Holiday Inn 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

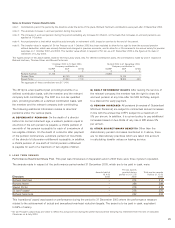

Notes to Directors’ Options table

+The number and the exercise prices of options over IHG PLC shares exchanged for former options over Six Continents PLC shares were calculated

in accordance with a formula based on the closing Six Continents PLC and opening IHG PLC share prices, both averaged over a five-day period.

All outstanding rolled over options are immediately exercisable and the latest date that any rolled over options may be exercised is October 2012.

AWhere options are exercisable and the market price per share at 31 December 2003 was above the option price;

BWhere the options are exercisable but the market price per share at 31 December 2003 was below the option price; and

CWhere options are not yet exercisable.

* Share options under the IHG Executive Share Option Plan were granted on 30 May 2003 at an option price of 438p. These options are

exercisable between May 2006 and May 2013, subject to the achievement of the performance condition.

** Share options under the IHG Sharesave Plan were granted on 19 December 2003 at an option price of 420.5p. These options are exercisable

between March 2007 and March 2009.

*** Represents the entitlement to IHG PLC shares which lapsed on 11 October 2003 under the former Six Continents Sharesave Schemes,

due to early termination of individual sharesave contracts, as a consequence of the Separation.

ºRepresents rolled over options under the Six Continents 1985 Executive Share Option Scheme which would otherwise have lapsed on 11 October 2003,

as a consequence of the Separation.

#Represents rolled over options under the Six Continents Sharesave Schemes which would otherwise have lapsed on 11 October 2003

as a consequence of the Separation.

Option prices range from 295.33p to 593.29p per IHG PLC share. The closing market value share price on 31 December 2003 was 529p and the range

during the period from listing on 15 April 2003 to 31 December 2003 was 339p to 556.25p per share.

The gain on exercise by directors in aggregate was £69,491 in the period ended 31 December 2003 (no gains in the year ended 30 September 2002).

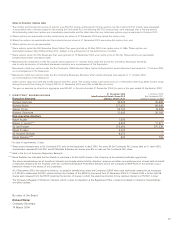

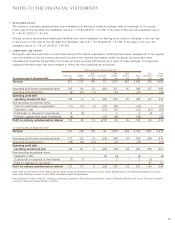

31 December 2003 1 October 2002*

7 DIRECTORS’ SHAREHOLDINGS InterContinental Hotels Group PLC Six Continents PLC

Executive directors Ordinary shares of £1 Ordinary shares of 28p**

Richard Hartman 30,345 35,808

Richard North 171,470 80,649

Stevan Porter 56,754 19,348

Richard Solomons 17,956 20,182

Non-executive directors

Ralph Kugler 1,000 –

Robert C Larson*** 9,805 11,571

Sir Ian Prosser 270,060 276,238

David Prosser 5,000 –

Sir Howard Stringer 8,474 –

David Webster**** 824 793

* Or date of appointment, if later.

** These share interests were in Six Continents PLC prior to the Separation in April 2003. For every 59 Six Continents PLC shares held on 11 April 2003,

shareholders received 50 IHG PLC and 50 Mitchells & Butlers plc shares plus 81p in cash per Six Continents PLC share.

*** Held in the form of American Depositary Receipts.

**** David Webster has indicated that he intends to purchase a further 5,000 shares in the Company at the earliest practicable opportunity.

The above shareholdings are all beneficial interests and include shares held by directors’ spouses and other connected persons, shares held on behalf

of executive directors by the Trustees of the Six Continents Employee Profit Share Scheme and of the Company’s ESOP. None of the directors has a

beneficial interest in the shares of any subsidiary.

At 31 December 2003, the executive directors, as potential beneficiaries under the Company’s ESOP, were each technically deemed to be interested

in 2,222,519 unallocated IHG PLC shares held by the Trustees of the ESOP. In the period from 31 December 2003 to 10 March 2004 a further 65,018

shares were released from the ESOP, reducing the number of shares in which the executive directors hold a residual interest to 2,157,501 in total.

The Company’s Register of Directors’ Interests, which is open to inspection at the Registered Office, contains full details of directors’ shareholdings

and share options.

By order of the Board

Richard Winter

Company Secretary

10 March 2004