Holiday Inn 2003 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

Options held under the Six Continents Savings Related Share

Option Schemes became exercisable for a period of six

months from 11 April 2003. Options exercised during this

period resulted in the issue of 1,659,515 IHG PLC shares.

The remainder of these options lapsed on 11 October 2003.

In February 2003, the Six Continents Employee Profit Share

Scheme released 1,408,292 Six Continents PLC shares out of

profits appropriated to them by the Six Continents PLC Board in

2000. Following Separation, the Six Continents PLC shares held

by the Trust on behalf of beneficiaries were exchanged for IHG

PLC and Mitchells & Butlers plc shares. At 31 December 2003,

1,549,907 IHG PLC shares were held by the Trustees on behalf

of 1,803 participants.

Under the terms of the Six Continents Special Deferred

Incentive Plan 246,355 IHG PLC shares were transferred

to 21 employees in December 2003, reflecting entitlements

existing prior to the Separation.

No awards were made during the period under the

Six Continents Long Term Incentive Plan, which ceased

to operate on Separation.

INTERCONTINENTAL HOTELS GROUP SHARE PLANS

A number of IHG Share Plans were established on Separation.

Under the Sharesave Plan, options were granted in December

2003 to 1,374 employees over 1,374,559 IHG PLC shares at

420.5p per share, a 20% discount to the market price.

Between June and December 2003, 661,867 IHG PLC shares

were awarded under the Britvic Share Incentive Plan to be

retained in Trust by Hill Samuel ESOP Trustee Limited as free

and partnership shares on behalf of 2,421 eligible employees,

subject to the Plan rules.

In May and September 2003, options were granted under the

Executive Share Option Plan to 170 employees over 7,375,272

IHG PLC shares at 438p and 491.75p per share respectively.

In June 2003, conditional rights over 5,281,020 IHG PLC

shares were awarded to 46 employees under the

Performance Restricted Share Plan.

A number of executives participated in the Short Term

Deferred Incentive Plan during the period but were not

eligible to receive an award.

Neither the Hotels Group Share Incentive Plan nor the

US Employee Stock Purchase Plan were operated during

the period.

SHARE CAPITAL

During the period, 4,902,352 IHG PLC shares were issued

under employee share schemes and the ordinary share capital

at 31 December 2003 consisted of 739,364,254 IHG PLC

shares of £1 each.

No IHG PLC shares were purchased during the period and

the authority granted by shareholders to purchase up to

110,095,835 IHG PLC shares remained unutilised as at the

date of this report. The authority remains in force until the

Annual General Meeting and a resolution to renew the authority

will be put to shareholders at the Annual General Meeting.

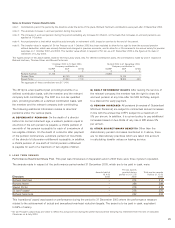

SUBSTANTIAL SHAREHOLDINGS

As at 10 March 2004, the Company has been notified

by shareholders of the following substantial interests

(3% or more) in its ordinary share capital:

Dodge & Cox Funds 3.4%

FMR Corp and Fidelity International Ltd 3.1%

Legal & General Group Plc 4.1%

POLICY ON PAYMENT OF SUPPLIERS

IHG PLC is a holding company and has no trade creditors.

GOING CONCERN

The financial statements which appear on pages 28 to 55

have been prepared on a going concern basis as, after

making appropriate enquiries, the directors have a reasonable

expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future.

CODE OF ETHICS

The Board has agreed the adoption of a specific Code

of Ethics for senior financial officers, consistent with the

Company’s existing guidelines for proper business conduct.

CHARITABLE DONATIONS

IHG continues to support community initiatives and charitable

causes and during the period donated £1.42 million. In addition

to these cash contributions, employees are encouraged to give

their time and skills to a variety of causes and IHG makes

donations in kind, such as hotel accommodation.

POLITICAL DONATIONS

The Group made no political donations during the period and

proposes to maintain its policy of not making such payments.

ANNUAL GENERAL MEETING

The Notice convening the Annual General Meeting to be held

at 3.30pm on Tuesday, 1 June 2004 is contained in a circular

sent to shareholders with this Report.

AUDITORS

Ernst & Young LLP have expressed their willingness to continue

in office as auditors of the Company and their reappointment

will be put to members at the Annual General Meeting.

By order of the Board

Richard Winter

Company Secretary

10 March 2004