Frontier Communications 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Voice Services

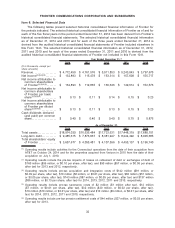

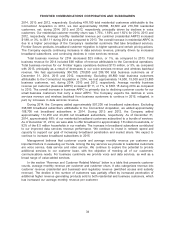

Voice services revenues for 2014 decreased $168 million, or 8%, as compared with 2013,

primarily due to $150 million, or 9%, in lower local and enhanced services revenue. This decrease is

primarily due to the continued loss of voice customers and, to a lesser extent, decreases in individual

features packages, partially offset by increased local voice charges to residential and business end

users. Long distance services revenue decreased $17 million, or 5%, primarily due to an 8% decrease

in minutes of use driven by fewer customers, partially offset by increased cost recovery surcharge

rates.

Voice services revenues for 2013 decreased $198 million, or 9%, as compared with 2012,

including $138 million, or 8%, in lower local and enhanced services revenue. This decrease was

primarily due to the continued loss of voice customers and, to a lesser extent, decreases in individual

features packages, partially offset by increased local voice charges to residential and business end

users to the extent permitted by the 2011 Order. Long distance services revenue decreased

$60 million, or 14%, primarily due to lower minutes of use driven by fewer customers and the migration

to bundled packages.

Data and Internet Services

Data and Internet services revenues for 2014 decreased $7 million as compared with 2013. Data

and Internet services includes nonswitched access revenue from data transmission services to other

carriers and high-volume business customers with dedicated high-capacity Internet and Ethernet

circuits. These nonswitched access revenues decreased $92 million, or 10%, primarily due to lower

monthly recurring charges attributable to a reduction in wireless backhaul and other carrier service

revenues. These decreases were mostly offset by increases in data services revenues of $85 million,

or 9%, primarily due to a 6% increase in the total number of broadband customers and sales of

Frontier Secure products. We expect wireless data usage to continue to increase, which may drive the

need for additional wireless backhaul capacity. Despite the need for additional capacity, we expect to

continue to experience declines in wireless backhaul revenue in 2015, as our carrier partners migrate

to Ethernet solutions at lower price points and certain customers migrate to our competitors.

Data and Internet services revenues for 2013 increased $61 million, or 3%, as compared with

2012. Data services revenue increased $85 million, or 10%, primarily due to a 6% increase in the

number of broadband customers and sales of Frontier Secure products. These increases were offset

by a $24 million, or 3%, decrease in nonswitched access revenue, primarily due to a reduction in

wireless backhaul.

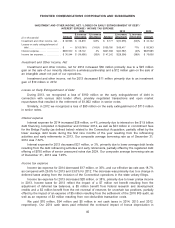

Other

Other revenues for 2014 increased $11 million, or 4%, primarily due to lower bad debt expenses

that are charged to other revenue and increased customer premise equipment revenues, partially

offset by lower wireless revenue associated with the sale of our interest in the Mohave partnership and

lower directory services revenues.

Other revenues for 2013 decreased $58 million, or 16%, primarily due to lower wireless revenues

associated with the sale of our interest in the Mohave partnership, lower directory services revenues

and the reduction in FiOSvideo service customers, partially offset by lower bad debt expenses.

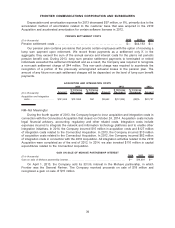

Switched Access and Subsidy

Switched access and subsidy revenue for 2014 decreased $41 million, or 7%, to $511 million, as

compared to 2013. Switched access revenue decreased $38 million, or 16%, and subsidy revenue

decreased $3 million in 2014. The decrease in switched access revenue was primarily due to the

impact of a decline in minutes of use related to access line losses and the displacement of minutes of

use by wireless and other communications services combined with a reduction due to the impact of the

lower rates enacted by the FCC’s intercarrier compensation reform in July 2013. The decrease in

36

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES