Holiday Inn 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 InterContinental Hotels Group 2003

US GAAP INFORMATION

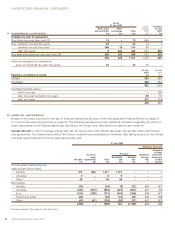

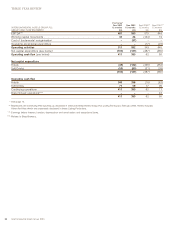

NET (LOSS)/INCOME IN ACCORDANCE WITH US GAAP

The significant adjustments required to convert earnings available for shareholders in accordance with UK GAAP to net

(loss)/income in accordance with US GAAP are:

3 months 12 months 15 months 12 months 3 months 12 months 15 months 12 months

to 31 Dec to 31 Dec to 31 Dec to 30 Sept to 31 Dec to 31 Dec to 31 Dec to 30 Sept

2002 2003 2003 2002 2002(b) 2003(b) 2003(b) 2002(b)

restated(a) restated(a)

£m £m £m £m $m $m $m $m

Earnings available for shareholders

in accordance with UK GAAP 64 (45) 19 457 105 (74) 31 676

Adjustments:

Pension costs (9) (14) (23) (21) (15) (23) (38) (31)

Amortisation of intangible fixed assets (4) (5) (9) (105) (7) (8) (15) (155)

Impairment of intangible fixed assets

on adoption of FAS 142 (712) – (712) –(1,154) – (1,154) –

Depreciation of tangible fixed assets – (4) (4) –– (7) (7) –

Disposal of tangible fixed assets 358658139

Impairment of tangible fixed assets –454577 –7373114

Provisions (1) 3 2 –(2) 5 3 –

Staff costs – (6) (6) –– (10) (10) –

Deferred revenue –33––55–

Change in fair value of derivatives(c) 7263379 12 43 55 117

Deferred taxation:

on above adjustments 246(4) 3710(6)

methodology (2) 14 12 7(3) 23 20 10

(716) 71 (645) 39 (1,161) 116 (1,045) 58

Minority share of above adjustments –333–554

(716) 74 (642) 42 (1,161) 121 (1,040) 62

Net (loss)/income in accordance with US GAAP (652) 29 (623) 499 (1,056) 47 (1,009) 738

Before cumulative effect on prior years of change

in accounting principle comprising:

Continuing operations 30 (1) 29 166 49 (2) 47 245

Discontinued operations:

result for the period 30 30 60 162 49 49 98 240

surplus on disposal of Bass Brewers

and other businesses –––171 –––253

Impairment of intangible fixed assets

on adoption of FAS 142 (712) – (712) –(1,154) – (1,154) –

(652) 29 (623) 499 (1,056) 47 (1,009) 738

Basic(d) and diluted(e) net (loss)/income

per American Depositary Share ££££$$$$

Before cumulative effect on prior years of change

in accounting principle comprising:

Continuing operations 0.04 – 0.04 0.23 0.07 (0.01) 0.06 0.34

Discontinued operations 0.04 0.04 0.08 0.45 0.07 0.07 0.14 0.67

Impairment of intangible fixed assets

on adoption of FAS 142 (0.97) – (0.97) –(1.58) – (1.58) –

(0.89) 0.04 (0.85) 0.68 (1.44) 0.06 (1.38) 1.01

(a) Restated following a review of unrealised gains in respect of the Group’s properties. This has resulted in additional goodwill of £145m ($226m)

arising on an acquisition in 2000. The impact on the income statement has been to increase the amortisation of intangible fixed assets by £4m ($6m)

and to decrease the deferred tax methodology charge by £50m ($74m). Overall, these restatements have increased net income by £46m ($68m).

(b) Translated at the weighted average rate of exchange for the period of £1 = $1.62 (2002 £1 = $1.48).

(c) Comprises net gains in the fair value of derivatives that do not qualify for hedge accounting of £28m (2002 £75m) and net gains reclassified from

other comprehensive income of £5m (2002 £4m).

(d) Calculated by dividing net (loss)/income in accordance with US GAAP of £623m loss (2002 £499m income) by 733m (2002 731m) shares, being

the weighted average number of ordinary shares in issue during the period. Each American Depositary Share represents one ordinary share.

(e) Calculated by adjusting basic net (loss)/income in accordance with US GAAP to reflect the notional exercise of the weighted average number

of dilutive ordinary share options outstanding during the period. The resulting weighted average number of ordinary shares is 733m (2002 734m).