Holiday Inn 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

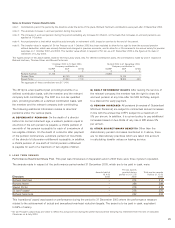

5 LONG TERM REWARD

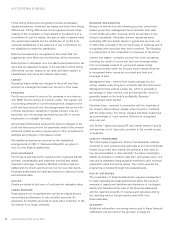

Performance Restricted Share Plan This plan was introduced on Separation and in 2003 there were three cycles in operation.

The awards made in respect of the performance period ended 31 December 2003, which are to be paid in cash, were:

Pre-tax awards

Awards held at granted during Total pre-tax awards

15.4.03 period to 31.12.03 held at 31.12.03

Directors £000 £000 £000

Richard Hartman – 214 214

Richard North – 398 398

Stevan Porter – 218 218

Sir Ian Prosser* – 276 276

Richard Solomons – 232 232

This ‘transitional’ award was based on performance during the period to 31 December 2003 where the performance measure

related to the achievement of actual and annualised overhead reduction targets. The award is to be paid in cash, equivalent

to 66% of salary.

* Sir Ian Prosser’s award was pro-rated to reflect his actual service during the performance period following his retirement from the role of executive

Chairman on 5 July 2003.

25

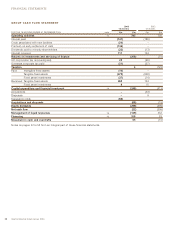

The 401(k) is a tax qualified plan providing benefits on a

defined contribution basis, with the member and the relevant

company both contributing. The DCP is a non-tax qualified

plan, providing benefits on a defined contribution basis, with

the member and the relevant company both contributing.

The following additional information relates to directors’

pensions under the various plans.

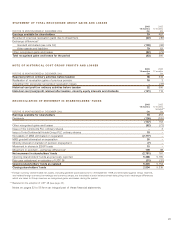

A) DEPENDANTS’ PENSIONS On the death of a director

before his normal retirement age, a widow’s pension equal to

one-third of his own pension is payable; a child’s pension of

one-sixth of his pension is payable for each of a maximum of

two eligible children. On the death of a director after payment

of his pension commences, a widow’s pension of two-thirds

of the director’s full pension entitlement is payable; in addition,

a child’s pension of one-sixth of his full pension entitlement

is payable for each of a maximum of two eligible children.

B) EARLY RETIREMENT RIGHTS After leaving the service of

the relevant company, the member has the right to draw his

accrued pension at any time after his 50th birthday, subject

to a discount for early payment.

C) PENSION INCREASES All pensions (in excess of Guaranteed

Minimum Pensions) are subject to contractual annual increases

in line with the annual rise in RPI, subject to a maximum of

5% per annum. In addition, it is current policy to pay additional

increases based on two-thirds of any rise in RPI above 5%

per annum.

D) OTHER DISCRETIONARY BENEFITS Other than the

discretionary pension increases mentioned in C above, there

are no discretionary practices which are taken into account

in calculating transfer values on leaving service.

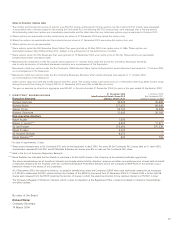

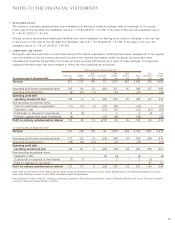

Notes to Directors’ Pension Benefits table

note 1: Contributions paid in the period by the directors under the terms of the plans. Richard Hartman’s contributions were paid after 31 December 2003.

note 2: The absolute increase in accrued pension during the period.

note 3: The increase in accrued pension during the period excluding any increase for inflation, on the basis that increases to accrued pensions are

applied at 1 October.

note 4: Accrued pension is that which would be paid annually on retirement at 60, based on service to the end of the period.

note 5: The transfer value in respect of Sir Ian Prosser as at 1 October 2002 has been restated to allow for his right to draw the accrued pension

without deduction, which was already funded and charged in previous accounts, and to allow for a 3% increase to his annual salary for pension

purposes on 1 October 2001 and 2002. The transfer value shown in respect of Sir Ian as at 31 December 2003 is the figure at his date of

retirement of 5 July 2003.

The figures shown in the above tables relate to the final salary plans only. For defined contribution plans, the contributions made by and in respect of

Richard Hartman, Thomas Oliver and Stevan Porter are:

1 October 2002 to 14 April 2003 15 April 2003 to 31 December 2003

Company contribution to Company contribution to

SCIRIP DCP 401(k) SCIRIP DCP 401(k)

£££ £££

Richard Hartman 27,700 22,800

Thomas Oliver 54,100 4,900 13,100 –

Stevan Porter 21,900 7,700 18,900 300

The aggregate of these contributions was £171,400.