Holiday Inn 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

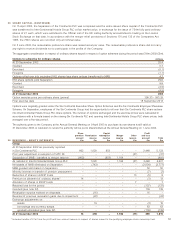

63

Pro forma*

31 Dec 31 Dec 30 Sept 30 Sept

2003 2002 2002** 2001**

INTERCONTINENTAL HOTELS GROUP PLC restated*** restated***

GROUP BALANCE SHEET £m £m £m £m

Fixed assets 4,281 4,510 4,495 4,575

Stocks 44 43 42 46

Debtors 523 456 545 484

Investments 377 193 216 364

Cash at bank and in hand 55 135 68 49

Amounts due from MAB –– 831 825

Short-term creditors (1,085) (1,025) (2,054) (1,759)

Net current (liabilities)/assets (86) (198) (352) 9

Long-term creditors (1,085) (1,423) (763) (1,179)

Provisions (393) (336) (334) (419)

Minority interests (163) (139) (149) (133)

Net assets 2,554 2,414 2,897 2,853

Shareholders’ funds 2,554 2,414 2,897 2,853

Comprising:

Hotels 3,738 4,060 4,084 3,918

Soft Drinks 300 268 246 252

Net operating assets 4,038 4,328 4,330 4,170

Net debt (569) (1,000) (1,191) (1,016)

Other**** (915) (914) (242) (301)

Shareholders’ funds 2,554 2,414 2,897 2,853

Statistics

Gearing***** 22.3% 41.4% 41.1% 35.6%

Return on net operating assets****** 7.0% 7.1% 7.6% 11.7%

* See page 12.

** Represents the continuing IHG business as disclosed in InterContinental Hotels Group PLC Listing Particulars February 2003. Hotels includes

Other Activities which was separately disclosed in those Listing Particulars.

*** Restated on the adoption of UITF 38 (see page 32).

**** Proposed dividend, corporate taxation, deferred taxation, minority interests and balances with MAB.

***** Net debt expressed as a percentage of shareholders’ funds.

****** Operating profit before exceptional items expressed as a percentage of net operating assets.