Holiday Inn 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

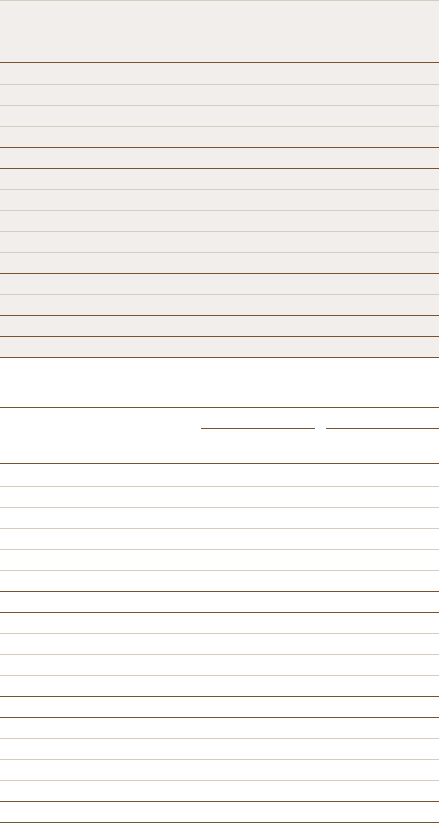

12 months to

31 Dec 31 Dec

2003 2002 Change

EMEA RESULTS £m £m %

Tu r n ov er :

Owned and leased 746 739 1

Managed 38 37 3

Franchised 23 24 -4

807 800 1

Operating profit before exceptional items:

Owned and leased 77 115 -33

Managed 19 21 -10

Franchised 18 14 29

114 150 -24

Regional overheads (22) (30) -27

Total £m 92 120 -23

Dollar equivalent $m 149 180 -17

FIGURE 3

Hotels Rooms

EMEA SYSTEM SIZE Change over Change over

AT 31 DECEMBER 2003 2003 over 2002 2003 over 2002

Analysed by brand:

InterContinental 63 -6 20,842 -82

Crowne Plaza 62 515,689 1,306

Holiday Inn 340 654,997 1,190

Holiday Inn Express 132 21 13,270 2,546

Other brands 3-1 1,010 -80

Total 600 25 105,808 4,880

Analysed by ownership type:

Owned and leased 129 –26,318 148

Managed 101 225,483 1,707

Franchised 370 23 54,007 3,025

Total 600 25 105,808 4,880

Analysed by geography:

United Kingdom 204 12 29,053 1,276

Rest of Europe 280 18 48,795 3,852

Middle East and Africa 116 -5 27,960 -248

Total 600 25 105,808 4,880

to that experienced in the Americas, with trading depressed by

the threat and then outbreak of the war in Iraq. In the second

half of the year, the UK market showed signs of recovery,

although the picture was less clear in Europe, with both the

German and French markets experiencing mixed trading

conditions.

The Holiday Inn UK estate recorded five consecutive months

of RevPAR growth to finish the year up 2.3%. The UK regions,

with their domestic focus, recovered earlier than London and

recorded seven consecutive months of growth. In London,

December 2003 trading was particularly strong with the

majority of the owned estate recording double digit RevPAR

growth to end the month up 12.3%.

Across EMEA the InterContinental estate finished the year

with an overall RevPAR decline of 5.7%. While the owned

InterContinental estate finished down 8.0% due to its exposure

to the main European gateways, the managed Middle East

estate traded more positively with the comparable Middle East

estate recording RevPAR growth of 2.7%.

Crowne Plaza finished the 12 months with RevPAR growth of

3.3% due to growth in the managed and franchised estates

of 11.1% and 3.2% respectively. This performance was helped

by the Middle East estate which finished the 12 months ended

31 December 2003 up 29.5%.

Franchise turnover fell due to a fall in RevPAR and exchange

rate movements, offset by growth in system size. Franchise

profits grew primarily due to savings in franchise overhead

realised as part of the reorganisation review.

EMEA pro forma operating profit before exceptional items

totalled £92m for the 12 months ended 31 December 2003.

The conversion of revenue to operating profit was depressed

by the owned and leased estate, where the combined effects

of pre-opening costs, hotels opening towards the end of the

period, and increased depreciation charges associated with

prior year refurbishment, all negatively impacted costs.

Regional overheads fell £8m to £22m for the 12 months

ended 31 December 2003 (£30m for the 12 months ended

31 December 2002) as a result of the reorganisation initiatives.

During the year the InterContinental Le Grand Paris reopened

after a full refurbishment to widespread acclaim, firmly

positioning the property at the top of the Paris market. The

Holiday Inn Paris Disney opened giving representation at one

of Europe’s leading family leisure destinations and the Crowne

Plaza Brussels Airport opened at the end of the year, giving

the brand another defining asset at a major European airport.

OPERATING AND FINANCIAL REVIEW

6InterContinental Hotels Group 2003