Haier 2010 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2010 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31 December 2010

二零一零年十二月三十一日

NOTES TO FINANCIAL STATEMENTS

財務報表附註

HAIER ELECTRONICS GROUP CO., LTD 海爾電器集團有限公司

Annual Report 2010 二零一零年年報 175

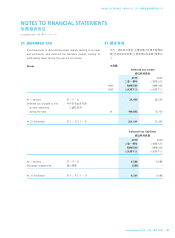

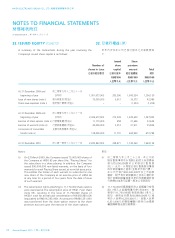

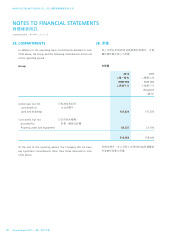

33. SHARE OPTION SCHEME (Cont’d)

The fair value of equity-settled share options granted during the

year was estimated as at the date of grant, taking into account the

terms and conditions upon which the options were granted. The

following table lists the inputs to the model used:

2010 2009

Management Directors and

staff and management External

key employees staff consultants

二零一零年

管理員工及 二零零九年

主要僱員 董事及管理員工 外聘顧問

Expected dividend yield (%) 預期股息率(%) 1.04 2.38 2.38

Expected volatility (%) 預期歷史波幅(%) 66.42 65.10 67.61

Risk-free interest rate (%) 無風險利率(%) 1.37 1.73 1.48

Life of options (year) 購股權年期(年) 4 5 4

Weighted average share 加權平均股價

price (HK$ per share) (每股港元) 4.82 1.70 1.70

The expected volatility is determined based on the historical volatility

of the share price of the Company. The expected volatility reflects

the assumption that the historical volatility is indicative of future

trends, which may also not necessarily be the actual outcome.

No other feature of the options granted was incorporated into the

measurement of fair value.

The 11,170,000 share options exercised during the year resulted in

the issue of 11,170,000 ordinary shares of the Company and new

share capital of HK$1,117,000 (equivalent to RMB958,000 and

share premium of HK$17,872,000 (equivalent to RMB15,335,000),

as further detailed in note 32 to the financial statements.

At the end of the reporting period, the Company had 98,440,000

share options outstanding under the Share Option Scheme. The

exercise in full of the outstanding share options would, under

the present capital structure of the Company, result in the

issue of 98,440,000 additional ordinary shares of the Company

and additional share capital of HK$9,844,000 (equivalent to

RMB8,367,000) and share premium of HK$238,499,000 (equivalent

to RMB202,719,000) (before issue expenses).

33. 購股權計劃

(續)

年內授出以股本結算之購股權公平值按授出日

期估計,並考慮授出購股權之條款及條件。下

表列出所用模式之輸入值:

預期波幅乃基於本公司股價之歷史波幅釐定。

預期波幅反映估算時乃假設過往波幅反映未來

趨勢,但亦未必與實際情況相符。

並無其他授出購股權之特性計入公平值之計

量。

於年內行使之11,170,000份購股權導致發行本

公 司11,170,000股 普 通 股 及 新 股 本1,117,000

港元(相等於人民幣958,000元 )及 股 份 溢 價

17,872,000港元(相等於人民幣15,335,000

元),詳情載於財務報表附註32。

於報告期末,本公司根據購股權計劃有

98,440,000份尚未行使購股權。根據本公司現

有股本架構,悉數行使尚未行使之購股權將導

致額外發行98,440,000股本公司普通股及增加

股 本9,844,000港元(相等於人民幣8,367,000

元)及股份溢價238,499,000港元(相等於人民幣

202,719,000元)(扣除發行費用前)。