Frontier Communications 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.consideration of $155 million. The repurchases resulted in a loss on the early retirement of debt of $19

million ($12 million or $0.01 per share after tax).

We may from time to time make additional repurchases of our debt in the open market, through

tender offers, exchanges of debt securities, by exercising rights to call or in privately negotiated

transactions. We may also refinance existing debt or exchange existing debt for newly issued debt

obligations.

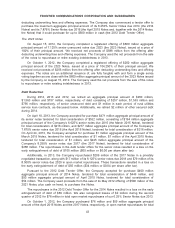

Capital Resources

We believe our operating cash flows, existing cash balances, and existing revolving credit facility

will be adequate to finance our working capital requirements, fund capital expenditures, make required

debt interest and principal payments, pay taxes, pay dividends to our stockholders, and support our

short-term and long-term operating strategies for the next twelve months. However, a number of

factors, including but not limited to, losses of customers, pricing pressure from increased competition,

lower subsidy and switched access revenues, and the impact of economic conditions may negatively

impact our cash generated from operations. In addition, based on information available to us, we

believe that the financial institutions syndicated under our revolving credit facility would be able to fulfill

their commitments to us, but this could change in the future. As of December 31, 2014, we had

$298 million and $383 million of debt maturing in 2015 and 2016, respectively.

Bridge Facility

On December 16, 2013, we signed a commitment letter for a bridge loan facility (the Bridge

Facility) to finance the Connecticut Acquisition and recognized interest expense related to this

commitment of $23 million and $1 million during the years ended December 31, 2014 and 2013,

respectively.

On July 16, 2014, the Bridge Facility was reduced by $350 million following execution of the 2014

CoBank Credit Agreement, as defined below. On September 17, 2014, the Bridge Facility, which was

undrawn, was terminated upon consummation of the registered debt offering referred to above.

Bank Financing

On June 2, 2014, the Company entered into a credit agreement with CoBank, ACB, as

administrative agent, lead arranger and a lender, and the other lenders party thereto, for a $350 million

senior unsecured delayed draw term loan facility (the 2014 CoBank Credit Agreement). The facility was

drawn upon closing of the Connecticut Acquisition with proceeds used to partially finance the

acquisition. The maturity date is October 24, 2019. Repayment of the outstanding principal balance will

be made in quarterly installments in the amount of $9 million, commencing on March 31, 2015, with the

remaining outstanding principal balance to be repaid on the maturity date. Borrowings under the 2014

CoBank Credit Agreement bear interest based on the margins over the Base Rate (as defined in the

2014 CoBank Credit Agreement) or LIBOR, at the election of the Company. Interest rate margins

under the facility (ranging from 0.875% to 2.875% for Base Rate borrowings and 1.875% to 3.875% for

LIBOR borrowings) are subject to adjustments based on the Total Leverage Ratio of the Company, as

such term is defined in the 2014 CoBank Credit Agreement. The interest rate on this facility at

December 31, 2014 was LIBOR plus 3.375%.

The Company has a credit agreement with CoBank, ACB, as administrative agent, lead arranger

and a lender, and the other lenders party thereto, for a $575 million senior unsecured term loan facility

with a final maturity of October 14, 2016 (the 2011 CoBank Credit Agreement). The entire facility was

drawn upon execution of the 2011 CoBank Credit Agreement in October 2011. Repayment of the

outstanding principal balance is made in quarterly installments of $14 million, which commenced on

March 31, 2012, with the remaining outstanding principal balance to be repaid on the final maturity

date. Borrowings under the 2011 CoBank Credit Agreement bear interest based on the margins over

the Base Rate (as defined in the 2011 CoBank Credit Agreement) or LIBOR, at the election of the

44

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES