Haier 2010 Annual Report Download - page 168

Download and view the complete annual report

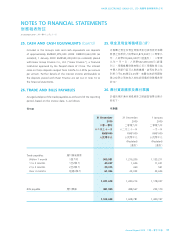

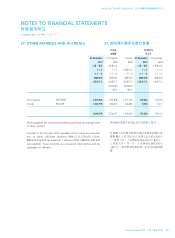

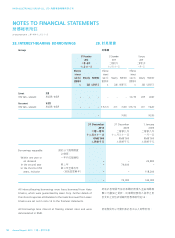

Please find page 168 of the 2010 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31 December 2010

二零一零年十二月三十一日

NOTES TO FINANCIAL STATEMENTS

財務報表附註

Annual Report 2010 二零一零年年報

HAIER ELECTRONICS GROUP CO., LTD 海爾電器集團有限公司

166

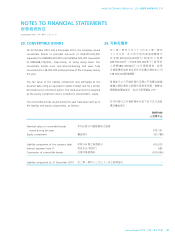

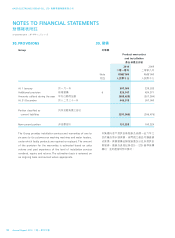

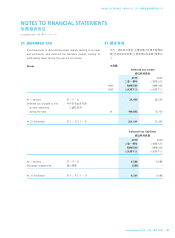

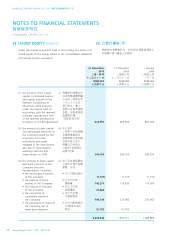

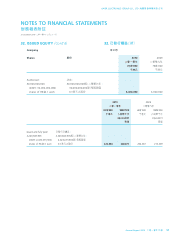

31. DEFERRED TAX (Cont’d)

The Group has tax losses arising in Hong Kong of RMB31,450,000

(2009: RMB31,782,000; 1 January 2009: RMB31,782,000) that are

available indefinitely for offsetting against future taxable profits

of the companies in which the losses arose. The Group also has

tax losses arising in Mainland China of RMB611,601,000 (2009:

RMB180,278,000; 1 January 2009: RMB178,059,000) that will

expire in one to five years for offsetting against future taxable

profit. Deferred tax assets have not been recognised in respect of

these losses as they have arisen in the Company and subsidiaries

that have been loss-making for some time and it is not considered

probable that taxable profits will be available against which the tax

losses can be utilised.

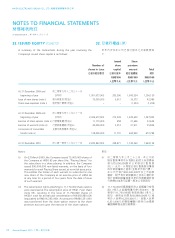

Pursuant to the PRC Corporate Income Tax Law, a 10% withholding

tax is levied on dividend declared to foreign investors from the

foreign investment enterprises established in Mainland China. The

requirement is effective from 1 January 2008 and applies to earnings

after 31 December 2007. A lower withholding tax rate may be

applied if there is a tax treaty between Mainland China and the

jurisdiction of the foreign investors. For the Group, the applicable

rate is 10%. The Group is therefore liable to withholding taxes on

dividends distributed by those subsidiaries established in Mainland

China in respect of earnings generated from 1 January 2008.

Except for the deferred tax liabilities of RMB9,257,000 (2009:

RMB9,588,000; 1 January 2009: RMB9,588,000), which represent

the withholding taxes for the earnings of the PRC subsidiaries to

be remitted, as at 31 December 2010, no deferred tax has been

recognised for withholding taxes that would be payable on the

unremitted earnings that are subject to withholding taxes of the

Group’s subsidiaries established in Mainland China. In the opinion

of the directors, it is not probable that these subsidiaries will

distribute such earnings in the foreseeable future. The aggregate

amount of temporary differences associated with investments in

subsidiaries in Mainland China for which deferred tax liabilities have

not been recognised totalled approximately RMB2,324,496,000

at 31 December 2010 (2009: RMB824,190,000; 1 January 2009:

RMB184,928,000).

There are no income tax consequences attaching to the payment

of dividends by the Company to its shareholders.

31. 遞延稅項

(續)

本集團於香港產生之稅項虧損為人民幣

31,450,000元(二零零九年:人民幣31,782,000

元;二零零九年一月一日:人民幣31,782,000

元), 可供無限期抵銷該等產生虧損之公司日後

應課稅溢利。本集團於中國大陸產生之稅項虧損

為人民幣611,601,000元(二零零九年:人民幣

180,278,000元;二零零九年一月一日:人民幣

178,059,000元),將於一至五年內屆滿以抵銷日

後應課稅溢利之稅項虧損。由於遞延稅項資產來

自虧損多時之本公司及附屬公司,故此並無就該

等虧損確認遞延稅項資產,而本公司不認為有可

能出現可動用稅項虧損之應課稅溢利。

根據中國企業所得稅法,於中國大陸成立之外

商投資企業向外商投資者宣派之股息,須按

10%之稅率徵收預扣稅。該規定自二零零八年

一月一日起生效,並適用於二零零七年十二月

三十一日後之盈利。倘中國大陸與外商投資者

所在司法權區已簽訂稅務協議,則可採用較低

之預扣稅率。本集團之適用稅率為10%。 因

此,自二零零八年一月一日起,本集團須就在

中國大陸成立之附屬公司所產生之盈利而分配

之股息履行徵收預扣稅之義務。

除遞延稅項負債人民幣9,257,000元(二零零九

年: 人 民幣9,588,000元; 二零零 九 年 一月一

日: 人民 幣9,588,000元)外(該款項為中國附

屬公司於二零一零年十二月三十一日將匯寄盈

利之預扣稅),概無就本集團於中國內地成立之

附屬公司須繳付預扣稅之未匯寄盈利之預扣稅

確認遞延稅項負債。董事認為,該等附屬公司

不大可能會於可見未來分派所有該等盈利。與

中國內地附屬公司投資有關而遞延稅項負債尚

未確認之暫時差異總額於二零一零年十二月三

十一日約為人民幣2,324,496,000元(二零零九

年:人民幣824,190,000元;二零零九年一月一

日:人民幣184,928,000元)。

本公司向其股東派付之股息概無附帶任何所得

稅後果。