Frontier Communications 2014 Annual Report Download - page 81

Download and view the complete annual report

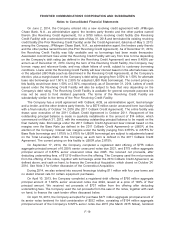

Please find page 81 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for total consideration of $216 million, and $277 million aggregate principal amount of the Company’s

7.875% senior notes due 2015 (the April 2015 Notes), tendered for total consideration of $316 million.

On April 24, 2013, the Company accepted for purchase $1 million aggregate principal amount of the

March 2015 Notes, tendered for total consideration of $1 million, $1 million of the April 2015 Notes,

tendered for total consideration of $1 million, and $225 million aggregate principal amount of the

Company’s 8.250% senior notes due 2017 (the 2017 Notes), tendered for total consideration of

$268 million. The repurchases in the debt tender offers for the senior notes resulted in a loss on the

early extinguishment of debt of $105 million, ($65 million or $0.06 per share after tax).

Additionally, during the second quarter of 2013, the Company repurchased $209 million of the

2017 Notes in a privately negotiated transaction, along with $17 million of its 8.125% senior notes due

2018 and $79 million of its 8.500% senior notes due 2020 in open market repurchases. These

transactions resulted in a loss on the early extinguishment of debt of $55 million ($34 million or $0.04

per share after tax).

On May 17, 2012, the Company completed a registered offering of $500 million aggregate

principal amount of 9.250% senior unsecured notes due 2021, issued at a price of 100% of their

principal amount. We received net proceeds of $490 million from the offering after deducting

underwriting fees and offering expenses. The Company also commenced a tender offer to purchase

the maximum aggregate principal amount of its 8.250% Senior Notes due 2014 (the 2014 Notes) and

the April 2015 Notes (and together with the 2014 Notes, the Notes) that it could purchase for up to

$500 million in cash (the 2012 Debt Tender Offer).

Pursuant to the 2012 Debt Tender Offer, the Company accepted for purchase $400 million

aggregate principal amount of 2014 Notes, tendered for total consideration of $446 million, and

$50 million aggregate principal amount of April 2015 Notes, tendered for total consideration of

$54 million. The Company used proceeds from the sale of its May 2012 offering of $500 million of

9.250% Senior Notes due 2021, plus cash on hand, to purchase the Notes.

In connection with the 2012 Debt Tender Offer and repurchase of the Notes, the Company

recognized a loss of $69 million for the premium paid on the early extinguishment of debt during 2012.

We also recognized losses of $2 million during 2012 for $78 million in total open market repurchases of

our 6.25% Senior Notes due 2013.

On August 15, 2012, the Company completed a registered offering of $600 million aggregate

principal amount of 7.125% senior unsecured notes due 2023 (the 2023 Notes), issued at a price of

100% of their principal amount. We received net proceeds of $588 million from the offering after

deducting underwriting fees and offering expenses. The Company used the net proceeds from the sale

of the notes to repurchase or retire existing indebtedness in 2013.

On October 1, 2012, the Company completed a registered debt offering of $250 million aggregate

principal amount of the 2023 Notes, issued at a price of 104.250% of their principal amount. We

received net proceeds of $256 million from the offering after deducting underwriting fees and offering

expenses. The notes are an additional issuance of, are fully fungible with and form a single series

voting together as one class with the $600 million aggregate principal amount of the 2023 Notes issued

by the Company on August 15, 2012. The Company used the net proceeds from the sale of the notes

to repurchase or retire existing indebtedness in 2013.

On October 1, 2012, the Company accepted for purchase $76 million and $59 million aggregate

principal amount of the April 2015 Notes and the 2017 Notes, respectively, in open market repurchases

for total consideration of $155 million. The repurchases resulted in a loss on the early retirement of

debt of $19 million.

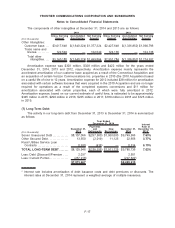

As of December 31, 2014, we were in compliance with all of our debt and credit facility financial

covenants.

F-20

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements