Haier 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

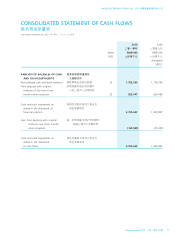

Year ended 31 December 2009

截至二零零九年十二月三十一日止年度

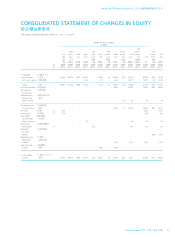

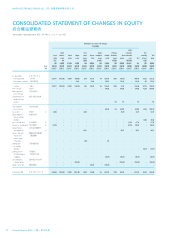

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

綜合權益變動表

HAIER ELECTRONICS GROUP CO., LTD 海爾電器集團有限公司

Annual Report 2010 二零一零年年報 71

Attributable to the owners of the Company

本公司股東應佔

Equity

Capital Share Capital Exchange component Non-

Issued reduction Capital Merger option Reserve redemption Retained fluctuation Total of convertible controlling Total

equity reserve reserve reserve reserve funds reserve profits reserve reserves notes Total interests equity

已發行 股本 購股權 資本贖回 外匯波動 可換股票據 非控股

權益 削減儲備 資本儲備 合併儲備 儲備 儲備基金 儲備 保留溢利 儲備 儲備總額 之權益部分 總計 權益 權益總值

Notes RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 RMB’000

附註 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元 人民幣千元

At 1 January 2009 於二零零九年一月一日

As previously reported 如前列報 1,485,859 (1,758,526 ) 572,005 (548,643 ) – 228,902 184 1,030,202 12,109 (463,767 ) – 1,022,092 95,270 1,117,362

Effect of business combination 業務合併的影響 – – – 11,279 – 2,272 – 90,226 – 103,777 – 103,777 403 104,180

As restated 經重列 1,485,859 (1,758,526 ) 572,005 (537,364 ) – 231,174 184 1,120,428 12,109 (359,990 ) – 1,125,869 95,673 1,221,542

Profit for the year (as restated) 年內溢利(經重列) – – – – – – – 448,652 – 448,652 – 448,652 50,643 499,295

Other comprehensive 年內其他全面收入:

income for the year:

Exchange differences on 換算海外業務之匯兌差異

translation of foreign (經重列)

operations (as restated) – – – – – – – – (43 ) (43 ) – (43 ) – (43 )

Total comprehensive income 年內全面收入總額

for the year (as restated) (經重列) – – – – – – – 448,652 (43 ) 448,609 – 448,609 50,643 499,252

Issue of shares 發行股份 32 42,986 – – – – – – – – – – 42,986 – 42,986

Share issue expenses 股份發行開支 32 (1,234 ) – – – – – – – – – – (1,234 ) – (1,234 )

Capital contribution 附屬公司當時控

from the then holding 股公司出資

companies of subsidiaries – – – 750 – – – – – 750 – 750 – 750

Equity-settled share 以股本結算之購股權安排

option arrangements 33 – – – – 7,286 – – – – 7,286 – 7,286 – 7,286

Dividends paid to 已付非控股股東股息

non-controlling

shareholders – – – – – – – – – – – – (14,588 ) (14,588 )

Dividends paid to the then 已付附屬公司

holding companies 當時控股公司股息

of subsidiaries – – – – – – – (5,358 ) – (5,358 ) – (5,358 ) – (5,358 )

Transfer to reserve funds 轉撥至儲備基金

(as restated) (經重列) – – – – – 49,452 – (49,452 ) – – – – – –

At 31 December 2009 於二零零九年十二月三十一日

(as restated) (經重列) 1,527,611 (1,758,526 ) 572,005 (536,614 ) 7,286 280,626 184 1,514,270 12,066 91,297 – 1,618,908 131,728 1,750,636