Holiday Inn 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 InterContinental Hotels Group 2003

NOTES TO THE FINANCIAL STATEMENTS

2003 2002

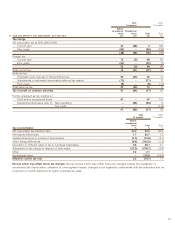

15 months 12 months

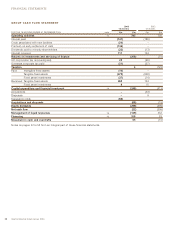

6 DIRECTORS’ EMOLUMENTS £000 £000

Basic salaries, fees, performance payments and benefits* 6,068 3,417

Long-term reward 1,338 –

Gains on exercise of share options 69 –

More detailed information on the emoluments, pensions, option holdings and shareholdings for each director is shown in the

Remuneration Report on pages 19 to 27.

* Includes long-term reward.

2003 2002

15 months 12 months

7 EXCEPTIONAL ITEMS note £m £m

Operating exceptional item

Continuing operations – Hotels impairment charge a(51) (77)

Non-operating exceptional items

Continuing operations:

Cost of fundamental reorganisation b(67) –

Separation costs c(51) (4)

Profit on disposal of fixed assets 42

Provision against fixed asset investments d(56) –

(170) (2)

Discontinued operations:*

Separation costs c(41) –

Loss on disposal of fixed assets (2) (2)

Profit on disposal of Bass Brewers e–57

(43) 55

Total non-operating exceptional items (213) 53

Total exceptional items before interest and taxation (264) (24)

Premium on early settlement of debt f(136) –

Tax credit/(charge) on above items 64 (9)

Exceptional tax credit g–114

Total exceptional items after interest and taxation (336) 81

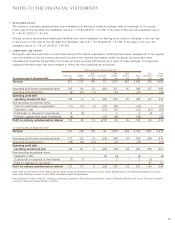

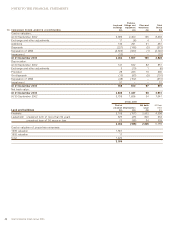

a Tangible fixed assets were written down by £73m (2002 £113m) following an impairment review of the hotel estate. £51m (2002 £77m) was charged

above as an operating exceptional item and £22m (2002 £36m) reversed previous revaluation gains.

b Relates to a fundamental reorganisation of the Hotels business. The cost includes redundancy entitlements, property exit costs and other

implementation costs.

c On 15 April 2003, the Separation of Six Continents PLC was completed. Costs of the Separation and bid defence total £96m. £4m of costs were

incurred in the year to 30 September 2002, the remainder in the period to 31 December 2003.

d Relates to a provision for diminution in value of the Group’s investment in FelCor Lodging Trust Inc. and other fixed asset investments and reflects

the directors’ view of the fair value of the holdings.

e Bass Brewers was disposed of in 2000. The profit in 2002 comprised £9m received in respect of the finalisation of completion account

adjustments, together with the release of disposal provisions no longer required of £48m.

f Relates to the premiums paid on the repayment of the Group’s £250m 103⁄8per cent debenture and EMTN loans.

g Represents the release of over provisions for tax in respect of prior years.

* Discontinued operations relate to Mitchells & Butlers plc and Bass Brewers.

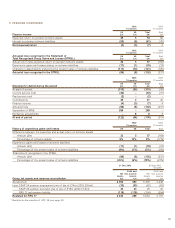

2003 2002

15 months 12 months

8 INTEREST PAYABLE AND SIMILAR CHARGES £m £m

Bank loans and overdrafts 38 21

Other 113 155

151 176