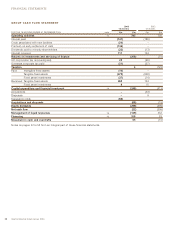

Holiday Inn 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

2003 2002

15 months 12 months

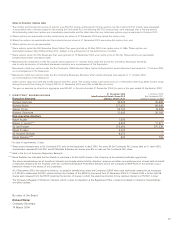

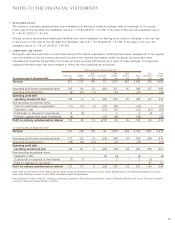

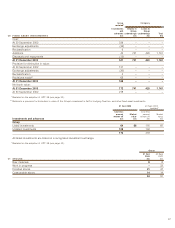

4 STAFF £m £m

Costs:

Wages and salaries 884 942

Social security costs 96 84

Pensions (see note 5) 33 11

1,013 1,037

2003 2002

Average number of employees, including part-time employees 15 months 12 months

Hotels 27,111 28,385

Soft Drinks 2,698 2,637

InterContinental Hotels Group PLC*29,809 31,022

Discontinued operations*15,014 38,747

44,823 69,769

* InterContinental Hotels Group PLC relates to continuing operations. Discontinued operations relate to Mitchells & Butlers plc.

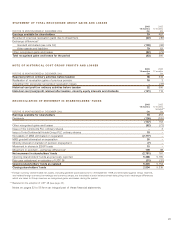

2003 2002

15 months 12 months

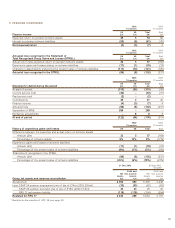

5 PENSIONS £m £m

Regular cost 33 35

Variations from regular cost (7) (28)

Notional interest on prepayment (4) (3)

Pension cost in respect of the principal plans 22 4

Other plans 11 7

33 11

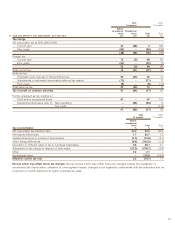

Retirement and death benefits are provided for eligible Group employees in the United Kingdom principally by the InterContinental

Hotels UK Pension Plan which covers approximately 2,000 employees and the Britvic Pension Plan which covers approximately

2,300 employees. The plans are predominantly defined benefit schemes for current members. For new entrants, the plans will

provide defined contribution benefits. The assets of the plans are held in self-administered trust funds separate from the Group’s

assets. The Group also maintains a US-based InterContinental Hotels Pension Plan. This plan is now closed to new members and

pensionable service no longer accrues for current employee members. In addition, the Group operates a number of minor

pension schemes outside the United Kingdom, the most significant of which is a defined contribution scheme in the United States;

there is no material difference between the pension costs of, and contributions to, these schemes.

On 1 April 2003, two new pension schemes were created for InterContinental Hotels Group PLC in the UK when Mitchells &

Butlers Retail Limited became the sponsoring employer for the Six Continents Pension Plan and the Six Continents Executive

Pension Plan. Approximately 30% of the assets and liabilities of these plans was transferred to the new InterContinental Hotels

UK Pension Plan and the Britvic Pension Plan, which were established with effect from 1 April 2003.

The Group continues to account for its defined benefit obligations in accordance with SSAP 24. The pension costs related to the

two UK principal plans are assessed in accordance with the advice of independent qualified actuaries using the projected unit

method. They reflect the 31 March 2002 actuarial valuations of the Six Continents PLC pension plans. The significant assumptions

in these valuations were that wages and salaries increase on average by 4% per annum, the long-term return on assets is 6.3% per

annum, and pensions increase by 2.5% per annum. The average expected remaining service life of current employees is 13 years.

At 31 March 2002, the market value of the combined assets of the Six Continents PLC pension plans was £1,187m and the value

of the assets was sufficient to cover 100% of the benefits that had accrued to members after allowing for expected increases

in earnings.

In the period to 31 December 2003, the Group made regular contributions to the two UK principal plans of £26m and additional

contributions of £13m. The agreed employer contribution rates to the defined benefit arrangements for the year to

31 December 2004 are 10.8% for the staff section of the InterContinental Hotels UK Pension Plan, 25.7% for the executive

section, 11.3% for the staff section of the Britvic Pension Plan and 30.5% for the executive section.

Certain pension benefits and post-retirement insurance obligations are provided on an unfunded basis. Where assets are not held

with the specific purpose of matching the liabilities of unfunded schemes, a provision is included within other provisions for

liabilities and charges. Liabilities are generally assessed annually in accordance with the advice of independent actuaries.