Frontier Communications 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

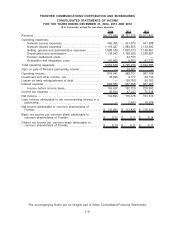

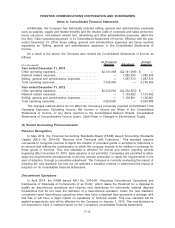

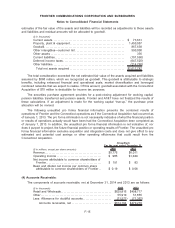

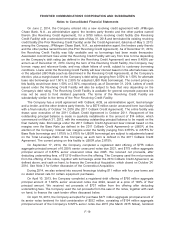

Additionally, the Company has historically included selling, general and administrative expenses

such as salaries, wages and related benefits and the related costs of corporate and sales personnel,

travel, insurance, non-network related rent, advertising and other administrative expenses, within the

line item “Other operating expenses” in its Consolidated Statements of Income. Effective with the year

ended December 31, 2014, these selling, general and administrative expenses are being reported

separately as “Selling, general and administrative expenses” in the Consolidated Statements of

Income.

As a result of the above, the Company also revised the Consolidated Statements of Income as

follows:

($ in thousands)

As Previously

Reported Adjustment

Revised

Reporting

Year ended December 31, 2013

Other operating expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,141,068 $(2,141,068) $ —

Network related expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,083,555 1,083,555

Selling, general and administrative expenses . . . . . . . . . . . . . — 1,057,513 1,057,513

Total operating expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,795,456 — 3,795,456

Year ended December 31, 2012

Other operating expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,234,553 $(2,234,553) $ —

Network related expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,133,692 1,133,692

Selling, general and administrative expenses . . . . . . . . . . . . . — 1,100,861 1,100,861

Total operating expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,024,685 — 4,024,685

The changes outlined above do not affect the Company’s previously reported Consolidated Total

Operating Expenses, Operating Income, Net Income or Income per Share in the Consolidated

Statements of Income, or any items reported in the Consolidated Balance Sheets, Consolidated

Statements of Comprehensive Income (Loss), Cash Flows or Changes in Stockholders’ Equity.

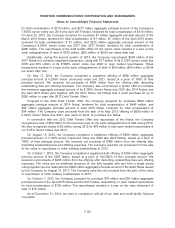

(2) Recent Accounting Pronouncements:

Revenue Recognition

In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards

Update (ASU) No. 2014-09, “Revenue from Contracts with Customers.” This standard requires

companies to recognize revenue to depict the transfer of promised goods or services to customers in

an amount that reflects the consideration to which the company expects to be entitled in exchange for

those goods or services. This new standard is effective for annual and interim reporting periods

beginning after December 15, 2016. Early adoption is not permitted. Companies are permitted to either

apply the requirements retrospectively to all prior periods presented, or apply the requirements in the

year of adoption, through a cumulative adjustment. The Company is currently evaluating the impact of

adopting the new standard, but has not yet selected a transition method or determined the impact of

adoption on its consolidated financial statements.

Discontinued Operations

In April 2014, the FASB issued ASU No. 2014-08, “Reporting Discontinued Operations and

Disclosures of Disposals of Components of an Entity” which raises the threshold for a disposal to

qualify as discontinued operations and requires new disclosures for individually material disposal

transactions that do not meet the definition of a discontinued operation. Under the new standard,

companies report discontinued operations when they have a disposal that represents a strategic shift

that has or will have a major impact on operations or financial results. This new standard will be

applied prospectively and will be effective for the Company on January 1, 2015. This new standard is

not expected to have a material impact on the Company’s consolidated financial statements.

F-13

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements