Holiday Inn 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

2003 2002

15 months 12 months

Before

exceptional Exceptional

items items Total Total

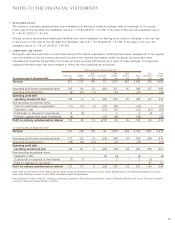

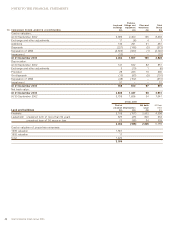

9 TAX ON PROFIT ON ORDINARY ACTIVITIES £m £m £m £m

Tax charge

UK corporation tax at 30% (2002 30%):

Current year 42 (38) 4 106

Prior years (80) – (80) (129)

(38) (38) (76) (23)

Foreign tax:

Current year 72 (3) 69 65

Prior years (20) – (20) (1)

52 (3) 49 64

Total current tax 14 (41) (27) 41

Deferred tax:

Origination and reversal of timing differences 53 (23) 30 17

Adjustments to estimated recoverable deferred tax assets (11) – (11) 11

Prior years (9) – (9) (17)

Total deferred tax 33 (23) 10 11

Tax on profit on ordinary activities 47 (64) (17) 52

Further analysed as tax relating to:

Profit before exceptional items 47 – 47 157

Exceptional items (see note 7): Non-operating – (64) (64) 9

Tax credit –––(114)

47 (64) (17) 52

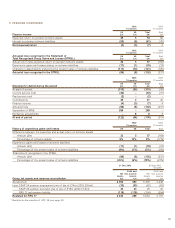

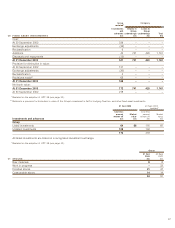

2003 2002

15 months 12 months

Before

exceptional

items Total Total

Tax reconciliation %%%

UK corporation tax standard rate 30.0 30.0 30.0

Permanent differences 1.7 20.7 1.3

Capital allowances in excess of depreciation (1.0) (12.6) (3.7)

Other timing differences (8.6) (104.2) (1.3)

Net effect of different rates of tax in overseas businesses 3.8 46.1 3.1

Adjustment to tax charge in respect of prior years (22.9) (276.7) (2.9)

Other 0.2 2.1 –

Exceptional items – 219.9 (18.8)

Effective current tax rate 3.2 (74.7) 7.7

Factors which may affect future tax charges The key factors which may affect future tax charges include the availability of

accelerated tax depreciation, utilisation of unrecognised losses, changes in tax legislation, settlements with tax authorities and the

proportion of profits subjected to higher overseas tax rates.