Frontier Communications 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

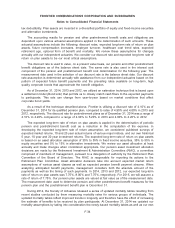

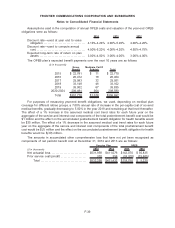

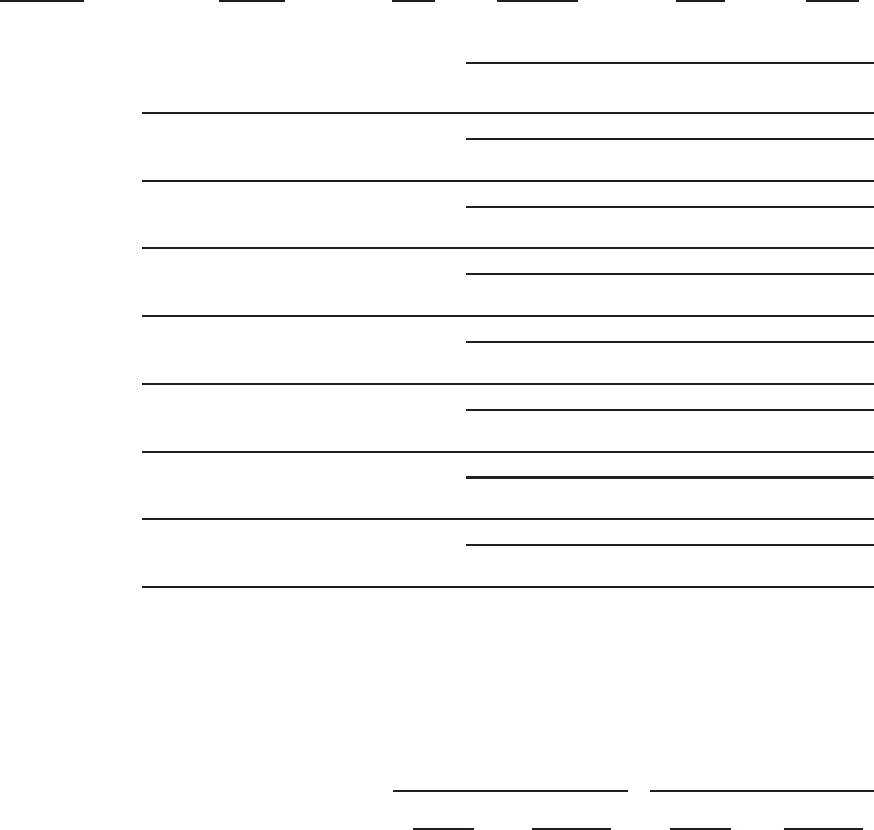

The following table represents the Plan’s Level 3 financial instruments for its interest in certain

limited partnerships and limited liability corporations, the valuation techniques used to measure the fair

value of those financial instruments as of December 31, 2014, and the significant unobservable inputs

and ranges of values for those inputs:

Instrument Property

Fair

Value

Principal

Valuation

Technique

Significant

Unobservable

Inputs

Significant

Input

Values

Interest in

Limited

Partnerships Direct Capitalization Capitalization Rate 8.50%

and Limited

Liability

Corporations

100 Comm Drive, LLC $8,689 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

12

Direct Capitalization Capitalization Rate 8.50%

100 CTE Drive, LLC $6,942 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

12

Direct Capitalization Capitalization Rate 8.50%

6430 Oakbrook Parkway, LLC $24,953 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

12

Direct Capitalization Capitalization Rate 8.50%

8001 West Jefferson, LLC $29,553 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

12

Direct Capitalization Capitalization Rate 8.85%

1500 MacCorkle Ave SE, LLC $16,219 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

14

Direct Capitalization Capitalization Rate 10.50%

400 S. Pike Road West, LLC $1,093 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

14

Direct Capitalization Capitalization Rate 10.00%

601 N US 131, LLC $1,062 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

14

Direct Capitalization Capitalization Rate 9.00%

9260 E. Stockton Blvd., LLC $5,222 Discounted

Cash Flow

Discount Rate

Duration (years)

8.00%

14

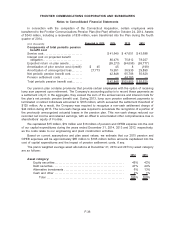

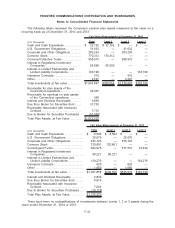

The fair value of our OPEB plan assets, which are all measured using Level 1 inputs, was

$2 million as of December 31, 2013.

The following table summarizes the carrying amounts and estimated fair values for long-term debt

at December 31, 2014 and 2013. For the other financial instruments including cash, accounts

receivable, long-term debt due within one year, accounts payable and other current liabilities, the

carrying amounts approximate fair value due to the relatively short maturities of those instruments.

($ in thousands)

Carrying

Amount Fair Value

Carrying

Amount Fair Value

2014 2013

Long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,485,615 $10,034,096 $7,873,667 $8,191,744

The fair value of our long-term debt is estimated based upon quoted market prices at the reporting

date for those financial instruments.

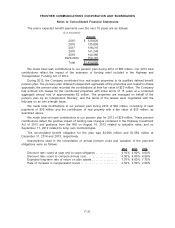

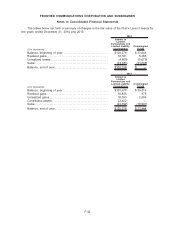

(18) Commitments and Contingencies:

We anticipate total capital expenditures of approximately $650 million to $700 million for 2015,

excluding the expenditure of funds previously received from the Connect America Fund program.

Although we from time to time make short-term purchasing commitments to vendors with respect to

these expenditures, we generally do not enter into firm, written contracts for such activities.

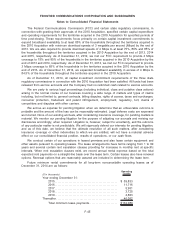

F-44

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements