Frontier Communications 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividends

We currently intend to continue to pay regular quarterly dividends. Our ability to fund a regular

quarterly dividend will be impacted by our ability to generate cash from operations. On December 11,

2014, our Board of Directors approved a 5% increase over the 2014 dividend rate in the planned

quarterly cash dividend rate, commencing with the dividend for the first quarter of 2015. On an annual

basis, this plan would increase the dividend from $0.40 to $0.42 per share. The declarations and

payment of future dividends is at the discretion of our Board of Directors, and will depend upon many

factors, including our financial condition, results of operations, growth prospects, funding requirements,

applicable law, restrictions in agreements governing our indebtedness and other factors our Board of

Directors deem relevant.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other

relationships with unconsolidated entities that would be expected to have a material current or future

effect upon our financial statements.

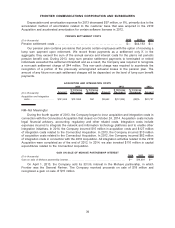

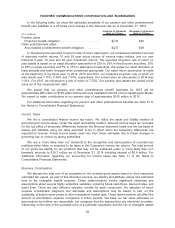

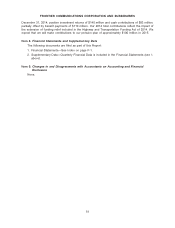

Future Contractual Obligations and Commitments

A summary of our future contractual obligations and commercial commitments as of December 31,

2014 is as follows:

($ in thousands) Total 2015 2016 2017 2018 2019 Thereafter

Payments due by period

Long-term debt obligations,

excluding interest. ................ $ 9,780,736 $ 297,622 $ 383,248 $ 645,156 $ 619,035 $ 644,565 $ 7,191,110

Interest on long-term debt .......... 6,525,133 718,108 720,305 683,732 657,903 593,191 3,151,894

Operating lease obligations ......... 132,080 59,833 11,716 5,951 3,725 4,803 46,052

Capital lease obligations ............ 33,581 3,245 3,300 3,357 3,415 3,474 16,790

Financing lease obligations ......... 100,211 7,043 7,225 7,418 7,632 7,838 63,055

Purchase obligations ............... 62,348 28,401 17,011 16,906 30 — —

“Take or pay” contract obligations . . . 140,800 140,800 — — — — —

Liability for uncertain tax positions. . . 19,662 2,521 504 6,680 9,957 — —

Total .......................... $16,794,551 $1,257,573 $1,143,309 $1,369,200 $1,301,697 $1,253,871 $10,468,901

At December 31, 2014, we had outstanding performance letters of credit totaling $47 million.

In our normal course of business we have obligations under certain non-cancelable arrangements

for services. During 2012, we entered into a “take or pay” arrangement for the purchase of future long

distance and carrier services. Our remaining commitment under the arrangement is $141 million for the

year ending December 31, 2015. As of December 31, 2014, we expect to utilize the services included

within the arrangement and no liability for the “take or pay” provision has been recorded.

As of December 31, 2014, all capital investment commitment requirements of the three state

regulatory commissions in connection with the 2010 Acquisition had been satisfied. All funds had been

released from escrow accounts and the Company had no restricted cash related to escrow accounts.

The FCC and certain state regulatory commissions, in connection with granting their approvals the

2010 Acquisition, specified certain capital expenditure and operating requirements for the territories

acquired in the 2010 Acquisition for specified periods of time post-closing. These requirements focus

primarily on certain capital investment commitments to expand broadband availability to at least 85% of

the households throughout the territories acquired in the 2010 Acquisition with minimum download

speeds of 3 Mbps by the end of 2013. We are required to provide download speeds of 4 Mbps to at

least 75%, 80% and 85% of the households throughout the territories acquired in the 2010 Acquisition

by the end of 2013, 2014 and 2015, respectively. As of December 31, 2012, we met our FCC

requirement to provide 4 Mbps coverage to 75% and 80% of the households in the territories acquired

46

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES