HSBC 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strong, steadfast, sustainable

www.hsbc.com

HSBC Holdings plc

Annual Report and Accounts 2009

Table of contents

-

Page 1

HSBC Holdings plc Annual Report and Accounts 2009 Strong, steadfast, sustainable www.hsbc.com -

Page 2

... customer groups and global businesses: Personal Financial Services (including consumer finance); Commercial Banking; Global Banking and Markets; and Private Banking. Certain defined terms Unless the context requires otherwise, 'HSBC Holdings' means HSBC Holdings plc and 'HSBC' or the 'Group' means... -

Page 3

... Corporate governance report ...Directors and senior management ...Board of Directors ...Employees ...294 294 302 318 Corporate sustainability ...Share capital ...Dividends, shareholders and meetings ...326 328 331 Directors' Remuneration Report1 ...334 Statement of Directors' Responsibilities... -

Page 4

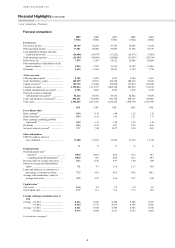

... per cent and tier 1 ratio of 10.8 per cent. • Rights issue • In April 2009, HSBC Holdings raised £12.5 billion (US$17.8 billion), net of expenses, by way of a fully underwritten rights issue, offering its shareholders 5 new ordinary shares for every 12 ordinary shares at a price of 254 pence... -

Page 5

....6 4.87 Share information at the year-end 2009 US$0.50 ordinary shares in issue (million) ...Market capitalisation (billion) ...Closing market price per ordinary share:6 - London ...- Hong Kong ...Closing market price per American Depositary Share7 ...Over 1 year HSBC total shareholder return to 31... -

Page 6

... assets ...Return on average total shareholders' equity ...Loans and advances to customers as a percentage of customer accounts ...Average total shareholders' equity to average total assets ...Capital ratios12 Tier 1 ratio ...Total capital ratio ...Foreign exchange translation rates to US$ Closing... -

Page 7

... ordinary shares. 8 Total shareholder return is defined on page 19. 9 The Financial Times Stock Exchange 100 Index. 10 The Morgan Stanley Capital International World Index. 11 The Morgan Stanley Capital International World Bank Index 12 The calculation of capital resources, capital ratios and risk... -

Page 8

... the monetary, interest rate and other policies of central banks and other regulatory authorities, including the UK Financial Services Authority, the Bank of England, the Hong Kong Monetary Authority, the US Federal Reserve, the US Securities and Exchange Commission, the US Office of the Comptroller... -

Page 9

...; and the effects of competition in the markets where HSBC operates including increased competition from non-bank financial services companies, including securities firms. - - - factors specific to HSBC: - the success of HSBC in adequately identifying the risks it faces, such as the incidence of... -

Page 10

... rights issue and internal capital generation. The core tier 1 ratio was 9.4 per cent at the same date, increasing by some 240 basis points. Throughout the crisis, our strategy has remained clear: to build on our position as the leading 2009: a year of transition In a number of important respects... -

Page 11

... rural presence during the year. In Indonesia, we nearly doubled our network to support the growing financial needs of personal and business banking customers, and we launched our SME fund in the United Arab Emirates in January 2010. These are just a few examples which illustrate our commitment... -

Page 12

...'s Statement customer needs. The market for capital has also suffered from clear distortions in recent years. There has been too great an emphasis on short-term gains, often accompanied by shareholder pressure to increase leverage in order to boost returns, and a dangerous underpricing of risk... -

Page 13

... to serve' those global customers who have increasingly diverse financial needs. In short, it is undesirable and impractical to prescribe some ideal model for a bank. The crisis clearly demonstrated that systemic importance is not a function of size or business focus. HSBC has always believed in... -

Page 14

...markets banking business and a uniquely cosmopolitan customer base with an extensive international network and substantial financial strength. The Group's strategy is aligned with the key trends which are shaping the global economy. In particular, HSBC recognises that, over the long term, developing... -

Page 15

... The process HSBC uses to estimate losses inherent in its credit exposure or assess the value of certain assets requires difficult, As a global financial institution, HSBC is exposed to these developments across all its businesses, both directly and through their impact on its customers and clients... -

Page 16

...'s retail business model depends on banking fees and a consolidation of the recovery observed in the financial markets in 2009 will help sustain profitability. Credit quality is expected to remain stable for personal customers due to the quality of the client base, though the outlook for commercial... -

Page 17

... pressure on spreads earned on HSBC's deposit base, however. As the disruption to financial markets eased, evidence emerged of contracting credit spreads and improved liquidity during 2009, beginning in the second quarter of the year, enabling many companies to issue debt and raise new capital. The... -

Page 18

... unforeseen market dislocations or interruptions. Rating agencies which determine HSBC's credit ratings and thereby influence the Group's cost of funds, take into consideration the effectiveness of HSBC's liquidity risk management framework. The market conditions that the financial services industry... -

Page 19

...with counterparties in financial services, including brokers and dealers, commercial banks, investment banks, mutual and hedge funds, and other institutional clients. Many of these transactions expose HSBC to credit risk in the event of default by its counterparty or client. HSBC's ability to engage... -

Page 20

...breach of data security, particularly involving confidential customer data, could cause serious damage to the Group's ability to service its clients, could breach regulations under which HSBC operates and could cause long-term damage to its business and brand. HSBC is subject to tax-related risks in... -

Page 21

.... Total shareholder return is used as a method of assessing the overall return to shareholders on their investment in HSBC, and is defined as the growth in share value and declared dividend income during the relevant period. TSR is a key performance measure in rewarding employees. In calculating TSR... -

Page 22

... 14 aspects. Employees rated HSBC above the external global average across all aspects. Brand perception In order to manage the HSBC brand most effectively, the Group tracks brand health among Personal Financial Services and Business Banking customers in each of HSBC's major markets. The survey... -

Page 23

... strengthening of the US dollar compared with its value in 2008, and were most significant in Europe due to the size of HSBC's operations in the UK. The following acquisitions and disposals affected both comparisons: • the gain on sale of HSBC's UK merchant acquiring business to a joint venture 49... -

Page 24

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Reconciliation of profit / Financial summary > Income statement Reconciliation of reported and underlying profit before tax 2009 compared with 2008 2008 at 2009 2009 Underadjustexchange lying change ments10 ... -

Page 25

... by an increase in loan impairment charges and other credit risk provisions elsewhere. Although HSBC's business in North America continued to record a loss, performance improved as write-downs in Global Banking and Markets reduced and loan impairment charges in Personal Financial Services decreased... -

Page 26

...Net trading income ...Changes in fair value of long-term debt issued and related derivatives ...Net income/(expense) from other financial instruments designated at fair value .. Net income/(expense) from financial instruments designated at fair value ...Gains less losses from financial investments... -

Page 27

...credit trading business. This was partly offset by a reduction in deposit spreads in Personal Financial Services and Commercial Banking as interest rates fell, and an increase in loan impairment charges in Global Banking, reflecting a deterioration in the credit position of a small number of clients... -

Page 28

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review Financial summary > Group performance > Net interest income / Net fee income (continued) Asia, Global Banking and Markets' results were strongly ahead, driven by foreign exchange, Rates and securities services. Balance ... -

Page 29

... the Group's customers, and impaired loans. 2009 US$m Cards ...Account services ...Funds under management ...Broking income ...Credit facilities ...Insurance ...Global custody ...Imports/exports ...Underwriting ...Remittances ...Corporate finance ...Unit trusts ...Trust income ...Mortgage servicing... -

Page 30

... year as market values rose and investor appetite for equity products increased. Account services fees fell, predominantly in North America as the result of a decline in credit card volumes and changes in customer behaviour, and in Private Banking due to a decrease in fiduciary deposit commissions... -

Page 31

... of trading assets. As noted in 'Net interest income', the cost of internally funding these assets declined significantly as a result of the low interest rate environment. The Credit business benefited from a general tightening of credit spreads following a return of liquidity to much of the market... -

Page 32

... fair value 2009 US$m Net income/(expense) arising from: - financial assets held to meet liabilities under insurance and investment contracts ...- liabilities to customers under investment contracts ...- HSBC's long-term debt issued and related derivatives ...Change in own credit spread on long-term... -

Page 33

... investment losses driven by falling equity and bond markets, predominantly affecting the value of assets held in unit-linked and participating funds in Hong Kong, France and the UK. The negative movement in fair value is partially offset by a corresponding reduction in 'Net insurance claims... -

Page 34

...the launch of new products including a life insurance product designed for high net worth individuals and a guaranteed savings product. In Hong Kong, HSBC retained its position as the leading bancassurer and net earned insurance premiums increased as a result of higher sales of unit-linked and whole... -

Page 35

... Service of Korea. In 2008, HSBC reported a gain of US$416 million in respect of the purchase of PMII. See Note 23 on the Financial Statements. An increase in insurance sales to new customers in Hong Kong resulted in positive movements in the present value of in-force ('PVIF') long-term insurance... -

Page 36

...sale of property fund assets and a reduction in Group real estate disposals in 2008. Similarly, in Hong Kong revaluation gains on investment properties did not recur. Life assurance enhancements to pension products resulted in increased present value of inforce long-term insurance ('PVIF') business... -

Page 37

...businesses, notably Personal Financial Services in North America and Commercial Banking in Hong Kong, but this was more than offset by increases elsewhere, primarily on individually significant loans within Global Banking and Markets and more broadly on Commercial Banking exposures outside Hong Kong... -

Page 38

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review Financial summary > Group performance > Loan impairment charges (continued) impairment charges in the real estate secured portfolio. Loan impairment charges in the Card and Retail Services portfolio decreased despite the ... -

Page 39

...for customers. In HSBC USA, loan impairment charges rose as credit quality worsened across the real estate secured portfolio and private label cards. Delinquencies rose in the prime first lien residential mortgage portfolio, Home Equity Line of Credit and Home Equity Loan second lien portfolios. The... -

Page 40

... network in the US were partly offset by savings resulting from the closure. General and administrative expenses fell as HSBC focused on managing costs tightly and increasing efficiency. Marketing and advertising costs fell across the group, most notably in Card and Retail Services in North America... -

Page 41

... conditions. A review of actuarial assumptions on employees' defined benefit pensions resulted in lower service costs in the UK. The restructuring of the consumer finance business in North America led to reduced headcount and lower costs. This was partially offset by higher salaries and increased... -

Page 42

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Group performance > Share of profit in associates and joint ventures // Economic profit Share of profit in associates and joint ventures 2009 US$m Associates Bank of Communications Co., Limited... -

Page 43

... long-term sustainable risk-based performance, HSBC emphasises the trend in economic profit ahead of absolute amounts within business units. The Group's long-term cost of equity is reviewed annually and for 2009 remained at 10 per cent. The following commentary on economic profit is on a reported... -

Page 44

... to customers ...Financial investments ...Other assets ...Total assets ...LIABILITIES AND EQUITY Liabilities Deposits by banks ...Customer accounts ...Trading liabilities ...Financial liabilities designated at fair value ...Derivatives ...Debt securities in issue ...Liabilities under insurance... -

Page 45

..., and a decrease in structured deposit accounts in Hong Kong as existing deals matured and customers expressed a preference for vanilla cash instruments in the uncertain economic environment. Financial liabilities designated at fair value grew by 4 per cent due to new HSBC debt issuances in Europe... -

Page 46

...to banks ...Loans and advances to customers ...Financial investments ...Other assets ...Total assets ...Deposits by banks ...Customer accounts ...Trading liabilities ...Financial liabilities designated at fair value ...Derivative liabilities ...Debt securities in issue ...Liabilities under insurance... -

Page 47

... 09 as Reported exchange Underlying Currency rates change reported change translation31 US$m US$m % US$m US$m 31 Dec 08 as reported US$m Loans and advances to customers (net) Personal Financial Services ...Commercial Banking ...Global Banking and Markets ...Private Banking ...Other ... Underlying... -

Page 48

... Trading assets32 ...357,504 Financial assets designated at fair value33 ...62,143 Impairment provisions ...(26,308) Non-interest-earning assets ...667,942 Total assets and interest income ...2,445,986 Short-term funds and loans and advances to banks Europe HSBC Bank ...HSBC Private Banking Holdings... -

Page 49

... America Other operations ... Financial investments Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East HSBC Bank... -

Page 50

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Average balance sheet Assets (continued) 2009 Average Interest balance income US$m US$m Other interest-earning assets Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse)... -

Page 51

... ...Financial liabilities designated at fair value (excluding own debt issued) ...Non-interest bearing current accounts ...Total equity and other non-interest bearing liabilities ...Total equity and liabilities ...Deposits by banks35 Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC... -

Page 52

... PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Average balance sheet Equity and liabilities (continued) Average balance US$m Customer accounts37 Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hong Kong... -

Page 53

...HSBC Private Banking Holdings (Suisse) ...HSBC France ...HSBC Finance ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East HSBC Bank USA ...HSBC Finance ...HSBC Bank Canada ...HSBC Markets... -

Page 54

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Net interest margin / Average asset distribution / Changes in net interest income and expense Net interest margin39 2009 % Europe HSBC Bank ...HSBC Private Banking Holdings (... -

Page 55

... Short-term funds and loans and advances to banks Europe HSBC Bank ...HSBC Private Banking Holdings (Suisse) ...HSBC France ...Hang Seng Bank ...The Hongkong and Shanghai Banking Corporation ...The Hongkong and Shanghai Banking Corporation ...HSBC Bank Malaysia ...HSBC Bank Middle East ...HSBC Bank... -

Page 56

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Changes in net interest income / net interest expense Interest income (continued) Increase/(decrease) in 2009 compared with 2008 Volume Rate US$m US$m (182) 165 (510) 25 1,380 ... -

Page 57

...HSBC Bank USA ...HSBC Bank Canada ...HSBC Mexico ...Brazilian operations34 ...HSBC Bank Panama ...HSBC Bank Argentina ...2,407 256 645 200 211 1,494 191 432 975 385 391 2,946 353 99 361 11,346 Financial liabilities designated at fair value - own debt issued Debt securities in issue Europe HSBC Bank... -

Page 58

...the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Short-term borrowings / Contractual obligations / Ratios / Loan maturities Short-term borrowings HSBC includes short-term borrowings within customer accounts, deposits by banks and debt securities in issue... -

Page 59

... 5 years Loans and advances to banks ...Commercial loans to customers Commercial, industrial and international trade ...Real estate and other property related ...Non-bank financial institutions ...Governments ...Other commercial ...Hong Kong Government Home Ownership Scheme ...Residential mortgages... -

Page 60

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > Deposits Deposits The following tables summarise the average amount of bank deposits, customer deposits and certificates of deposit ('CD's) and other money market instruments (... -

Page 61

Customer accounts 2009 Average Average balance rate US$m % Europe ...Demand and other - non-interest bearing ...Demand - interest bearing ...Savings ...Time ...Other ...Hong Kong ...Demand and other - non-interest bearing ...Demand - interest bearing ...Savings ...Time ...Other ...Rest of Asia-... -

Page 62

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Financial summary > Balance sheet > CDs // Critical accounting policies Certificates of deposit and other money market instruments 2009 Average Average balance rate US$m % Europe ...Hong Kong ...Rest of Asia-... -

Page 63

...advances HSBC's accounting policy for losses arising from the impairment of customer loans and advances is described in Note 2g on the Financial Statements. Loan impairment allowances represent management's best estimate of losses incurred in the loan portfolios at the balance sheet date. Management... -

Page 64

... carrying amount of loans and advances. Goodwill impairment HSBC's accounting policy for goodwill is described in Note 2p on the Financial Statements. Note 22 on the Financial Statements lists the Group's cash generating units ('CGU's) by geographical region and global business. Total goodwill for... -

Page 65

... to changes in key assumptions. Valuation of financial instruments HSBC's accounting policy for determining the fair value of financial instruments is described in Note 2d on the Financial Statements. The best evidence of fair value is a quoted price in an actively traded market. In the event... -

Page 66

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review Critical accounting policies (continued) Impairment of available-for-sale financial assets HSBC's accounting policy for impairment of available-for-sale financial assets is described in Note 2j on the Financial Statements. ... -

Page 67

... losses in the next financial year. Deferred tax assets HSBC's accounting policy for the recognition of deferred tax assets is described in Note 2s on the Financial Statements. A deferred tax asset is recognised to the extent that it is probable that future taxable profits will be available against... -

Page 68

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Summary / Personal Financial Services Customer groups and global businesses Page Summary ...Personal Financial Services ...Commercial Banking ...Global Banking and Markets ...Private Banking ...... -

Page 69

... .. Net insurance claims 43 42 Strategic direction HSBC's strategy for Personal Financial Services is to use its global reach and scale to grow profitably in selected markets by providing relationship banking and wealth management services. In markets where HSBC already has scale, such as Hong Kong... -

Page 70

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Personal Financial Services in the US declined and consumer finance and unsecured lending activities in other countries were scaled back. These factors were partially mitigated by the benefit of... -

Page 71

.... In Hong Kong, HSBC maintained its market leading position with gross mortgage balance growth of 7 per cent during the year. • As part of its strategy to deliver a globally consistent customer experience, Personal Financial Services commenced a global retail store update and refresh programme... -

Page 72

... income .. Net insurance claims 43 42 Strategic direction HSBC's Commercial Banking strategy is focused on two key initiatives: âˆ' to be the leading international business bank, using HSBC's extensive geographical network together with product expertise in payments, trade, receivables finance and... -

Page 73

... the importance of this segment to the Commercial Banking business. Customer loans and advances in business banking were US$53 billion, and HSBC continued to support businesses in the global downturn. The US$5 billion International SME Fund was launched in December 2008 in five key markets. The fund... -

Page 74

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Commercial Banking / Global Banking and Markets • Total revenue in the corporate segment was US$6.3 billion. Deposits from corporate customers were US$121 billion, while loans and advances ... -

Page 75

... the Group's extensive distribution network; developing Global Banking and Markets' hub-and-spoke business model; and continuing to build capabilities in major hubs to support the delivery of an advanced suite of services to corporate, institutional and government clients across the HSBC network... -

Page 76

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Global Banking and Markets Management view of total operating income 2009 US$m Global Markets44 ...Credit ...Rates ...Foreign exchange ...Equities ...Securities services45 ...Asset and structured... -

Page 77

...at year end. In August 2009, Global Asset Management entered the European Exchange Traded Funds ('ETF') market, working closely with Global Markets and HSBC Securities Services, and launched three ETF funds. • In Principal Investments, opportunities for private equity realisations were limited and... -

Page 78

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Global Banking and Markets / Private Banking Balance sheet data significant to Global Banking and Markets Hong Kong US$m 25,742 16,937 21,991 27,789 92,181 217,146 5,824 26,650 10,720 16,619 ... -

Page 79

... position, and extensive global network provides a foundation from which Private Banking continues to attract and retain clients. Product and service leadership in areas such as credit, estate planning, hedge funds, and investment advice helps Private Banking meet the complex international financial... -

Page 80

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Private Banking • Trading income fell by 18 per cent, also reflecting lower client trading activity, mainly in foreign exchange and structured products. Gains less losses from financial ... -

Page 81

...415) Private Banking Net interest income ...Net fee income ...Other income15 ...Net operating income16 .. Loan impairment charges and other credit risk provisions ...Net operating income ...Operating expenses ...Operating profit ...Income from associates ...Profit before tax ... 2008 as reported US... -

Page 82

... accounting reasons were reflected through the income statement. Net expense from financial instruments designated at fair value declined by 90 per cent to US$90 million due to reduced income from non-qualifying interest and exchange rate hedges related to long-term debt issued by HSBC Holdings... -

Page 83

... with the revenue reported in other operating income. Costs at HSBC's Group Service Centres rose by 10 per cent as the number of migrated activities increased in line with the Group's Global Resourcing model. Other Net interest expense ...Net fee income ...Changes in fair value ...Gains on disposal... -

Page 84

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Profit/(loss) before tax Analysis by customer group and global business Profit/(loss) before tax 2009 Personal Financial Commercial Services Banking US$m US$m 25,107 8,238 637 65 702 7,883 3,702... -

Page 85

... debt issued and related derivatives ...Net income/(expense) from other financial instruments designated at fair value ...Net income/(expense) from financial instruments designated at fair value ...Gains less losses from financial investments ...Dividend income ...Net earned insurance premiums... -

Page 86

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Customer groups > Profit/(loss) before tax // Geographical regions > Summary Profit/(loss) before tax (continued) 2007 Personal Financial Services US$m 29,069 11,742 38 140 178 Commercial Banking US$m 9,055 3,972... -

Page 87

... Kong's three note-issuing banks, accounting for more than 67.2 per cent by value of banknotes in circulation in 2008. Rest of Asia-Pacific HSBC offers personal, commercial, global banking and markets services in mainland China, mainly through its local subsidiary, HSBC Bank (China) Company Limited... -

Page 88

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Summary / Europe In the analysis of profit by geographical regions that follows, operating income and operating expenses Profit/(loss) before tax 2009 US$m Europe ...Hong Kong ...Rest of ... -

Page 89

...customer groups and global businesses Personal Financial Commercial Services Banking US$m US$m 2009 UK ...France51 ...Germany ...Malta ...Switzerland ...Turkey ...Other ...364 54 - 33 - 43 (182) 312 2008 UK...507 8,595 Loans and advances to customers (net) by country 2009 US$m UK ...France51 ...... -

Page 90

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe > 2009 Profit before tax Europe Net interest income ...Net fee income ...Net trading income ...Changes in fair value of long-term debt issued and related derivatives ...Net income/(... -

Page 91

... unemployment levels led to a rise in loan impairment charges in the Personal Financial Services and Commercial Banking businesses. HSBC Bank continued to provide lending services to its customers while maintaining effective credit control and strengthening collection practices and systems. 89 -

Page 92

... market share in equity capital markets issues as corporates and financial institutions restructured their balance sheets by raising share capital. As part of its wealth management strategy, HSBC continued to grow the Premier customer base and successfully launched the World Selection fund in the UK... -

Page 93

... global asset management business in 2008. Offsetting this was the non-recurrence of a favourable embedded value adjustment following HSBC's introduction of enhanced benefits to existing pension products in the UK in 2008, and lower gains on the sale and leaseback of branches. Net insurance claims... -

Page 94

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe > 2009 / 2008 Markets' exceptional revenue and profit growth in selective businesses. In Personal Financial Services and Commercial Banking businesses, operational cost savings ... -

Page 95

... by narrowing deposit spreads, as base rates were cut in the UK, and increased funding costs, principally for trading activities, in France. Higher net interest income from the expansion of credit card lending and commercial loan portfolio growth in the small and mid-market customer segments in... -

Page 96

... European property company, and additional credit risk provisions on debt securities held within the Group's available-for-sale portfolio, mainly in Solitaire Funding Limited ('Solitaire'), a special purpose entity managed by HSBC. A modest improvement in the UK personal finance sector reflected... -

Page 97

Analysis by customer group and global business Profit/(loss) before tax 2009 Personal Financial Commercial Services Banking US$m US$m 5,413 1,949 34 (1) 33 2,739 1,679 3 17 20 Global Banking & Markets US$m 4,367 1,670 2,267 1,869 4,136 Private Banking US$m 949 883 175 23 198 Intersegment ... -

Page 98

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Europe > Profit/(loss) before tax by customer group Profit/(loss) before tax (continued) 2008 Personal Financial Services US$m 6,464 2,612 47 - 47 Commercial Banking US$m 3,435 2,025 71 12 ... -

Page 99

... debt issued and related derivatives ...Net income/(expense) from other financial instruments designated at fair value ...Net income/(expense) from financial instruments designated at fair value ...Gains less losses from financial investments ...Dividend income ...Net earned insurance premiums... -

Page 100

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Hong Kong > 2009 Hong Kong Profit/(loss) before tax by customer group and global business 2009 US$m Personal Financial Services ...Commercial Banking ...Global Banking and Markets ...... -

Page 101

... of deposit spreads. Average customer lending balances remained broadly in line with 2008, as lower Commercial Banking balances, which reflected the reduction in exports in the first half of 2009, were broadly offset by higher lending in Personal Financial Services and Global Banking and Markets. As... -

Page 102

... spreads compressed in the near-zero interest rate environment. HSBC continued to increase market share in savings and deposit accounts, and balances grew following a series of deposit acquisition campaigns. In Personal Financial Services, customer account balances rose by 15 per cent and Premier... -

Page 103

... led to increased impairment charges against unsecured lending in Personal Financial Services, though bankruptcy levels improved in the second half of the year. Property prices increased during 2009 and mortgage lending remained well secured with conservative loan-to-value ratios and origination... -

Page 104

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Hong Kong > 2008 / Profit/(loss) before tax by customer group allocated to policyholders in full, the portion of decline in the value passed on to clients who have products with ... -

Page 105

... and global business Profit/(loss) before tax 2009 Personal Financial Commercial Services Banking US$m US$m 2,577 1,410 186 3 189 938 530 92 - 92 Global Banking & Markets US$m 1,150 563 792 16 808 Private Banking US$m 212 125 91 - 91 Intersegment elimination50 US$m (124) - - 124 124 Hong Kong Net... -

Page 106

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Hong Kong > Profit/(loss) before tax by customer group Profit/(loss) before tax (continued) 2008 Personal Financial Services US$m 3,381 1,441 143 11 154 Commercial Banking US$m 1,498 548 79... -

Page 107

2007 Personal Financial Services US$m 3,342 1,973 188 5 193 Commercial Banking US$m 1,540 526 63 - 63 Global Banking & Markets US$m 986 682 553 241 794 Private Banking US$m 70 179 280 - 280 Intersegment elimination50 US$m 312 - - (312) (312) Hong Kong Net interest income/(expense) ...Net fee income... -

Page 108

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > 2009 Rest of Asia-Pacific27 Profit/(loss) before tax by country within customer groups and global businesses Personal Financial Commercial Services Banking US$m US$m ... -

Page 109

... retail sales rising by 17.5 per cent in the year. The annual CPI rate was negative throughout much of 2009, largely reflecting the earlier movements in food and energy prices, before accelerating to 1.9 per cent in December 2009. The renminbi exchange rate was little changed against the US dollar... -

Page 110

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > 2009 Profit before tax Rest of Asia-Pacific27 Net interest income ...Net fee income ...Net trading income ...Changes in fair value of long-term debt issued and ... -

Page 111

... has strengthened HSBC's network in India, allowing it to offer wealth management products through over 200 additional outlets. Building the Group's mainland China business and renminbi capabilities continued to be a key focus, as demonstrated by the opening of onshore renminbi accounts in mainland... -

Page 112

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > 2009 / 2008 by asset repricing, particularly in Commercial Banking. Average lending balances fell in Global Banking and Markets and Commercial Banking as a result of ... -

Page 113

... as the number of migrated activities and processes increased in accordance with the Group's global resourcing strategy to develop centres of excellence. All related costs are recharged to other Group entities and the income from these recharges is reported within other operating income. New outlets... -

Page 114

... in Personal Financial Services and Commercial Banking rose due to customer acquisition, notably among small businesses following the launch of the HSBC Direct for Business product. These deposits were deployed in increasing lending, where spreads improved on the corporate lending and credit card... -

Page 115

...mainly by increased customer activity and high levels of market volatility. A net expense from financial instruments designated at fair value of US$171 million was recorded compared with income of US$121 million in 2007. Declines in equity markets affected unitlinked insurance products, particularly... -

Page 116

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > Profit before tax by customer groups Analysis by customer group and global business Profit before tax 2009 Personal Financial Commercial Services Banking US$m US$m 1,... -

Page 117

... debt issued and related derivatives ...Net income/(expense) from other financial instruments designated at fair value ...Net income/(expense) from financial instruments designated at fair value ...Gains less losses from financial investments ...Dividend income ...Net earned insurance premiums... -

Page 118

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Rest of Asia-Pacific > Profit before tax by customer group // Middle East Profit before tax (continued) 2007 Personal Financial Services US$m 1,507 594 42 (2) 40 Commercial Banking US$m 750... -

Page 119

...tax by country within customer groups and global businesses Personal Financial Commercial Services Banking US$m US$m 2009 Egypt ...United Arab Emirates ...Other ...Middle East (excluding Saudi Arabia) ...Saudi Arabia ...18 (177) 13 (146) 20 (126) 2008 Egypt ...United Arab Emirates ...Other ...Middle... -

Page 120

... 41.1 8,050 Balance sheet data41 2009 US$m Loans and advances to customers (net) ...Loans and advances to banks (net) ...Trading assets, financial assets designated at fair value, and financial investments ...Total assets ...Deposits by banks ...Customer accounts ...For footnotes, see page 149. All... -

Page 121

... in 2009. Net interest income declined by 4 per cent, driven by lower deposit and lending balances and deposit spread compression across all customer groups. Commercial Banking lending balances fell as trade levels declined. In Personal Financial Services, average mortgages and credit card balances... -

Page 122

... expenditure in Global Banking and Markets was offset by lower staff costs in Personal Financial Services and Commercial Banking as headcount declined. Non-staff costs rose as new head office buildings in the UAE and Qatar caused higher rental costs, and IT investment increased from systems upgrades... -

Page 123

.... HSBC also successfully launched new banking products across the region, in addition to growing the Premier customer base. Business volume growth and wider asset spreads drove higher net interest income, and fee income rose as volumes of cards and trade products grew. As global financial conditions... -

Page 124

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Middle East > Profit/(loss) before tax by customer group Analysis by customer group and global business Profit/(loss) before tax 2009 Personal Financial Commercial Services Banking US$m US... -

Page 125

...% 0.8 29.6 - (60) 60 - - - (279) 2,389 (959) 1,430 316 1,746 % 18.8 35.9 Share of HSBC's profit before tax ...Cost efficiency ratio ... 3.1 53.2 Balance sheet data41 US$m Loans and advances to customers (net) ...Total assets ...Customer accounts ...7,226 8,168 13,753 US$m 13,221 14,672 10,978 US... -

Page 126

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Middle East > Profit/(loss) before tax by customer group // North America > 2009 Profit/(loss) before tax (continued) 2007 Personal Financial Services US$m 458 172 30 - 30 2 - 22 684 - 684 ... -

Page 127

... America Profit/(loss) before tax by country within customer groups and global businesses Personal Financial Commercial Banking Services US$m US$m 2009 US ...Canada ...Bermuda ...Other ...(5,292) 17 49 - (5,226) 2008 US52 ...Canada ...Bermuda ...Other ...158 347 37 1 543 Global Banking & Markets... -

Page 128

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America > 2009 Profit/(loss) before tax North America Net interest income ...Net fee income ...Net trading income/(expense) ...Changes in fair value of long-term debt issued and ... -

Page 129

... in Personal Financial Services and lower operating expenses following the closure of the Consumer Lending branch network at the beginning of 2009, partly offset by higher loan impairment charges and other credit risk provisions in the corporate and commercial, and Private Banking, books. Net... -

Page 130

...customer behaviour, aligning it with the policy used across the Group. As a consequence of this, real estate secured loan balances are now written down to net realisable value generally no later than the end of the month in which the account becomes 180 days delinquent, and personal lending products... -

Page 131

... of the branch network amounted to US$150 million. Staff costs decreased as a result of lower staff numbers, offsetting higher performance-related costs in Global Banking and Markets. General and administrative costs declined with lower marketing costs in Card and Retail Services as a significant... -

Page 132

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions >North America > 2008 activity was curtailed. Deposit insurance expenses increased by US$143 million following a Federal Deposit Insurance Corporation special assessment in response to the ... -

Page 133

... designated at fair value rose by US$304 million to US$293 million due to income from ineffective hedges related to long-term debt issued by the Group's subsidiaries in North America. Gains less losses from financial investments declined, mainly due to losses on US government agency securities... -

Page 134

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America > 2008 / Profit/(loss) before tax by customer group Other operating income declined due to losses on sale of the Canadian vehicle finance businesses and other loan portfolios ... -

Page 135

Analysis by customer group and global business Profit/(loss) before tax 2009 Personal Financial Commercial Services Banking US$m US$m 11,244 3,174 257 60 317 1,391 453 (10) 3 (7) Global Banking & Markets US$m 999 1,045 (179) 175 (4) Private Banking US$m 178 142 (3) (1) (4) Intersegment Other ... -

Page 136

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > North America > Profit/(loss) before tax by customer group Profit/(loss) before tax (continued) 2008 Personal Financial Services US$m 12,632 3,896 (250) 66 (184) Commercial Banking US$m 1,... -

Page 137

... Personal Financial Services US$m 13,175 4,571 (349) 134 (215) Commercial Banking US$m 1,558 338 (2) - (2) Global Banking & Markets US$m 378 701 (871) 137 (734) Private Banking US$m 273 279 11 - 11 Intersegment elimination50 US$m (520) - - 520 520 North America Net interest income/(expense) ...Net... -

Page 138

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America > 2009 Latin America Profit/(loss) before tax by country within customer groups and global businesses Personal Financial Commercial Services Banking US$m US$m 2009 Argentina ... -

Page 139

... US$m Loans and advances to customers (net) ...Loans and advances to banks (net) ...Trading assets, financial assets designated at fair value, and financial investments ...Total assets ...Deposits by banks ...Customer accounts ...For footnote, see page 149. All commentaries on Latin America are on... -

Page 140

... and Commercial Banking and lower revenues in Personal Financial Services. Global Banking and Markets' performance improved driven by strong results in trading and Balance Sheet Management. 2009 was a year of consolidating risk policies and strongly emphasising cost control. Additional capital was... -

Page 141

... resulted from increased foreign exchange and Rates trading income, which benefited from early positioning against interest rate movements in a volatile market. Net income from financial instruments designated at fair value rose by 36 per cent, primarily from higher insurance-related assets. This... -

Page 142

...2008. Commercial loan volume growth was driven by increased lending for working capital and trade finance loans in Brazil, and medium-sized businesses and the real estate sector in Mexico. Increased income on customer liabilities, which was driven by volume growth, particularly in time deposits, was... -

Page 143

... of new fees and volume growth, particularly in cards, personal loans, packaged deposit products and payments and cash management. Trading income rose by 22 per cent largely reflecting favourable positioning against foreign exchange movements and increased foreign exchange sales volumes. Trading... -

Page 144

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America > Profit/(loss) before tax by customer group Analysis by customer group and global business Profit/(loss) before tax 2009 Personal Financial Commercial Services Banking US$m ... -

Page 145

... in fair value of longterm debt issued and related derivatives ...Net income from other financial instruments designated at fair value ...Net income from financial instruments designated at fair value ...Gains less losses from financial investments ...Dividend income ...Net earned insurance premiums... -

Page 146

... HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Geographical regions > Latin America > Profit/(loss) before tax by customer group // Products and services Profit/(loss) before tax (continued) 2007 Personal Financial Services US$m 3,983 1,372 67 10 77 Commercial... -

Page 147

..., offerings include personal banking products (current and savings accounts, mortgages and personal loans, credit cards, and local and international payment services) and wealth management services (insurance and investment products and financial planning services). HSBC Premier ('Premier') provides... -

Page 148

...exchange traded futures; equity services, including research, sales and trading for institutional, corporate and private clients and asset management services; distribution of capital markets instruments, including debt, equity and structured products, utilising HSBC's global network; and securities... -

Page 149

... returns. Products and services offered include: Private Banking Services: These comprise multi-currency deposit accounts and fiduciary deposits, credit and specialist lending, treasury Other information Funds under management 2009 US$bn Funds under management At 1 January ...Net new money ...Value... -

Page 150

HSBC HOLDINGS PLC Report of the Directors: Operating and Financial Review (continued) Other information > Assets held in custody / Property / Legal proceedings / Data security // Footnotes increased, primarily as a result of the improvement in global equity markets during the year. Global Asset ... -

Page 151

... and rights of its clients and of the Group and to further enhance its security policies and data protection practices. Footnotes to the Operating and Financial Review Key performance indicators (page 18) 1 The percentage increase in net operating income before loan impairment and other credit risk... -

Page 152

... shares and other equity instruments issued by HSBC Holdings; and - deducting average reserves for unrealised gains/(losses) on effective cash flow hedges and available-for-sale securities. Return on invested capital is based on the profit attributable to ordinary shareholders of the parent company... -

Page 153

...; assess the applicability and relevance of good practice recommendations to their disclosures, acknowledging the importance of such guidance; seek to enhance the comparability of financial statement disclosures across the UK banking sector; and clearly differentiate in their annual reports between... -

Page 154

... mortgage exposure. • The particular topics covered in respect of HSBC's securitisation activities and exposure to structured products are as follows: overview of exposure; business model; risk management; accounting policies; nature and extent of HSBC's exposures; fair values of financial... -

Page 155

... US$m Financial assets reclassified to loans and receivables ABSs ...Trading loans - commercial mortgage loans ...Leveraged finance and syndicated loans ...Financial assets reclassified to available for sale Corporate debt and other securities ... Effect on income statement for 2008 Recorded in Net... -

Page 156

... policy' on page 151, the dislocation of financial markets which developed in the second half of 2007 continued throughout 2008 and into 2009. For the last four half-year periods, the write-downs incurred by the Group on ABSs, trading loans held for securitisation, leveraged finance transactions... -

Page 157

... holdings in which significant first loss protection is provided through capital notes issued by the securities investment conduits ('SIC's), excluding Solitaire. At each reporting date, an assessment is made of whether there is any objective evidence of impairment in the value of available-for-sale... -

Page 158

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Overview of exposure > AFS ABSs impairment // Business model / Risk management / Accounting policies / Nature and extent of exposures Services downgraded the ratings on substantially all US Alt-A residential MBSs ... -

Page 159

... lending held at fair value through profit or loss; ABSs including MBSs and CDOs; monolines; credit derivative product companies ('CDPC's); and leveraged finance transactions. MBSs are securities that represent interests in a group of mortgages. Investors in these securities have the right to cash... -

Page 160

... risk characteristics to sub-prime, for example, UK non-conforming mortgages (see below); US Home Equity Lines of Credit: a form of revolving credit facility provided to customers, which is supported by a first or second lien charge over residential property. Global Banking and Markets' holdings... -

Page 161

... holdings of ABSs, and direct lending held at fair value through profit or loss Designated at fair value through Held to maturity profit or loss US$m US$m Of which held through consolidated SPEs Total US$m US$m Trading US$m At 31 December 2009 Sub-prime residential mortgage-related assets ...Direct... -

Page 162

... HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Overview of exposure > Nature and extent of exposures HSBC's consolidated holdings of ABSs, and direct lending held at fair value through profit or loss 2009 At 31 December 2009 Gross fair value movements Realised Credit... -

Page 163

... 1,029 74,007 Commercial property MBS and MBS CDOs8,9 ...- high grade10 ...- rated C to A ...- not publicly rated ...Leveraged finance-related assets ABSs and ABS CDOs8 ...- high grade10 ...- rated C to A ...Student loan-related assets ABSs and ABS CDOs8 ...- high grade10 ...- rated C to A ...Other... -

Page 164

... directly by HSBC, Solitaire and the SICs were downgraded. In particular, Moody's Investor Services downgraded the ratings on substantially all the Group's holdings of US Alt-A residential MBSs issued in 2006 and 2007. The downgrade of assets is reflected in the disclosure of fair value movements... -

Page 165

... insurers HSBC's principal exposure to monolines is through a number of over-the-counter ('OTC') derivative transactions, mainly credit default swaps ('CDS's). HSBC entered into these CDSs primarily to purchase credit protection against securities held at the time within the trading portfolio... -

Page 166

... at 31 December 2009 (2008: US$2 million drawn). HSBC's exposure to debt securities which benefit from guarantees provided by monoline insurers Within both the trading and available-for-sale portfolios, HSBC holds bonds that are 'wrapped' with a credit enhancement from a monoline. As the bonds are... -

Page 167

... year. HSBC's additional exposure to leveraged finance loans through holdings of ABSs from its trading and investment activities is shown in the table on page 159. HSBC's exposure to leveraged finance transactions Funded exposures21 US$m 2009 Europe ...Rest of Asia-Pacific ...North America ...3,790... -

Page 168

...end, ultimate responsibility for the determination of fair values lies with Finance, which reports functionally to the Chief Financial Officer, Executive Director, Risk and Regulation. Finance establishes the accounting policies and procedures governing valuation and is responsible for ensuring that... -

Page 169

... in other market factors such as benchmark interest rates or foreign exchange rates. Specifically, the change in fair value of issued debt securities attributable to the Group's own credit spread is computed as follows: for each security at each reporting date, an externally verifiable price is... -

Page 170

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value All net positions in non-derivative financial instruments, and all derivative portfolios, are valued at bid or offer prices as appropriate. Long positions ... -

Page 171

... methodologies employed. Over time, as model development progresses, model limitations are addressed within the core revaluation models and a model limitation adjustment is no longer needed. Inception profit (Day 1 P&L reserves) Inception profit adjustments are adopted where the fair value estimated... -

Page 172

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value of the unobservable component. The 'observability boundary' is the point at which during the lifetime of the trade the previously unobservable significant ... -

Page 173

... the calculation. uncertainties inherent in estimating fair value for private equity investments. Debt securities, treasury and other eligible bills, and equities The fair value of these instruments is based on quoted market prices from an exchange, dealer, broker, industry group or pricing service... -

Page 174

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value that are generally observable include foreign exchange spot and forward rates, benchmark interest rate curves and volatility surfaces for commonly traded ... -

Page 175

... Other portfolios include holdings in various bonds, preference shares and debentures where the unobservability relates to the prices of the underlying securities. The decrease during the year was due to a reduction in the fair value of loans held for securitisation and disposals of positions within... -

Page 176

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value between interest rates and foreign exchange rates. The movement in Level 3 trading liabilities during the year was primarily due to the issue of new equity ... -

Page 177

... net interest income'. Fair value changes on long term debt designated at fair value and related derivatives are presented in the income statement under 'Changes in fair value of long-term debt issued and related derivatives'. The income statement line item 'Net income/(expense) from other financial... -

Page 178

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value Reflected in profit or loss Favourable Unfavourable changes changes US$m US$m At 31 December 2008 ...Private equity investments ...Asset-backed securities ...... -

Page 179

... at fair value in the financial statements: Bases of valuing HSBC Holdings' financial assets and liabilities measured at fair value Quoted market price Level 1 US$m At 31 December 2009 Assets Derivatives ...Financial investments: available for sale ...Liabilities Financial liabilities designated at... -

Page 180

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) Fair values of financial instruments > Carried at fair value / Not carried at fair value Assessing available-for-sale assets for impairment HSBC's policy on impairment of available-for-sale assets is described on page ... -

Page 181

... by capital note holders. Fair values of financial instruments not carried at fair value Financial instruments that are not carried at fair value on the balance sheet include loans and advances to banks and customers, deposits by banks, customer accounts, debt securities in issue and subordinated... -

Page 182

... to customers ...Financial investments: debt securities ...Financial investments: treasury and other eligible bills ...Liabilities Deposits by banks ...Customer accounts ...Debt securities in issue ...Subordinated liabilities ...179,781 896,231 17,526 101 124,872 1,159,034 146,896 30,478 Fair value... -

Page 183

...: Fair values of HSBC Holdings' financial instruments not carried at fair value on the balance sheet 2009 Carrying amount US$m Assets Loans and advances to HSBC undertakings ...Liabilities Amounts owed to HSBC undertakings ...Debt securities in issue ...Subordinated liabilities ...23,212 Fair value... -

Page 184

... financed by issuing CP or drawing advances from HSBC. The cash flows received by the conduits from the third-party assets are used to service the funding and provide a commercial rate of return for HSBC for structuring, for various other administrative services, and for the liquidity and credit... -

Page 185

... billion). Weighted average life of portfolios It should be noted that securities purchased by SICs typically benefit from substantial transactionspecific credit enhancements such as subordinated tranches and/or excess spread, which absorb any credit losses before they fall on the tranche held by... -

Page 186

...mortgages ...US Alt-A ... 0.7 1.9 2.6 Asset class at 31 December 2008 Structured finance Vehicle loans and equipment leases ...Consumer receivables ...Credit card receivables ...Residential MBSs ...Commercial MBSs ...Auto floor plan ...Trade receivables ...Student loan securities ...Vehicle finance... -

Page 187

... designated at fair value ...Derivative assets ...Loans and advances to banks ...Loans and advances to customers ...Financial investments ...Other assets ... 0.1 - - - 11.1 0.9 12.1 - 0.2 0.1 - 19.9 - 20.2 0.1 0.2 0.1 - 31.0 0.9 32.3 - 0.1 - 13.4 - 0.4 13.9 - - 0.1 - 0.3 - 0.4 Funding structure... -

Page 188

HSBC HOLDINGS PLC Report of the Directors: Impact of Market Turmoil (continued) SPEs > SIVs and conduits / Money market funds / CNAV funds Weighted average life of the funding liabilities Other SICs Years 0.1 10.3 Total SICs Years 0.1 10.3 Total multi-seller conduits Years 0.1 - Total SIVs Years ... -

Page 189

... money market funds invest in diverse portfolios of highly-rated debt instruments, and historically included limited holdings in instruments issued by SIVs. At 31 December 2009, these funds had no exposure to instruments issued by SIVs (2008: US$0.5 billion). Constant Net Asset Value funds During... -

Page 190

...non-money market funds to enable customers to invest in a range of assets, typically equities and debt securities. At the launch of a fund HSBC, as fund manager, usually provides a limited amount of initial capital known as 'seed capital' to enable the fund to start purchasing assets. These holdings... -

Page 191

... and for capital efficiency purposes. In such cases, the loans and advances are transferred by HSBC to the SPEs for cash, and the SPEs issue debt securities to investors to fund the cash purchases. Credit enhancements to the underlying assets may be used to obtain investment grade ratings on the... -

Page 192

... to enable the notes issued to the investors to be rated. The SPEs are not consolidated by HSBC when the investors bear substantially all the risks and rewards of ownership through the notes. The total fair value of liabilities (notes issued and derivatives) in structured credit transaction SPEs was... -

Page 193

... assets ...Direct lending31 ...ABSs31 ...ABCP ...Other ... Funding provided by HSBC ...CP ...MTNs ...Junior notes ...Term repos executed ...Investments in funds ...Drawn liquidity facility ...Capital notes32 ... 191 Total maximum exposure to consolidated SPEs ... Liquidity and credit enhancements... -

Page 194

...CP ...MTNs ...Junior notes ...Term repos executed ...Investments in funds ...Drawn liquidity facility ...Capital notes32 ... Report of the Directors: Impact of Market Turmoil (continued) 192 Total maximum exposure to consolidated SPEs33 ... Liquidity and credit enhancements Deal-specific liquidity... -

Page 195

....2 116.4 18.1 Money market funds35 Enhanced VNAV VNAV CNAV funds funds funds US$bn US$bn US$bn Non-money market funds35 MultiSpecialist Local manager funds funds funds37 US$bn US$bn US$bn At 31 December 2009 Total assets ... Funding provided by HSBC ...MTNs ...Investments in funds ... Total maximum... -

Page 196

... disclosed in Note 39 on the Financial Statements. The majority by value of undrawn credit lines arise from 'open to buy' lines on personal credit cards, advised overdraft limits and other pre-approved loan products, and mortgage offers awaiting customer acceptance. HSBC generally has the right to... -

Page 197

... committed loan facility amount not yet drawn down by the customer, less any fair value write-downs, net of fees held on deposit. 23 Derivatives, trading assets and trading liabilities are presented as one category to reflect the manner in which these financial instruments are risk-managed. 24... -

Page 198

... these exchanges. In the UK, these are the Listing Rules of the Financial Services Authority ('FSA'); in Hong Kong, The Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited ('HKSE'); in the US, where the shares are traded in the form of ADSs, HSBC Holdings' shares are... -

Page 199

...is the Financial Services and Markets Act 2000 ('FSMA'). Additionally, data privacy is regulated by the Data Protection Act 1998. Other UK financial services legislation is derived from EU directives relating to banking, securities, insurance, investments and sales of personal financial services. In... -

Page 200

...OCC') and the Federal Deposit Insurance Corporation (the 'FDIC') govern many aspects of HSBC's US business. HSBC and its US operations are subject to supervision, regulation and examination by the Federal Reserve Board because HSBC is a 'bank holding company' under the US Bank Holding Company Act of... -

Page 201

...and bank holding companies to maintain a minimum amount of capital in relation to their balance sheet assets (measured on a non-risk weighted basis). HSBC Bank USA and HTCD are subject to risk-based assessments from the Federal Deposit Insurance Corporation ('FDIC'), which insures deposits generally... -

Page 202

... Financial Officer, Executive Director, Risk and Regulation within the integrated Finance and Risk function, which the latter represents on the Board. Global Risk has functional responsibility for the principal financial risk types, namely retail and wholesale credit, market, operational, security... -

Page 203

... costs and their mitigation. The credit risk governance structures and control frameworks implemented by the Group are designed for all stages of economic and financial cycles. During 2009, a number of processes, for example, crisis management and new product review, were enhanced in response to... -

Page 204

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Management manuals their detailed credit policies and procedures, consistent with Group policy; • guiding HSBC's operating companies on the Group's appetite for credit risk exposure to specified market sectors, activities ... -

Page 205

... by customer and retail product segments. A Credit Review and Risk Identification team reports directly to each regional Chief Risk Officer, and reviews the robustness and effectiveness of key risk measurement, monitoring and control activities. HSBC's credit risk rating systems and processes... -

Page 206

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Management amount of the asset is reduced directly. For further details, see 'Accounting policies' on page 369. Impairment allowances may be assessed and created either for individually significant accounts or, on a ... -

Page 207

... numbers of relatively lowvalue assets are managed using a portfolio approach, typically low-value, homogeneous small business accounts in certain countries or territories; residential mortgages that have not been individually assessed; credit cards and other unsecured consumer lending products... -

Page 208

... advances to the commercial real estate sector, notably in parts of Europe, the Middle East and North America. Exposure to personal lending secured on residential property remained significant. HSBC suffered from continuing weakness in credit conditions in the US mortgage market. However, in the UK... -

Page 209

... banks ...Hong Kong Government certificates of indebtedness ...Trading assets ...Treasury and other eligible bills ...Debt securities ...Loans and advances to banks ...Loans and advances to customers ...Financial assets designated at fair value ...Treasury and other eligible bills ...Debt securities... -

Page 210

...in the commercial real estate sector, charges over the properties being financed; and in the financial sector, charges over financial instruments such as cash, debt securities and equities in support of trading facilities. not impaired, or on individually assessed impaired loans and advances, as it... -

Page 211

...bills. A more detailed analysis of financial investments is set out in Note 19 on the Financial Statements and an analysis by credit quality is provided on page 225. The insurance businesses held diversified portfolios of debt and equity securities designated at fair value (2009: US$25 billion; 2008... -

Page 212

...international trade...Commercial real estate ...Other property-related ...Government ...Other commercial5 ...Financial ...Non-bank financial institutions ...Settlement accounts ...Asset-backed securities reclassified ...Total gross loans and advances to customers ...Gross loans and advances to banks... -

Page 213

... and commercial ...Commercial, industrial and international trade ...Commercial real estate ...Other property-related ...Government ...Other commercial5 ...Financial ...Non-bank financial institutions ...Settlement accounts ...Asset-backed securities reclassified ...Total gross loans and advances to... -

Page 214

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Credit exposure > Concentration of exposure Gross loans and advances to customers by country within Rest of Asia-Pacific, Middle East and Latin America (Audited) Commercial, international trade and other US$m Residential ... -

Page 215

...accordance with the Bank of England Country Exposure Report (Form CE) guidelines, outstandings comprise loans and advances (excluding settlement accounts), amounts receivable under finance leases, acceptances, commercial bills, CDs and debt and equity securities (net of short positions), and exclude... -

Page 216

... liquidity, and reduced demand for their products and services; this encouraged them to reduce indebtedness through portfolio disposals, extend the duration of short-term finance and focus increasingly on cost efficiency. HSBC has worked closely with its customers to identify problem areas early and... -

Page 217

... offers loans secured on existing assets, such as first and second liens on residential property; unsecured lending products such as overdrafts, credit cards and payroll loans; and debt consolidation loans which may be secured or unsecured. In 2009, credit exposure in the personal lending portfolios... -

Page 218

... PLC Report of the Directors: Risk (continued) Credit risk > Areas of special interest > Personal lending HSBC's US vehicle finance portfolio. The transaction is currently expected to close in the first quarter of 2010. The Consumer Lending business historically provided real estate secured... -

Page 219

...Bank and First Direct as HSBC grew market share in UK mortgage lending (discussed in greater detail below). Other personal lending in the UK declined by 11 per cent to US$29 billion, primarily due to reduced customer demand for credit. In Latin America, gross loans and advances to personal customers... -

Page 220

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Areas of special interest > Personal lending > Mortgage lending For an analysis of loan impairment allowances and impaired loans, see page 230. Mortgage lending The Group offers a wide range of mortgage products designed to ... -

Page 221

... all new business originations are made through HSBC's own salesforce and mainly to existing customers holding a current or savings account relationship with the Group. HSBC does not accept self-certification of income and restricts lending to purchase residential property for rental. UK mortgage... -

Page 222

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Areas of special interest > Personal lending > Mortgage lending // US personal lending - credit quality Mortgage lending products (Unaudited) Rest of Europe US$m 9,205 2 9,207 - (41) - (41) - 1,084 - 1,084 11.8% - - - - Rest... -

Page 223

... market, though the first-time homebuyer tax credit and the low interest rates were the main forces driving up home sales and shrinking inventories of unsold properties. This resulted in some house price stabilisation in the latter half of 2009, particularly in the middle and lower price sector... -

Page 224

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Areas of special interest > US personal lending - credit quality Mortgage lending In line with its exit strategy for non-prime real estate secured mortgage lending, HSBC continued to reduce mortgage lending exposure in the ... -

Page 225

... in the US: Quarter ended As Ex. period reported change 31 Dec 31 Dec 2009 2009 US$m US$m In Personal Financial Services in the US Residential mortgages Second lien mortgage lending ...Vehicle finance ...Credit card ...Private label ...Personal non-credit card ...Total ... 30 Sep 2009 US$m 30... -

Page 226

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Areas of special interest > Renegotiated loans // Credit quality Quarter ended As Ex. period change reported 31 Dec 31 Dec 2009 2009 US$m US$m In Mortgage Services and Consumer Lending Mortgage Services: ...3,477 4,456 - ... -

Page 227

...and retail lending business, as well as the external ratings attributed by external agencies to debt securities. There is no direct correlation between the internal and external ratings at granular level, except to the extent each falls within a single quality classification. Credit quality of HSBC... -

Page 228

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Credit quality > Risk ratings / Financial instruments by credit quality Quality classification definitions • 'Strong': exposures demonstrate a strong capacity to meet financial commitments, with negligible or low ... -

Page 229

... of collection from other banks ...Hong Kong Government certificates of deposit ...Trading assets ...- treasury and other eligible bills ...- debt securities ...- loans and advances to banks - loans and advances to customers ...Financial assets designated at fair value24 ...- treasury and other... -

Page 230

... of collection from other banks ...Hong Kong Government certificates of indebtedness ...Trading assets ...- treasury and other eligible bills ...- debt securities ...- loans and advances to banks - loans and advances to customers ...Financial assets designated at fair value24 ...- treasury and other... -

Page 231

... overdue loans fully secured by cash collateral; mortgages that are individually assessed for impairment, and that are in arrears more than 90 days, but where the value of collateral is sufficient to repay both the principal debt and all potential interest for at least one year; and short-term trade... -

Page 232

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Credit quality > Past due but not impaired // Impaired loans and advances / Impairment allowances Up to 29 days US$m At 31 December 2008 Items in the course of collection from other banks ...Loans and advances held at ... -

Page 233

... on loans and advances to customers by geographical region (Audited) Hong Kong US$m Rest of AsiaPacific7 US$m North Middle East7 America US$m US$m Latin America US$m Europe US$m At 31 December 2009 Gross loans and advances Individually assessed impaired loans27 ...Collectively assessed ...Impaired... -

Page 234

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Impairment allowances > Movements Impairment allowances on loans and advances to customers and banks by industry sector (Audited) At 31 December 2009 Individually Collectively assessed assessed Total allowances allowances ... -

Page 235

... to income statement ...Personal ...- residential mortgages ...- other personal ...Corporate and commercial ...- commercial, industrial and international trade ...- commercial real estate and other property-related ...- other commercial ...Financial33 ...Governments ...Exchange and other movements... -

Page 236

... to income statement34 ...Personal ...- residential mortgages ...- other personal ...Corporate and commercial ...- commercial, industrial and international trade ...- commercial real estate and other propertyrelated ...- other commercial ...Financial33 ...Exchange and other movements ...Impairment... -

Page 237

... ...Charge to income statement ...Personal ...- residential mortgages ...- other personal ...Corporate and commercial ...- commercial, industrial and international trade ...- commercial real estate and other propertyrelated ...- other commercial ...Financial33 ...Exchange and other movements... -

Page 238

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Impairment allowances > Net loan impairment charge Individually and collectively assessed impairment charge to income statement by industry segment (Unaudited) 2009 Individually Collectively assessed assessed US$m US$m Banks... -

Page 239

Net loan impairment charge to the income statement by geographical region (Unaudited) Hong Kong US$m Rest of AsiaPacific7 US$m North Middle East7 America US$m US$m Latin America US$m Europe US$m 2009 Individually assessed impairment allowances New allowances ...Release of allowances no longer ... -

Page 240

... small number of large individually assessed impairments against corporate and commercial exposures, together with the effects of credit quality deterioration in the personal lending portfolio. In the unsecured portfolios, credit quality declined in the cards and personal loans portfolios reflecting... -

Page 241

... rates on losses has not been as severe as initially expected due, in part, to lower fuel prices and the boost to cash flow provided by government stimulus programmes that meaningfully benefit non-prime customers. In HSBC Bank USA personal lending portfolios, new loan impairment allowances increased... -

Page 242

... as delinquency rates increased across credit cards, personal loans and corporate lending in light of the deteriorating economic environment. Elsewhere, impairment charges on the commercial portfolio rose in the UK, particularly in the final quarter of 2008 as the weakening property market led to... -

Page 243

... HSBC Holdings from transactions with Group subsidiaries and from guarantees issued in support of obligations assumed by certain Group operations in the normal conduct of their business. These risks are reviewed and managed within regulatory and internal limits for exposures by the HSBC Global Risk... -

Page 244

HSBC HOLDINGS PLC Report of the Directors: Risk (continued) Credit risk > Risk elements principal and/or interest are classified as unimpaired loans when the Group expects to recover the contractual cash flows in full. Troubled debt restructurings The SEC requires separate disclosure of any loans ... -

Page 245