Frontier Communications 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.households as of December 31, 2014. Since 2012, Frontier received a total of $72 million from

the first round of the Federal Communications Commission’s (FCC) Connect America Fund

(CAF) Phase I and $61 million related to the second round of CAF Phase I to support

broadband deployment in unserved and underserved high-cost areas. We spent $56 million of

these funds on network expansion in 2014 and $94 million to date, enabling broadband for

164,000 unserved and underserved households.

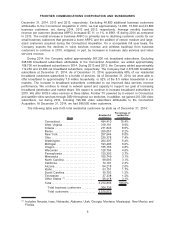

•Revenue Trajectory and Customer Metrics

Total residential revenue for 2014 increased 3% as compared to 2013. Total residential revenue

for 2014 included $116 million of revenues attributable to the Connecticut Acquisition for the

period from October 24, 2014 through December 31, 2014. Excluding the Connecticut

operations, total residential revenue declined 3% as compared with 2013. Our average monthly

residential revenue per customer during 2014 improved by 3% as compared to the prior year.

Total business revenue for 2014 decreased 1% as compared to 2013. Total business revenue

for 2014 included $90 million of revenues attributable to the Connecticut Acquisition for the

period from October 24, 2014 through December 31, 2014. Excluding the Connecticut

operations, total business revenue declined 5% as compared with 2013. Our average monthly

business revenue per customer during 2014 improved by 1% as compared to the prior year.

Our residential customer losses, excluding the Connecticut operations, improved slightly in

2014. We believe that this improvement in customer retention is principally due to investments in

our network, our local engagement strategy, improved customer service and simplified products

and pricing. In addition to our increase in broadband subscribers, we added approximately

201,300 net video subscribers during 2014, substantially all of which were attributable to the

Connecticut Acquisition. See “Customer Metrics” for additional information.

•Financial Profile

During 2014, we generated total revenue of $4,772 million, including customer revenue of

$4,253 million and regulatory revenue of $520 million, and net cash provided by operating

activities of $1,270 million. We have a well-balanced debt maturity schedule and we had

available liquidity of over $1.4 billion as of December 31, 2014, comprised of cash and available

credit on our $750 million revolving credit facility.

Our operating results, prudent capital investments, and expense management provided a strong

cash flow base and a solid financial platform for investing in our business, servicing our debt and

maintaining our dividend payout in 2014.

•Local Engagement

On September 10, 2014, we, along with our strategic partners DISH Network and CoBank,

launched America’s Best Communities (ABC), a $10 million prize competition to stimulate

growth and revitalization in small cities and towns across our footprint. The ABC contest was

designed to help address the need for growth by identifying and investing in innovative ideas

that small cities and towns can use to build and sustain their local economies. The winning

ideas, which will be announced in 2017, will then be available as a roadmap for growth for all

rural communities across the U.S. In creating this contest, we emphasize our commitment to

supporting sustained economic success in small communities in the United States.

The Verizon Transaction

On February 5, 2015, the Company entered into an agreement with Verizon Communications Inc.

(Verizon) to acquire Verizon’s wireline operations that provide services to residential, commercial and

wholesale customers in California, Florida and Texas for a purchase price of $10.54 billion in cash (the

Verizon Transaction). As of the date of the announcement, these Verizon properties included

3.7 million voice connections, 2.2 million broadband connections, and 1.2 million FiOSvideo

connections. The network being acquired is the product of substantial capital investments made by

3

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES