Frontier Communications 2014 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

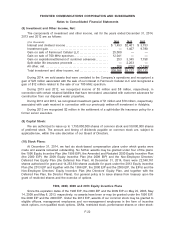

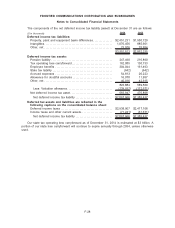

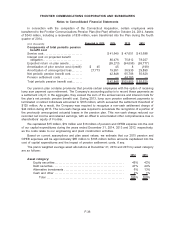

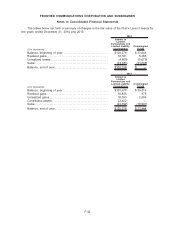

The significant items reclassified from each component of accumulated other comprehensive loss

for the years ended December 31, 2014, 2013 and 2012 are as follows:

($ in thousands)

Details about Accumulated Other

Comprehensive Loss Components 2014 2013 2012

Affected Line Item in the

Statement Where Net

Income is Presented

Amount Reclassified from

Accumulated Other Comprehensive Loss(a)

Amortization of Pension Cost

Items(b)

Prior-service costs . . . . . . . . . . . . . . $ (45) $ (8) $ 199

Actuarial gains (losses). . . . . . . . . . (19,951) (36,930) (29,890)

Pension settlement costs . . . . . . . . — (44,163) —

(19,996) (81,101) (29,691) Income (loss) before income taxes

Tax impact . . . . . . . . . . . . . . . . . . . . . 7,497 30,818 11,282 Income tax (expense) benefit

$(12,499) $(50,283) $(18,409) Net income (loss)

Amortization of OPEB Cost Items(b)

Prior-service costs . . . . . . . . . . . . . . $ 3,911 $ 6,101 $ 10,068

Actuarial gains (losses). . . . . . . . . . (2,916) (7,846) (7,537)

995 (1,745) 2,531 Income (loss) before income taxes

Tax impact . . . . . . . . . . . . . . . . . . . . . (373) 663 (962) Income tax (expense) benefit

$ 622 $ (1,082) $ 1,569 Net income (loss)

(a) Amounts in parentheses indicate losses.

(b) These accumulated other comprehensive loss components are included in the computation of net

periodic pension and OPEB costs (see Note 16—Retirement Plans for additional details).

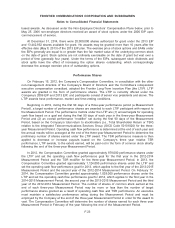

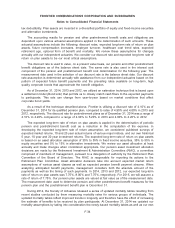

(14) Segment Information:

We operate in one reportable segment. Frontier provides both regulated and unregulated voice,

data and video services to residential, business and wholesale customers and is typically the

incumbent voice services provider in its service areas.

As permitted by U.S. GAAP, we have utilized the aggregation criteria to combine our operating

segments because all of our properties share similar economic characteristics, in that they provide the

same products and services to similar customers using comparable technologies in all of the states in

which we operate. The regulatory structure is generally similar. Differences in the regulatory regime of

a particular state do not significantly impact the economic characteristics or operating results of a

particular property.

F-32

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements