Frontier Communications 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

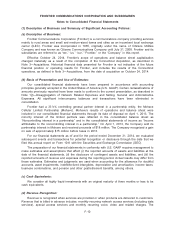

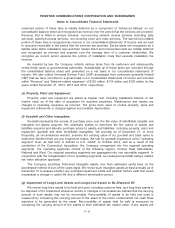

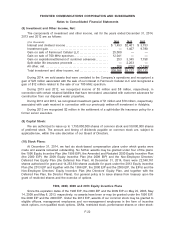

estimates of the fair value of the assets and liabilities will be recorded as adjustments to those assets

and liabilities and residual amounts will be allocated to goodwill.

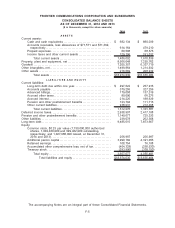

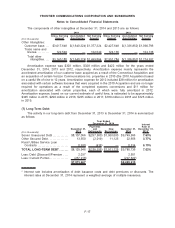

($ in thousands)

Current assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 73,631

Property, plant & equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,450,057

Goodwill. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 867,638

Other intangibles—customer list . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 590,000

Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 336

Current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (101,590)

Deferred income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (647,525)

Other liabilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (214,760)

Total net assets acquired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,017,787

The total consideration exceeded the net estimated fair value of the assets acquired and liabilities

assumed by $868 million, which we recognized as goodwill. This goodwill is attributable to strategic

benefits, including enhanced financial and operational scale, market diversification and leveraged

combined networks that we expect to realize. Of this amount, goodwill associated with the Connecticut

Acquisition of $75 million is deductible for income tax purposes.

The securities purchase agreement provides for a post-closing adjustment for working capital,

pension liabilities transferred and pension assets. Frontier and AT&T have not finalized the results of

these calculations. If an adjustment is made for the working capital “true-up,” the purchase price

allocation will be revised.

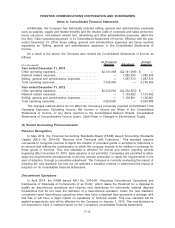

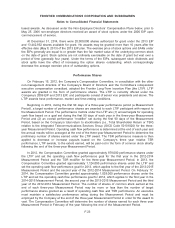

The following unaudited pro forma financial information presents the combined results of

operations of Frontier and the Connecticut operations as if the Connecticut Acquisition had occurred as

of January 1, 2013. The pro forma information is not necessarily indicative of what the financial position

or results of operations actually would have been had the Connecticut Acquisition been completed as

of January 1, 2013. In addition, the unaudited pro forma financial information is not indicative of, nor

does it purport to project, the future financial position or operating results of Frontier. The unaudited pro

forma financial information excludes acquisition and integration costs and does not give effect to any

estimated and potential cost savings or other operating efficiencies that could result from the

Connecticut Acquisition.

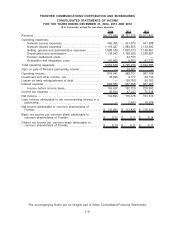

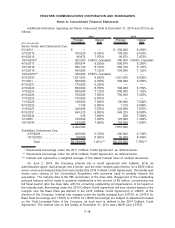

($ in millions, except per share amounts) 2014 2013

(Unaudited)

For the year ended December 31,

Revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $5,775 $6,011

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 985 $1,049

Net income attributable to common shareholders of

Frontier. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 191 $ 83

Basic and diluted net income per common share

attributable to common shareholders of Frontier . . $ 0.19 $ 0.08

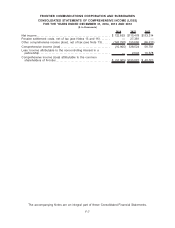

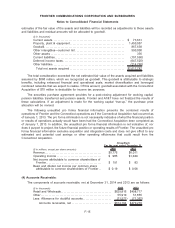

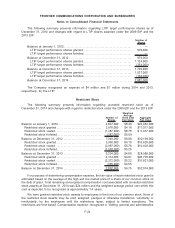

(4) Accounts Receivable:

The components of accounts receivable, net at December 31, 2014 and 2013 are as follows:

($ in thousands) 2014 2013

Retail and Wholesale. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $629,816 $498,717

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55,919 51,855

Less: Allowance for doubtful accounts. . . . . . . . . . . . . . . . . . . . . (71,571) (71,362)

Accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $614,164 $479,210

F-15

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements