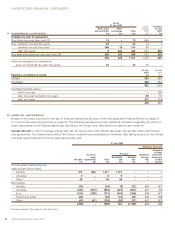

Holiday Inn 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

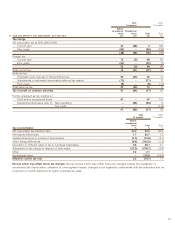

30 Sept 2002

Interest at fixed rate

Weighted

average

Currency Principal Weighted period for

swap At variable At fixed average which rate

Net debt agreements Total rate* rate rate is fixed

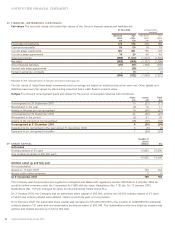

28 FINANCIAL INSTRUMENTS (CONTINUED) £m £m £m £m £m % (years)

Current asset investments and

cash at bank and in hand:

Sterling 196 2,153 2,349 2,349 – – –

US dollar 30 – 30 30–––

Other 76 – 76 76–––

Borrowings:

Sterling (532) – (532) (327) (205) 10.2 13.5

US dollar (463) (1,490) (1,953) (1,195) (758) 5.4 2.1

Euro (183) (628) (811) (598) (213) 4.9 1.9

Hong Kong dollar (215) – (215) (158) (57) 3.2 1.0

Other (86) (35) (121) (104) (17) 4.7 2.0

(1,177) – (1,177) 73 (1,250) 6.0 4.2

* Primarily based on the relevant inter-bank rate.

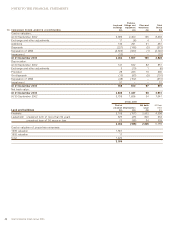

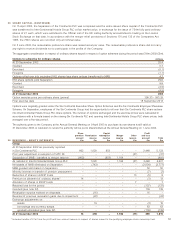

At 31 December 2003, the Group had investments and advances totalling £172m (30 September 2002 £218m) on which no

interest is receivable and which do not have a maturity date. These interests are denominated primarily in US dollars.

The Group had other creditors and deferred income, denominated primarily in US dollars, due after one year of £97m at

31 December 2003 (30 September 2002 £100m) on which no interest is payable.

At 31 December 2003, the Group had not entered into any interest rate option agreements. At 30 September 2002, the Group

had entered into the following agreements:

30 Sept 2002

Principal Cap rate Swap rate Maturity

US dollar swaption – interest payable US$250m – 3.47% 2005

US dollar cap – interest payable US$100m 4.00% – 2005

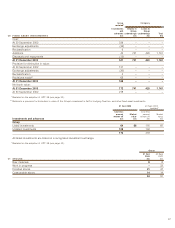

Currency risk In order to manage currency risk, the Group enters into agreements for the forward purchase or sale of foreign

currencies as well as currency options. Foreign currency flows in respect of imports and exports are also netted where practical.

As virtually all foreign exchange gains and losses are charged to the Statement of Total Recognised Group Gains and Losses

under the hedging provisions of SSAP 20, no disclosure of the remaining currency risks has been provided on the grounds

of materiality.

At 31 December 2003, the Group had contracted to exchange within one year the equivalent of £49m (30 September 2002 £35m)

of various currencies.

Liquidity risk A liquidity analysis of the Group’s borrowings is provided in note 27, along with details of the Group’s material

unutilised committed borrowing facilities. The liquidity analysis of the Group’s other financial liabilities is set out below:

31 Dec 30 Sept

2003 2002

restated*

Other creditors and deferred income £m £m

Due: between one and two years 36 36

between two and five years 35 39

after five years 26 25

97 100

* Restated for the reclassification of pension provisions (see page 32).