Haier 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 Haier annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31 December 2010

二零一零年十二月三十一日

NOTES TO FINANCIAL STATEMENTS

財務報表附註

HAIER ELECTRONICS GROUP CO., LTD 海爾電器集團有限公司

Annual Report 2010 二零一零年年報 143

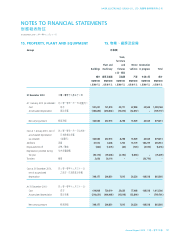

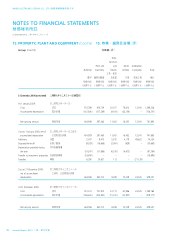

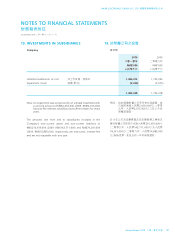

15. PROPERTY, PLANT AND EQUIPMENT (Cont’d)

All buildings of the Group are erected on land in Mainland China

held under medium term leases.

As at 31 December 2010, certain of the Group’s buildings with an

aggregate net book value of approximately RMB329,824,00 (2009:

RMB315,809,000 (as restated); 1 January 2009: RMB346,621,000

(as restated)) did not have building ownership certificates registered

under the names of the respective subsidiaries of the Company.

With respect to the above properties and the Group’s investment

properties, on 24 February 2005 and 20 September 2006, Haier

Corp issued two undertakings to the Company, pursuant to which

Haier Corp agreed to provide other suitable properties to the

Group to ensure the operations of certain subsidiaries of the

Company and indemnify the Group against any losses arising

from the above defective property title issue and for any moving

cost/loss incurred, if, for any reason, the respective subsidiaries

were not able to continue to use the buildings before the related

acquisition and registration procedures have been completed. The

aggregate net book value of the Group’s buildings and investment

properties indemnified by Haier Corp in the two undertakings as at

31 December 2010 amounted to approximately RMB132,163,000

(2009: RMB147,465,000; 1 January 2009: RMB155,712,000).

In addition, on 28 August 2010, Haier Corp also issued an

undertaking to the Company in respect of the properties acquired

in the Acquisition Transactions, pursuant to which Haier Corp

agreed to indemnify the Group against any losses arising from the

defective property title issue. The aggregate net book value of the

Group’s buildings indemnified by Haier Corp in the undertaking as

at 31 December 2010 amounted to approximately RMB96,997,000

(2009: RMB62,574,000; 1 January 2009: RMB66,663,000).

In the opinion of the directors, the Group is entitled to lawfully

and validly occupy and use the buildings and investment properties

for its daily operations, notwithstanding the fact that the related

building ownership certificates have not yet been obtained.

15. 物業、廠房及設備

(續)

本集團全部樓宇均按中期租約持有,且位於中

國大陸。

於二零一零年十二月三十一日,本集團總賬面

淨值約為人民幣329,824,000元(二零零九年:

人民幣315,809,000元(經重列)、二零零九年一

月一日:人民幣346,621,000元(經重列))之若

干樓宇並無以本公司各附屬公司之名義登記之

房地產權證。

就上述物業及本集團投資物業而言,於二零零

五年二月二十四日及二零零六年九月二十日,

海爾集團公司向本公司作出兩項承諾,據此,

海爾集團公司同意,倘各附屬公司如因任何理

由無法在有關收購及登記程序完成前繼續使用

樓宇經營業務,則海爾集團公司將向本集團提

供其他合適物業,以確保本公司若干附屬公司

可經營業務,並彌償本集團因上述有瑕疵物業

業權問題產生之任何損失以及所招致之任何搬

遷成本╱損失。於二零一零年十二月三十一

日,海爾集團公司彌償本集團之樓宇及投資物

業總賬面淨值約為人民幣132,163,000元(二零

零九年:人民幣147,465,000元;二零零九年一

月一日:人民幣155,712,000元)。

此外,於二零一零年八月二十八日,海爾集團

公司也就收購交易所收購的物業向本公司作出

一項承諾,據此,海爾集團公司同意彌償本集

團因有瑕疵物業業權問題產生之任何損失。

於二零一零年十二月三十一日,海爾集團公

司彌償本集團之樓宇總賬面淨值約為人民幣

96,997,000元(二零零九年:人民幣62,574,000

元;二零零九年一月一日:人民幣66,663,000

元)。

董事認為,儘管仍未取得有關房地產權證,惟

本集團有權合法及有效地佔用及使用樓宇及投

資物業以進行日常營運。