Holiday Inn 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

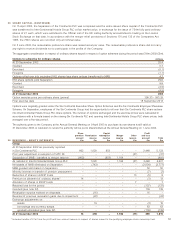

29 SHARE CAPITAL (CONTINUED)

On 15 April 2003, the Separation of Six Continents PLC was completed and the entire issued share capital of Six Continents PLC

was transferred to InterContinental Hotels Group PLC at fair market value, in exchange for the issue of 734m fully paid ordinary

shares of £1 each, which were admitted to the Official List of the UK Listing Authority and admitted to trading on the London

Stock Exchange on that date. In accordance with the merger relief provisions of Sections 131 and 133 of the Companies Act

1985, the 734m shares are recorded only at nominal value.

On 5 June 2003, the redeemable preference share was redeemed at par value. The redeemable preference share did not carry

any right to receive dividends nor to participate in the profits of the Company.

The aggregate consideration in respect of ordinary shares issued in respect of option schemes during the period was £18m (2002 £3m).

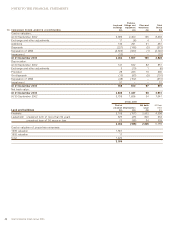

Options to subscribe for ordinary shares millions

At 30 September 2002 25.4

Granted 0.7

Exercised (0.1)

Foregone (1.1)

Options rolled over into equivalent IHG shares less share options transferred to MAB 4.7

IHG share options post Separation 29.6

Granted 8.8

Exercised (4.9)

Foregone (4.9)

At 31 December 2003 28.6

Option exercise price per ordinary share (pence) 295.33 – 593.29

Final exercise date 18 September 2013

Options were originally granted under the Six Continents Executive Share Option Schemes and the Six Continents Employee Sharesave

Scheme. On Separation, employees of the Six Continents Group had the opportunity to roll over their Six Continents PLC share options

into InterContinental Hotels Group PLC share options. The number of options exchanged and the exercise prices were calculated in

accordance with a formula based on the closing Six Continents PLC and opening InterContinental Hotels Group PLC share prices, both

averaged over a five-day period.

The authority given to the Company at the Annual General Meeting on 9 April 2003 to purchase its own shares is still valid at

31 December 2003. A resolution to renew the authority will be put to shareholders at the Annual General Meeting on 1 June 2004.

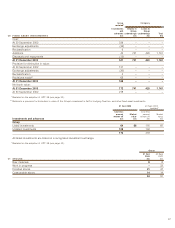

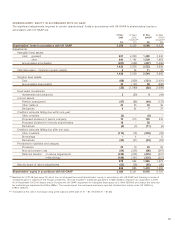

Share Capital Profit

premium Revaluation redemption Merger Other and loss

account reserve reserve reserve reserve account Total

30 RESERVES – EQUITY INTERESTS £m £m £m £m £m £m £m

Group

At 30 September 2002 as previously reported

in Six Continents PLC 802 1,020 853 – – 2,448 5,123

Prior year adjustment on adoption of UITF 38 ––––(31)–(31)

Separation of MAB – transfers to merger reserve (802) – (853) 1,164 – – (491)

As restated in InterContinental Hotels Group PLC – 1,020 – 1,164 (31) 2,448 4,601

Net assets of MAB eliminated on Separation – (743) – – – (2,034) (2,777)

MAB goodwill eliminated on Separation –––––5050

Minority interest on transfer of pension prepayment –––––(7)(7)

Reduction of shares in ESOP trusts ––––13(5)8

Premium on allotment of ordinary shares* 14 ––––(1)13

Allocation of shares in ESOP trusts ––––7–7

Retained loss for the period –––––(137) (137)

Goodwill (see note 32) –––––139139

Revaluation surplus realised on disposals – (16) – – – 16 –

Reversal of previous revaluation gains due to impairment – (22) ––––(22)

Exchange adjustments on:

assets – 19 – – – (3) 16

borrowings and currency swaps –––––6363

goodwill eliminated (see note 32) –––––(139) (139)

At 31 December 2003 14 258 – 1,164 (11) 390 1,815

* Includes transfer of £1m from the profit and loss account reserve in respect of shares issued to the qualifying employee share ownership trust.