS) No. 157, “Fair Value Measurements” effective

April 1, 2008. This statement defi nes fair value as the price that

would be received to sell an asset or paid to transfer a liability

in an orderly transaction, and emphasizes that a fair value

measurement should be determined based on the assumptions

that market participants would use in pricing an asset or

liability. The adoption of this statement did not have a material

impact on the Company’s consolidated fi nancial position or

results of operations.

(Foreign Currency Exchange Rate Risk)

Foreign currency forward exchange contracts and purchased

option contracts are used to hedge currency risk of sale

commitments denominated in foreign currencies (principally

U.S. dollars).

Foreign currency written option contracts are entered into in

combination with purchased option contracts to offset

premium amounts to be paid for purchased option contracts.

The tables below provide information about our derivatives

related to foreign currency exchange rate risk as of March 31,

2008 and 2009. For forward exchange contracts and currency

options, the table presents the contract amounts and fair value.

All forward exchange contracts and currency contracts to which

we are a party have original maturities of less than one year.

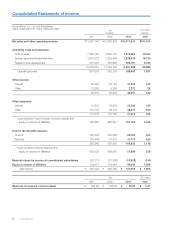

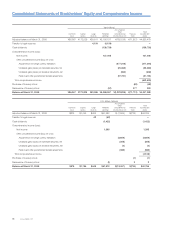

Foreign Exchange Risk

2008 2009

Yen (millions) Average

contractual

rate (Yen)

Yen (millions) Average

contractual

rate (Yen)Fiscal years ended March 31

Contract

amounts Fair value

Contract

amounts Fair value

Forward Exchange Contracts

To sell US$ ¥214,797 9,199 104.25 ¥182,941 (8,966) 93.33

To sell EUR 40,963 64 157.99 42,324 (2,086) 123.40

To sell CA$ 14,146 560 101.72 379 (5) 76.99

To sell GBP 70,227 2,739 207.07 49,681 (2,673) 133.42

To sell other foreign currencies 12,147 362 various 16,549 (387) various

To buy US$ 7,104 (196) 102.92 3,287 131 94.26

To buy other foreign currencies 2,272 (29) various 1,933 (11) various

Cross-currencies 254,189 (517) various 234,521 94 various

Total ¥615,845 12,182 ¥531,615 (13,903)

Currency Option Contracts

Option purchased to sell US$ ¥ 96,720 877 various ¥ 24,548 304 various

Option written to sell US$ 136,005 (502) various 51,551 (1,743) various

Option purchased to sell other currencies 17,378 409 various —— —

Option written to sell other currencies 22,101 (457) various — — —

Total ¥272,204 327 ¥ 76,099 (1,439)

Annual Report 2009 61