Holiday Inn 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 InterContinental Hotels Group 2003

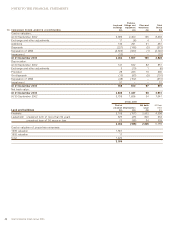

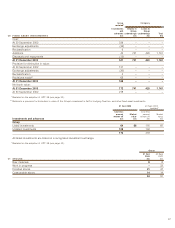

NOTES TO THE FINANCIAL STATEMENTS

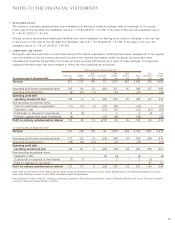

5 PENSIONS (CONTINUED)

FRS 17 disclosures The valuations used for FRS 17 disclosures are based on the results of the actuarial valuations at

31 March 2002 updated by independent qualified actuaries to 31 December 2003. Scheme assets are stated at market value at

31 December 2003 and the liabilities of the schemes have been assessed as at the same date using the projected unit method.

As the principal plans are now closed as defined benefit schemes, the current service cost as calculated under the projected

unit method will increase as members approach retirement.

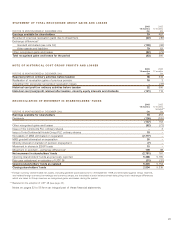

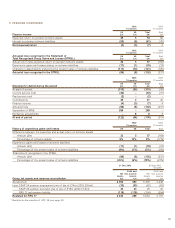

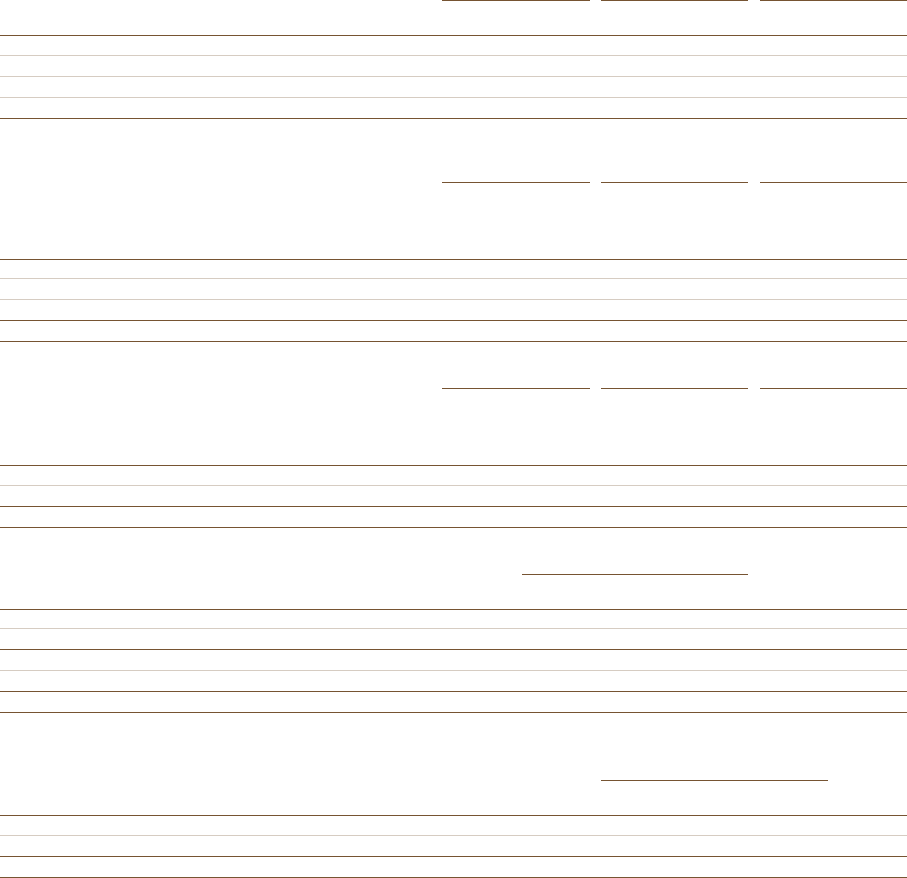

The principal assumptions used by the actuaries to determine the liabilities on an FRS 17 basis were:

31 Dec 2003 30 Sept 2002 30 Sept 2001

UK US UK US UK US

%%%%%%

Wages and salaries increases 4.3 – 3.8 – 3.9 –

Pensions increases 2.8 – 2.3 – 2.4 –

Discount rate 5.4 6.3 5.5 6.8 6.1 7.5

Inflation rate 2.8 – 2.3 – 2.4 –

The combined assets of the principal schemes and expected rate of return were:

31 Dec 2003 30 Sept 2002 30 Sept 2001

Long-term Long-term Long-term

rate of rate of rate of

return return return

expected Value expected Value expected Value

UK Schemes %£m %£m %£m

Equities 8.0 238 8.0 507 7.5 700

Bonds 5.4 117 4.7 397 5.1 304

Other ––8.0 92 7.5 94

Total market value of assets 355 996 1,098

31 Dec 2003 30 Sept 2002 30 Sept 2001

Long-term Long-term Long-term

rate of rate of rate of

return return return

expected Value expected Value expected Value

US Schemes %£m %£m %£m

Equities 9.2 29 11.2 27 11.5 29

Bonds 6.0 19 6.2 22 7.0 25

Total market value of assets 48 49 54

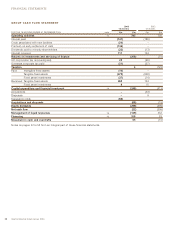

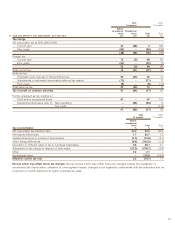

30 Sept 30 Sept

31 Dec 2003 2002 2001

UK US Total Total Total

£m £m £m £m £m

Total market value of assets 355 48 403 1,045 1,152

Present value of scheme liabilities (477) (102) (579) (1,415) (1,207)

Deficit in the scheme (122) (54) (176) (370) (55)

Related deferred tax asset 37 21 58 116 21

Net pension liability (85) (33) (118) (254) (34)

If FRS 17 had been recognised in the financial statements, the effects would have been as follows:

2003 2002

15 months 12 months

UK US Total Total

Operating profit charge £m £m £m £m

Current service cost 32 – 32 31

Past service cost 2–2–

Total operating profit charge 34 – 34 31