Holiday Inn 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34 InterContinental Hotels Group 2003

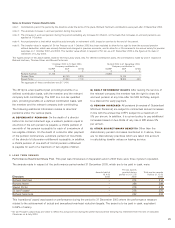

ACCOUNTING POLICIES

Those timing differences recognised include accelerated

capital allowances, unrelieved tax losses and short-term timing

differences. Timing differences not recognised include those

relating to the revaluation of fixed assets in the absence of a

commitment to sell the assets, the gain on sale of assets rolled

into replacement assets and the distribution of profits from

overseas subsidiaries in the absence of any commitment by

the subsidiary to make the distribution.

Deferred tax assets are recognised to the extent that it is

regarded as more likely than not that they will be recovered.

Deferred tax is calculated on a non-discounted basis at the tax

rates that are expected to apply in the periods in which timing

differences reverse, based on tax rates and laws enacted or

substantively enacted at the balance sheet date.

LEASES

Operating lease rentals are charged to the profit and loss

account on a straight line basis over the term of the lease.

PENSIONS

The Group continues to account for pensions in accordance

with SSAP 24 ‘Accounting for pension costs’. The regular cost

of providing pensions to current employees is charged to the

profit and loss account over the average expected service life

of those employees. Variations in regular pension cost are

amortised over the average expected service life of current

employees on a straight line basis.

Accumulated differences between the amount charged to the

profit and loss account and the payments made to the pension

plans are treated as either prepayments or other provisions for

liabilities and charges in the balance sheet.

The additional disclosures required by the transitional

arrangements of FRS 17 ‘Retirement Benefits’ are given in

note 5 to the financial statements.

SELF INSURANCE

The Group is self-insured for various levels of general liability,

workers’ compensation and employee medical and dental

insurance coverage. Insurance liabilities include projected

settlements for known and incurred, but not reported claims.

Projected settlements are estimated based on historical trends

and actuarial data.

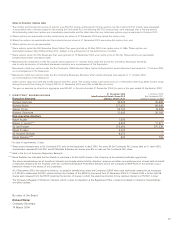

STOCKS

Stocks are stated at the lower of cost and net realisable value.

TRADE DEBTORS

Trade debtors are recognised and carried at original amount

earned less an allowance for any doubtful accounts. An

allowance for doubtful accounts is made when collection of the

full amount is no longer probable.

REVENUE RECOGNITION

Revenue is derived from the following sources: owned and

leased properties; management fees; franchise fees; sale

of soft drinks and other revenues which are ancillary to the

Group’s operations. Generally, revenue represents sales

(excluding VAT and similar taxes) of goods and services, net

of discounts, provided in the normal course of business and is

recognised when services have been rendered. The following

is a description of the composition of revenues of the Group.

Owned and leased – primarily derived from hotel operations,

including the rental of rooms and food and beverage sales

from a worldwide network of owned and leased hotels

operated primarily under the Group’s brand names. Revenue

is recognised when rooms are occupied and food and

beverage is sold.

Management fees – earned from hotels managed by the

Group, usually under long-term contracts with the hotel owner.

Management fees include a base fee, which is generally a

percentage of hotel revenue, and an incentive fee, which is

generally based on the hotel’s profitability. Revenue

is recognised when earned.

Franchise fees – received in connection with the franchise of

the Group’s brand names, usually under long-term contracts

with the hotel owner. The Group charges franchise royalty fees

as a percentage of room revenue. Revenue is recognised

when earned.

Soft Drinks – sales (excluding VAT and similar taxes) of goods

and services, net of discounts, provided in the normal course

of business.

LOYALTY PROGRAMME

The hotel loyalty programme, Priority Club Rewards, enables

members to earn points during each stay at an InterContinental

Hotels Group hotel and redeem the points at a later date for

free accommodation or other benefits. The future redemption

liability is included in creditors less than, and greater than, one

year and is estimated using actuarial methods to give eventual

redemption rates and points values. The cost to operate the

programme is funded through hotel assessments.

USE OF ESTIMATES

The preparation of financial statements requires management

to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the financial statements

and the reported amounts of revenues and expenses during

the reporting period. Actual results could differ from

those estimates.

GLOSSARY

Additional information concerning terms used in these financial

statements can be found in the glossary on page 64.