Holiday Inn 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36 InterContinental Hotels Group 2003

NOTES TO THE FINANCIAL STATEMENTS

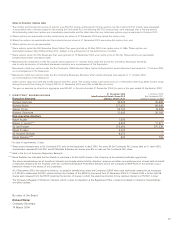

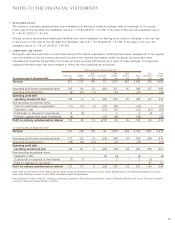

2 TURNOVER AND PROFIT (CONTINUED) Profit on

ordinary

Tu r no ve r activities

By By before

origin destination interest

15 months ended 31 December 2003* £m £m £m

United Kingdom 2,131 2,124 117

Rest of Europe, the Middle East and Africa 506 513 (7)

United States of America 571 571 63

Rest of Americas 127 127 28

Asia Pacific 148 148 18

3,483 3,483 219

12 months ended 30 September 2002*

United Kingdom 2,491 2,485 436

Rest of Europe, the Middle East and Africa 411 416 57

United States of America 476 476 78

Rest of Americas 108 108 16

Asia Pacific 129 130 7

3,615 3,615 594

* Other than for Soft Drinks which reflects the 64 weeks ended 20 December (2002 52 weeks ended 28 September) and Mitchells & Butlers plc which

reflects the 28 weeks ended 12 April (2002 52 weeks ended 28 September).

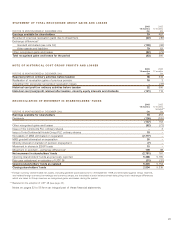

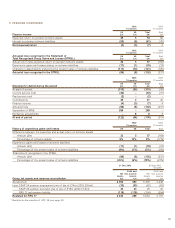

2003 2002

15 months 12 months

Continuing Discontinued Continuing Discontinued

operations operations* Total operations operations* Total

3 COSTS AND OVERHEADS, LESS OTHER INCOME £m £m £m £m £m £m

Raw materials and consumables 484 204 688 360 377 737

Changes in stocks of finished goods and work in progress (1) 2 1 3 (5) (2)

Staff costs (see note 4) 815 198 1,013 659 378 1,037

Depreciation of tangible fixed assets 236 54 290 175 86 261

Impairment of tangible fixed assets 51 – 51 77 – 77

Amortisation of goodwill 13 – 13 9110

Hire of plant and machinery 18 17 35 19 30 49

Property rentals 65 24 89 58 42 100

Income from fixed asset investments (3) – (3) (8) – (8)

Other external charges 717 157 874 530 283 813

2,395 656 3,051 1,882 1,192 3,074

Operating exceptional items included above:

Impairment of tangible fixed assets 51 – 51 77 – 77

* Relates to Mitchells & Butlers plc.

2003 2002

15 months 12 months

Auditors’ remuneration paid to Ernst & Young LLP £m £m

Audit fees 2.8 1.9

Audit related fees 7.2 3.2

Tax fees 1.2 1.2

Other fees –0.4

11.2 6.7

Audit related fees include £6.3m (2002 £1.7m) in relation to the Separation and bid defence. These costs have been charged to

exceptional items (see note 7). Non-audit fees payable for UK services were £6.6m (2002 £4.1m).

The Audit Committee has introduced a process to ensure that any non-audit services do not compromise the independence and

objectivity of the external auditor, and that relevant UK and US professional and regulatory requirements are met. A number of

criteria are applied when deciding whether pre-approval for such services should be given. These include the nature of the

service, the level of fees, and the practicality of appointing an alternative provider, having regard to the skills and experience

required to supply the service effectively. Cumulative fees for audit and non-audit services are presented to the Audit Committee

on a quarterly basis for review. The Audit Committee is responsible for monitoring adherence to the pre-approval policy.