Holiday Inn 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

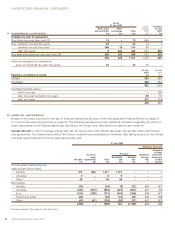

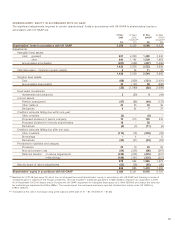

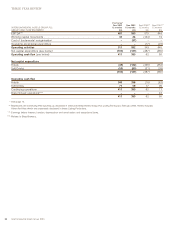

SHAREHOLDERS’ EQUITY IN ACCORDANCE WITH US GAAP

The significant adjustments required to convert shareholders’ funds in accordance with UK GAAP to shareholders’ equity in

accordance with US GAAP are:

31 Dec 30 Sept 31 Dec 30 Sept

2003 2002 2003(b) 2002(b)

restated(a) restated(a)

£m £m $m $m

Shareholders’ funds in accordance with UK GAAP 2,554 5,335 4,546 8,322

Adjustments:

Intangible fixed assets:

Cost: goodwill 837 2,269 1,490 3,540

other 843 1,194 1,500 1,863

Accumulated amortisation (257) (958) (457) (1,495)

1,423 2,505 2,533 3,908

Intangible asset – minimum pension liability 624 11 37

1,429 2,529 2,544 3,945

Tangible fixed assets:

Cost (68) (956) (121) (1,491)

Accumulated depreciation 33 (133) 59 (208)

(35) (1,089) (62) (1,699)

Fixed asset investments:

Investments and advances 2(29) 4(44)

Current assets:

Pension prepayment (47) (88) (84) (137)

Other debtors 22 25 39 39

Derivatives 424 737

Creditors: amounts falling due within one year:

Other creditors (2) –(4) –

Proposed dividend of parent company 70 213 125 332

Proposed dividend for minority shareholders 16 –28 –

Derivatives (6) (3) (11) (4)

Creditors: amounts falling due after one year:

Other creditors (114) (18) (203) (28)

Borrowings –4–6

Derivatives (24) (41) (43) (64)

Provisions for liabilities and charges:

Provisions 25 19 45 29

Accrued pension cost (54) (235) (96) (367)

Deferred taxation: on above adjustments (238) (206) (423) (321)

methodology (169) (161) (301) (251)

879 944 1,565 1,473

Minority share of above adjustments (53) (58) (95) (90)

826 886 1,470 1,383

Shareholders’ equity in accordance with US GAAP 3,380 6,221 6,016 9,705

(a) Restated for UITF 38 (see page 32) which has not changed the overall shareholders’ equity in accordance with US GAAP and following a review of

unrealised gains in respect of the Group’s properties. This has resulted in additional goodwill of £145m ($226m) arising on an acquisition in 2000.

At 30 September 2002 the impact was to increase the US GAAP adjustment for intangible fixed assets by £134m ($209m) and reduce the deferred

tax methodology adjustment by £53m ($83m). The overall impact has increased previously reported shareholders’ equity under US GAAP by

£187m ($292m).

(b) Translated at the rate of exchange ruling at the balance sheet date of £1 = $1.78 (2002 £1 = $1.56).