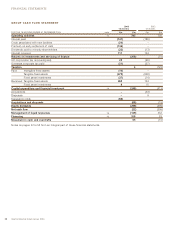

Holiday Inn 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

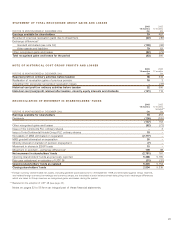

The figures above represent emoluments earned as directors during the period since the listing of IHG PLC following Separation.

Comparative figures for 2002 apply only to those directors who also served as directors of Six Continents PLC. These figures

represent their emoluments for the financial year ended 30 September 2002. ‘Performance payments’ include payments in respect

of participation in the Short Term Deferred Incentive Plan (but excluding any matching shares) and payments from the Performance

Restricted Share Plan ‘transitional incentive’ for the period ended 31 December 2003 (further details of which are set out on

page 25 under Long Term Reward).

‘Benefits’ incorporate all tax assessable benefits arising from the individual’s employment. For Sir Ian Prosser and Messrs

Hartman, North and Solomons, this relates in the main to the provision of a fully expensed company car and private healthcare

cover. In addition, Mr Hartman received housing, child education and relocation benefits. For Stevan Porter, benefits relate in the

main to private healthcare cover and relocation.

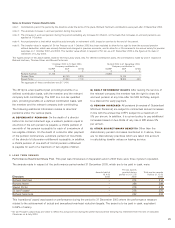

STDIP STDIP

shares shares Market Market Value

awarded vested price price based

STDIP during the during the per per STDIP on share

shares period period share at share at shares price at

SHORT TERM DEFERRED held at Vesting 15.4.03 to 15.4.03 to Award award vesting held at Vesting 31.12.03***

INCENTIVE PLAN (STDIP) 15.4.03* date 31.12.03 31.12.03 date date** date 31.12.03 date £

Directors

Richard North 39,628 18.12.03 – 39,628 18.12.02 335.5p 540.75p

3,789 31.5.04 3,789 31.5.04 20,044

Stevan Porter 55,428 18.12.03 – 55,428 18.12.01 434.3p 540.75p

55,428 18.12.04 55,428 18.12.04 293,214

Messrs Hartman, North, Porter and Solomons participated in the STDIP during the period 15.4.03 to 31.12.03, but were not eligible to receive an award.

* IHG PLC shares provided at 372p per share in equal value exchange for Six Continents PLC shares outstanding at 14.4.03 under the Six Continents

Special Deferred Incentive Plan.

** Award originally made in Six Continents PLC shares. The share prices shown are the equivalent IHG PLC share prices, based on a five day average

immediately preceding the award date.

*** The IHG PLC share price on 31.12.03 was 529p per share.

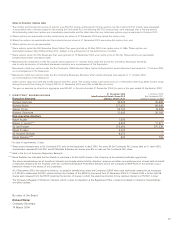

Total emoluments

Basic excluding pensions

salaries Performance 1.10.02 to 1.10.01 to

DIRECTORS’ EMOLUMENTS FROM SIX CONTINENTS PLC and fees payments Benefits 14.4.03 30.9.02

FROM 1 OCTOBER 2002 TO 14 APRIL 2003 £000 £000 £000 £000 £000

Executive directors

Tim Clarke* 322 26 14 362 694

Iain Napier (resigned 4 September 2000)*+– – 409 409 –

Richard North 282 31 16 329 629

Thomas Oliver*++ 263 409 283 955 956

Sir Ian Prosser 438 38 12 488 971

Non-executive directors

Roger Carr* 56––56 46

Robert C Larson 23 – – 23 36

Sir Geoffrey Mulcahy* 23 – – 23 36

Bryan Sanderson* 23 – – 23 36

Sir Howard Stringer 23 – – 23 13

Total 1,453 504 734 2,691 3,417

* In accordance with the principle of full disclosure, details of emoluments earned by former directors of Six Continents PLC who have not served

as directors of IHG PLC have also been presented.

+As previously disclosed in the Six Continents PLC Annual Report 2001, Iain Napier, a former director, was entitled to certain benefits under the terms

of an agreement reached with him prior to the sale of Bass Brewers. Specifically, Mr Napier was entitled to an annuity (index linked at 5% pa) after

22 May 2003 of approximately £24,000 pa or an appropriate lump sum. The figure above represents the lump sum paid to Iain Napier in this regard.

++ Thomas Oliver retired on 31 March 2003 and, under the terms of his contract, was repatriated to the United States.