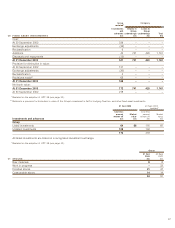

Holiday Inn 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 InterContinental Hotels Group 2003

NOTES TO THE FINANCIAL STATEMENTS

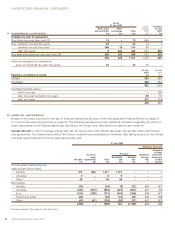

Group Company

31 Dec 2003 30 Sept 2002

Total After Total After 31 Dec

one year restated* one year 2003

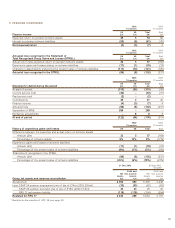

22 DEBTORS £m £m £m £m £m

Trade debtors 277 – 289 – –

Amounts owed by Group undertakings ––––367

Other debtors 104 17 153 2 –

Corporate taxation 37 7 1––

Pension prepayment 47 47 88 88 –

Other prepayments 58 5 98 1 –

523 76 629 91 367

* Restated for the reclassification of pension provisions (see page 32).

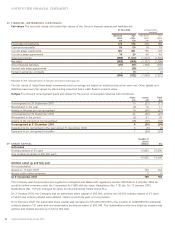

Group Company

31 Dec 30 Sept 31 Dec

2003 2002 2003

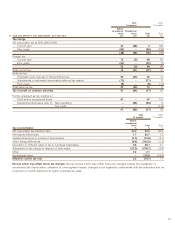

23 CREDITORS: AMOUNTS FALLING DUE WITHIN ONE YEAR £m £m £m

Borrowings (see note 27) 13 848 –

Trade creditors 133 178 –

Corporate taxation 389 455 –

Other taxation and social security 46 82 –

Accrued charges 235 274 5

Proposed dividend of parent company 70 213 70

Proposed dividend for minority shareholders 16 ––

Other creditors 183 223 –

1,085 2,273 75

Group Company

31 Dec 30 Sept 31 Dec

2003 2002 2003

restated*

24 CREDITORS: AMOUNTS FALLING DUE AFTER ONE YEAR £m £m £m

Borrowings (see note 27) 988 631 420

Other creditors and deferred income 97 100 –

1,085 731 420

* Restated for the reclassification of pension provisions (see page 32).

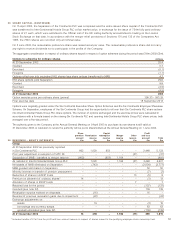

Group

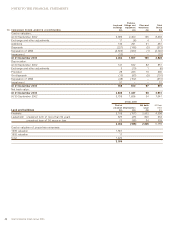

25 DEFERRED TAXATION £m

At 30 September 2002 495

Exchange and other adjustments 1

Separation of MAB (189)

Disposals (3)

Profit and loss account 10

At 31 December 2003 314

Group

31 Dec 30 Sept

2003 2002

Analysed as tax on timing differences related to: £m £m

Fixed assets 252 437

Deferred gains on loan notes 123 125

Losses (37) (67)

Pension prepayment 14 26

Other (38) (26)

314 495